MOTOR FUELS FLAT (FLT) FILE and EDI FILING GUIDE

This guide contains general, plain-text instructions you need to file motor fuels tax information (tax returns, information reports, and certain claims for refund (hereafter collectively referred to as tax forms ) online using Flat (FLT) File or EDI files with the CDTFA. This guide, along with the other information provided on the CDTFA Motor Fuels Online Filing web page, is designed to provide the rules, procedures, and technical requirements for the online filing of motor fuels taxes. All directions set forth in this guide and on the website must be followed for successful participation in online filing.

How to Use This Guide

Each section of this guide contains important information relevant to filing motor fuels tax forms via FLT and EDI. The Getting Started section provides important information to get started filing via FLT and EDI including important contact information. For further information for filing online with the CDTFA and for Excel templates that you can use to create a FLT file, visit our Motor Fuels Online Filing webpage.

The FLT and EDI sections provide filing specifications and other information relating to the applicable filing format. The Guidelines section provides further information relating to filing via FLT and EDI. The Certification Testing section provides the information necessary to help you complete the optional certification testing process and the Examples section provides examples of completed Excel templates.

You must connect to the CDTFA website to submit your files and use a browser that supports 128 bit SSL. Usernames and passwords are required. A Secure Socket Layer (SSL) encrypted session will be established between you and the CDTFA when you log in. Your system must be configured to accept cookies. The CDTFA Online Services system requires a cookie as an element in maintaining the secure internet connection.

Open All Close AllLog In Procedures

You must go to our Online Services login page and enter your Username and password.

Transmitting Data

For a FLT or an EDI file that contains a single account: After you have logged in to the Online Services Login page, on your Home page, follow these steps:

- Select File and/or View a Return button, then

- Select the account and period to file and select the Add button, then select the type of file (EDI or FLT) to be uploaded.

- If the file passes a basic syntax check, you will be required to verify the amounts included in the filing. You will be prompted to certify that the information contained in the file is true, correct, and complete by entering your name, title, and telephone number, and then selecting submit, and entering your login password. The Confirmation page displays the confirmation number, filer information, and total due. Links are included on the Confirmation page to make a payment, print the return, and exit the page.

For an EDI file that contains more than one account: After you have logged in to the Online Services Login page, on your Home page, follow these steps:

- Select Return Bulk File button, then

- Select EDI Motor Fuel Returns button, and select Add

- Select the type of file (EDI or FLT) to be submitted. If the file passes a basic syntax check, you will be required to verify the amounts included in the filing. You will be prompted to certify that the information contained in the file is true, correct, and complete by entering your name, title, and telephone number, and then selecting submit, and entering your login password. The Confirmation page displays the confirmation number, filer information, and total due. Links are included on the Confirmation page to make a payment, print the return, and exit the page.

The CDTFA will not accept the following data transmissions:

- Files of a type not identified in this document as approved for submission

- Data for multiple taxpayers in the same envelope

- Multiple report formats in the same envelope.

Other Functions

In addition to the File and/or View a Return option, the Home page provides the customer with several other options. Below is a sample of the available options.

Make a Payment - Allows you to make a payment.

Return Bulk File Allows you to upload EDI files that contain multiple accounts in one file

Return Bulk File then Validate Bulk File Allows you to validated the syntax of a filing before upload

Request Access to an Account Allows you to request access to another account

Request Power of Attorney Allows you to request Power of Attorney to another account

Contacts

File Transmissions:

If you have any questions regarding transmitting Motor Fuels FLT or EDI filings, please contact the eServices Coordinator between 8:00 a.m. and 5:00 p.m., (Pacific time), Monday through Friday except state holidays at:

You may submit written correspondence to the eServices Coordinator at the following address:

California Department of Tax and Fee Administration

eServices Coordinator, MIC:40

PO Box 942879

Sacramento, CA 94279-0040

Data Concerns/Questions:

If you have questions regarding data for motor fuels online filing, please call the Business Tax and Fee Division, Appeals and Data Analysis Branch, Data Analysis Unit between 8:00 a.m. and 5:00 p.m., Pacific time, Monday through Friday (excluding State holidays), at:

Phone: 1-800-400-7115 (TTY: 711); from the main menu, select the option "special taxes and fees." FAX: 1-916-445-6385

You may submit written correspondence to the Data Analysis Unit at the following address:

California Department of Tax and Fee Administration

Business Tax and Fee Division

Data Analysis Unit, MIC: 30

P.O. Box 942879 Sacramento, CA 94279-0030

Please include the tax program you are inquiring about and provide contact information, such as name, address, phone number, and email in your written inquiries.

General Questions

If you have any general questions, you may contact our Customer Service Center at 1-800-400-7115 (CRS:711), Monday through Friday, 7:30 a.m. to 5:00 p.m., (Pacific time), except state holidays.

Website Information

For additional information on motor fuels online filing, please visit the CDTFA website. On the CDTFA website, you can find the latest developments in tax-related news. Some of the topics and information available include:

- Motor Fuels Online Filing Page, including:

- FLT templates

- Online Filing Glossary

- Filing Frequently Asked Questions (FAQs)

- CDTFA Online Services Information

- Hot Topics

- News Releases

- Special Taxpayer Alerts

- Telephone Numbers and Addresses for Other Services

You can also obtain tax forms, publications, and other information online.

Guide Updates

The information contained in this guide is subject to change. If you are a filing participant in CDTFA motor fuels online filing, we recommend that you check our website for updates to this guide and the Motor Fuels Online Filing web page. Updates may include, but are not limited to:

- Changes to online filing rules or requirements

- Changes to motor fuel tax returns or reports

- New schedules

- New tax forms added to online filing

Assistance for Persons with Disabilities

Assistance for persons with hearing or speech impairments can be obtained by calling California Relay Service (CRS): 711, between 8:00 a.m. and 5:00 p.m., Pacific time, Monday through Friday (excluding State holidays).

Disclaimer

This guide summarizes the law and applicable regulations in effect when the document was written. However, changes in the law or in regulations may have occurred since that time. If there is a conflict between this guide and the law, decisions will be based on the law, and not this guide.

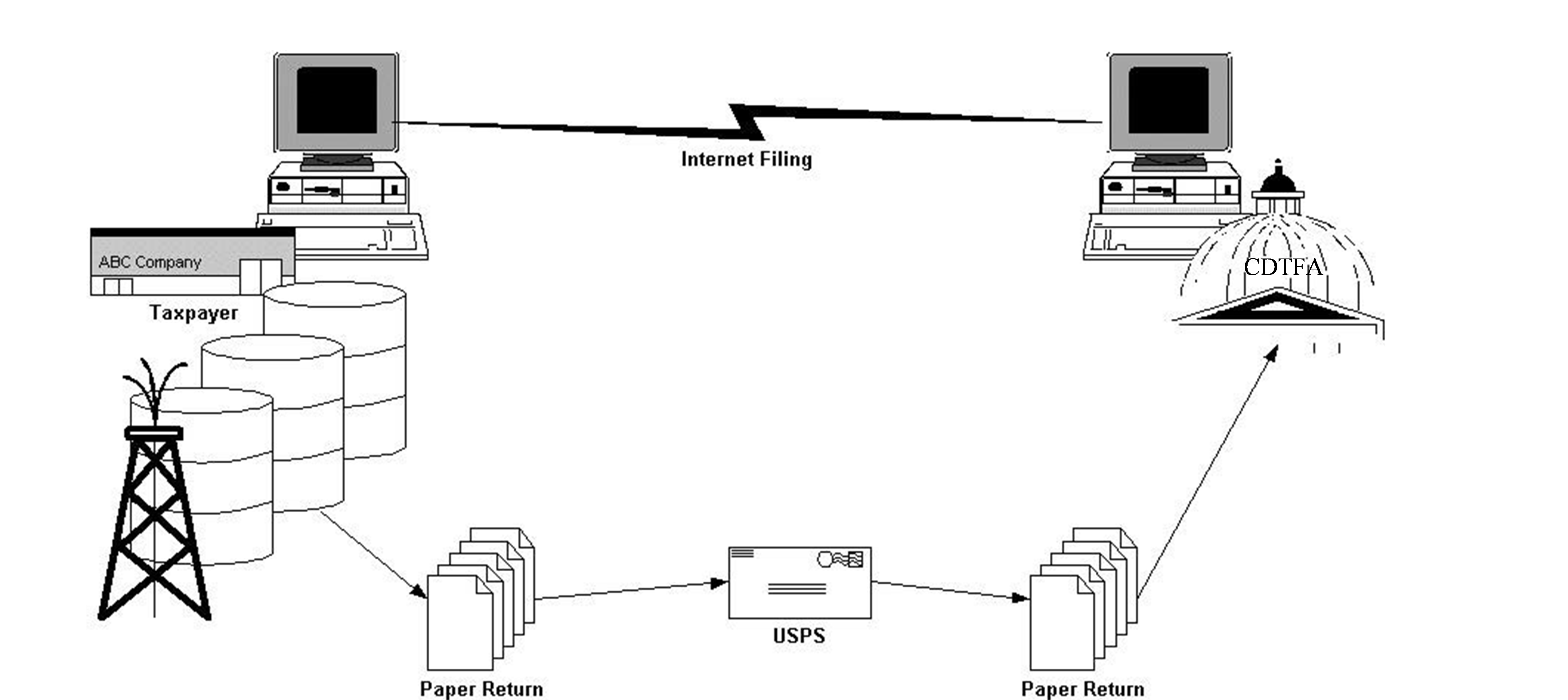

Illustration

Figure 1, below, illustrates the information flow from taxpayer to tax authority in both the paper and online processing environment. To effectively and efficiently process large volumes of information, both parties to the transaction need to eliminate paper processing by sharing information online. Online, both parties can communicate and resolve errors faster, thereby reducing overhead costs. Online processing can also reduce the possibility of interest and penalty charges as a result of more efficient and timely processing.

Information Flow Model

Figure 1 illustrates the information flow from taxpayer to tax authority in both the paper and online processing environment. To effectively and efficiently process large volumes of information, both parties to the transaction need to eliminate paper processing by sharing information online. Online, both parties can communicate and resolve errors faster, thereby reducing overhead costs. Online processing can also reduce the possibility of interest and penalty charges as a result of more efficient and timely processing.

Figure 1. Illustrates the path information flows from customer to Tax Authority

XML and Other File Format Standards

The CDTFA continues to be responsive to the reporting needs of our online filing participants. If there is a demand for mapping using XML or other emerging file formats, the CDTFA will work with its customers to develop reporting procedures.

An FLT file transmission is made up of one or more data sets. Data Set is the term used to describe the online equivalent of a paper document (tax return, information report, etc.). X12-formatted EDI files are the foundation of motor fuels online filing. For the purpose of this guide, EDI and FLT data will be referred to as a data set.

Open All Close AllData Set

The data included in an FLT or EDI data set conveys the same information as the conventional paper document. Within each data set, there are sections that correspond directly to the format of the paper document:

- The header section contains information that pertains to the entire document, such as the filing date, company name, company address, filing period, account number, contact information, etc.

- The return section contains information describing which return is present in the data set.

- The summary item section contains information that cannot be derived from the detail, such as other exempt removals, etc.

- The transaction detail section includes the same information found on the paper schedules, such as bill of lading, carrier information, origin and destination information, gallons, etc.

A FLT data set is designed for a smaller business entity than one that may use EDI and that may have a less automated system and enter the data by hand in a software application like Microsoft Excel or Access.

FLT Standards

The group responsible for developing the FLT (flat file) standards is the CDTFA. These standards apply only to files being submitted by a motor fuels customer.

FLT standards for the CDTFA can be found on the Motor Fuels Online Filing web page. They include:

- Attribute Conventions - formatting requirements

- Data Elements - field identifiers

- File Structure - FE/FG /FS

- Segments - tax form descriptors

Standards prescribe the framework for how a specific FLT message is formatted.

The CDTFA has developed Microsoft Excel workbook files for specific tax forms. Though each template may be used to create FLT documents, they are intended as examples for reference only.

The FLT workbooks are available on the Motor Fuels Online Filing web page. Also available are example workbooks which contain data that correspond to one of the example tax forms.

The CDTFA does not endorse the Microsoft Excel product nor does it accept liability for any problems resulting from submitting an online file developed from the Excel workbook files. The CDTFA's Microsoft Excel workbook file may be used without a complete understanding of the FLT format; however, a level of computer skill is required to use Microsoft Excel.

CDTFA FLT (Flat File) Specifications

General

You will follow the FLT File Format, as defined in Version 1 Release 4 (CDTFA map). The CDTFA requires that all schedules provide the detailed information needed to perform tracking of monthly fuel transactions.

The CDTFA requires that both gallon and dollar amounts be rounded to the nearest whole number. Do not use decimals.

This section provides the information you need to create motor fuels tax forms. It will cover all the necessary specifications in detail for the creation of these tax forms. The topics covered are as follows:

- Motor Fuels FLT File Format Flow

This section describes the record types contained in a file. Each of the record types is used for a specific purpose and, if a record type is required, it must be placed in the file in the order the record types are listed.

- Motor Fuels FLT File Structure Overview

This section lists all of the fields in each record type without the formatting requirements for the fields. It also contains a description of the use for the record type as well as tips for completing record types. This section of the chapter is useful for laying out the flat file as it applies to individual reporting needs.

- Motor Fuels FLT File Tax Form Descriptors

This section provides two key pieces of information for the development of a FLT file. First, it provides the Report Type field data for each tax form. This field data is used in every record type except the Filing Format Identifier record type. Second, this section provides detailed information about the line item requirements for each tax form.

- Attribute Conventions and Separator Requirements

This section provides information helpful for understanding the formatting requirements for each field in a record type.

- Motor Fuels FLT File Reporting Map

This section provides detailed information on the requirements for each record type. This information includes formatting requirements for each field.

Version of FLT File Specifications

The CDTFA s FLT File Specifications version control number for this publication is 4.0. The version control number will change when the CDTFA publishes updates to the FLT File format. This number is used by the CDTFA to manage changes between versions in flat files. Report the version control number in the File Type (FLT) Segment found in the FLT File format map of this chapter.

Record Types

"Record type" is the term used to describe a line in the flat file. There are five different record types, and they are used to report different information. Some record types may or may not be required in a flat file, depending on the tax form being created, and some record types are only used once (FLT and FE record types) while others are repeated as often as necessary (FG and FS). Each record type is composed of fields containing the data needed to convey the information required by the CDTFA. A complete flat file will contain all the record types necessary to convey the information required for the tax form to be filed with the CDTFA in the proper format.

The FLT file format is designed to accommodate multiple tax forms. Therefore, fields are included in the record type's map that may not be applicable to every individual tax form. In these instances, no data is required to populate that field, but the empty field must be included in the file to maintain its integrity. A "Filler Tab" is used for this purpose.

Motor Fuels FLT File Format Flow

All tax forms follow the FLT File format flow. The number of records in the FG and FS record types sections may vary depending on the requirements of the tax form and the type and quantity of transactions to be reported. For example, the line item record type (FG) will be repeated as many times as needed to report all line items for the tax form being created. (See "Motor Fuels FLT File Tax Form Descriptors" in this document for the requirements for each form.) Refer to the overview and format of the tax form to be reported to determine specific reporting requirements.

Table 1 FLT File Format Flow

| Record Type | Description | Comments |

|---|---|---|

| FLT | Filing Format Identifier | Used for all tax forms |

| FE | Header | Used for all tax forms |

| FP | Payment Order/Remittance Advice | Requirements vary by tax form |

| FG | Line Items | Requirements vary by tax form |

| FS | Schedules | Used for all tax forms |

Motor Fuels FL Structure Overview

The Filing Format Identifier Record Type (FLT) is used for all tax forms. It lets the CDTFA know what type of file is being submitted. To maintain data integrity throughout the file, the data in field 4, Interchange Control Number, must be used in field 21 of the header record type (FE) and field 37 of each permutation of the schedule record type (FS).

Table 2 Filing Format Identifier FLT File Structure Overview

| Field No | Filing Format Identifier |

|---|---|

| 01 | Electronic Return Record Type (FLT) |

| 02 | Version |

| 03 | CDTFA DUNS Number |

| 04 | Interchange Control Number Unique Number For This Filing |

The Header Record Type (FE) is used for all tax forms. It provides the CDTFA with the information it needs to identify the filer and validate the filing s acceptability. To maintain data integrity throughout the file, the information in fields 1-9 is repeated for every subsequent record type. Field 9 identifies the type of tax form being filed. A description of the data needed to populate that field is in "Motor Fuels FLT File Tax Form Descriptors" of this document.

Table 3 Header FLT File Structure Overview

| Field No | Header |

|---|---|

| 01 | Record Type (FE) |

| 02 | Account Number |

| 03 | Alternate ID Type |

| 04 | Alternate ID |

| 05 | Report End Date |

| 06 | Report Start Date |

| 07 | Purpose Code |

| 08 | Purpose Transaction Type |

| 09 | Report Type |

| 10 | "Filler Tab" |

| 11 | No Activity Flag |

| 12 | Record ID Qualifier |

| 13 | Record ID |

| 14 | "Filler Tab" |

| 15 | Authorization Code |

| 16 | Security Code |

| 17 | Sender ID |

| 18 | "Filler Tab" |

| 19 | Test or Production Indicator |

| 20 | Sender ID |

| 21 | Interchange Control Number Unique Number For This Filing |

| 22 | Information Provider Type |

| 23 | Information Provider's Name |

| 24 | Information Provider's DBA Line 1 |

| 25 | Information Provider's DBA Line 2 |

| 26 | Information Provider's Address Line 1 |

| 27 | Information Provider's Address Line 2 |

| 28 | Information Provider's City |

| 29 | Information Provider's State |

| 30 | Information Provider's ZIP |

| 31 | Information Provider's ZIP +4 |

| 32 | Information Provider's General Contact Type |

| 33 | Information Provider's General Contact Name |

| 34 | General Contact's Area Code |

| 35 | General Contact's Phone Number |

| 36 | General Contact's Extension |

| 37 | General Contact's Fax Area Code |

| 38 | General Contact's Fax Number |

| 39 | General Contact's Fax Extension |

| 40 | General Contact's Email Address |

| 41 | Information Provider's Online Filing Contact Type |

| 42 | Information Provider's Online Filing Contact Name |

| 43 | Online Filing Contact's Area Code |

| 44 | Online Filing Contact's Phone Number |

| 45 | Online Filing Contact's Extension |

| 46 | Online Filing Contact's Fax Area Code |

| 47 | Online Filing Contact's Fax Number |

| 48 | Online Filing Contact's Fax Extension |

| 49 | Online Filing Contact's Email Address |

The Line Item Record Type (FG) reports the line item information (the face of paper returns) to the CDTFA. It is not used for all tax forms. Refer to "Motor Fuels FLT File Tax Form Descriptors" in this document to determine what line item information, if any, is required for the tax form in question. All fields must be completed for each line item on the tax form.

Table 4 Line Item FLT File Structure Overview

| Field No | Line Item |

|---|---|

| 01 | Record Type (FG) |

| 02 | Account Number |

| 03 | Alternate ID Type |

| 04 | Alternate ID |

| 05 | Report End Date |

| 06 | Report Start Date |

| 07 | Purpose Code |

| 08 | Purpose Transaction Type |

| 09 | Report Type |

| 10 | Line Item Code |

| 11 | Unit of Measure - GA |

| 12 | Unit of Measure Qualifier |

| 13 | Amount |

| 14 | Unit of Measure - USD |

| 15 | Unit of Measure Qualifier |

| 16 | Amount |

| 17 | Rate |

| 18 | Product Code |

The Payment Order/Remittance Advice Record Type (FP) reports the payment authorization information to the CDTFA. It is not used for all tax forms. It applies to forms SDR (Supplier of Diesel and Motor Vehicle Fuel) and DLR (Aircraft Jet Fuel Dealer). The segment is only included if a payment is remitted with the online tax return. The segment is not required if the payment for the return is made using other existing EFT methods.

Table 5 Payment Order/Remittance Advice FLT File Structure Overview

| Field No | Line Item |

|---|---|

| 01 | Record Type (FP) |

| 02 | Account Number |

| 03 | Alternate ID Type |

| 04 | Alternate ID |

| 05 | Report End Date |

| 06 | Report Start Date |

| 07 | Purpose Code |

| 08 | Purpose Transaction Type |

| 09 | Report Type |

| 10 | Payment Warehouse Date |

| 11 | Routing Transit Number |

| 12 | Bank Account Number Qualifier |

| 13 | Bank Account Number |

| 14 | Payment Amount |

| 15 | Online Filing Payment Contact Name |

| 16 | Online Filing Payment Contact's Area Code |

| 17 | Online Filing Payment Contact's Phone Number |

| 18 | Online Filing Payment Contact's Extension |

The Schedule Record Type (FS) is not used for all tax forms. It is used to report individual transactions. All 45 fields are used to report one transaction. Each transaction is a separate line and contains all 45 fields. The Schedule Record Type was developed to encompass all the transaction schedules used by the CDTFA; therefore, all fields do not apply to every schedule. If a field does not apply to the schedule used to report a transaction, no entry is required for that field, and a "Filler Tab" should be inserted in place of any data to maintain the integrity of the record type.

Table 6 Schedule FLT File Structure Overview

| Field No | Schedule |

|---|---|

| 01 | Record Type (FS) |

| 02 | Account Number |

| 03 | Alternate ID Type |

| 04 | Alternate ID |

| 05 | Report End Date |

| 06 | Report Start Date |

| 07 | Purpose Code |

| 08 | Purpose Transaction Type |

| 09 | Report Type |

| 10 | Schedule Code |

| 11 | Product Code |

| 12 | Position Holder Tax ID Type |

| 13 | Position Holder Tax ID |

| 14 | Receiving Party Tax ID Type |

| 15 | Receiving Party Tax ID |

| 16 | Consignor Tax ID Type |

| 17 | Consignor Tax ID |

| 18 | Carrier Tax ID Type |

| 19 | Carrier Tax ID |

| 20 | Mode |

| 21 | Origin State/Country |

| 22 | Origin Terminal Control Number |

| 23 | Destination State/Country |

| 24 | Destination Terminal Control Number |

| 25 | Seller Tax ID Type |

| 26 | Seller Tax ID |

| 27 | Buyer Tax ID Type |

| 28 | Buyer Tax ID |

| 29 | Document Date |

| 30 | Document Number |

| 31 | Net Quantity Unit of Measure |

| 32 | Net Quantity |

| 33 | Gross Quantity Unit of Measure |

| 34 | Gross Quantity |

| 35 | Billed Quantity Unit of Measure |

| 36 | Billed Quantity |

| 37 | Interchange Control Number Unique Number For This Filing |

| 38 | Seller's Name |

| 39 | Position Holder's Name |

| 40 | Receiving Party Name |

| 41 | Consignor's Name |

| 42 | Carrier's Name |

| 43 | Buyer's Name |

| 44 | Purchase Date |

| 45 | Tax Rate |

Motor Fuels FLT File Tax Form Descriptors

Each tax form contains different line items on its face except the terminal operator report and petroleum carrier (common carrier) report. These line items must be reported in the Line Item Record Type of the report. Each line item is reported using four (4) fields in the record type: FG10 (Line Item Code), FG11 (Unit of Measure (UOM) Qualifier), FG12 (UOM), and FG13 (Amount). The following tables identify the required field information and reporting order in the Line Item Record Type for each accepted tax form.

Table 7 Train Operator Report (Train Operator) FLT File Form Descriptors

| Ref Line No | Description | FG10 Line Item Code | FG11 UOM | FG12 UOM Qualifier |

|---|---|---|---|---|

| No line items in a Train Operator Report | ||||

| Report Type = PTR |

Table 8 Petroleum Carrier Report (Common Carrier) FLT File Form Descriptors

| Ref Line No | Description | FG10 Line Item Code | FG11 UOM | FG12 UOM Qualifier |

|---|---|---|---|---|

| No line items in a Petroleum Carrier Report | ||||

| Report Type = CCR |

Table 9 Terminal Operator Report FLT File Form Descriptors

| Ref Line No | Description | FG10 Line Item Code | FG11 UOM | FG12 UOM Qualifier |

|---|---|---|---|---|

| No line items in a Terminal Operator Report | ||||

| Report Type = TOR |

Table 10 Supplier of Diesel Fuel Tax Return or Supplier of Motor Vehicle Fuel Tax Return FLT File Form Descriptors

| Ref Line No | Description | FG10 Line Item Code | FG11 UOM | FG12 UOM Qualifier |

|---|---|---|---|---|

| X | Gallons for Which Tax Applies or Refund Is Due at Rate by Product | L00031 | GA | Billed |

| 4 | Total Gallons for Which Tax Applies or Refund Is Due | L00001 | GA | Billed |

| 5 | Excess Tax Collected | L00032 | USD | Tax |

| 6 | Total Tax Due or Refund Claimed | L00002 | USD | Tax |

| 7 | Penalty | L00003 | USD | Pen |

| 8 | Interest | L00004 | USD | Int |

| 9 | Total Amount Due and Payable or Refund Claimed | L00005 | USD | Total |

| Report Type = SDR Syntax Note: Only Diesel Fuel Tax Returns may include a claim for refund Gallons at Rate (Ref Line No. X) is reported once for the current rate and repeated up to four times for additional rates. | ||||

Table 11 Aircraft Jet Fuel Dealer Tax Return FLT File Form Descriptors

| Ref Line No | Description | FG10 Line Item Code | FG11 UOM | FG12 UOM Qualifier |

|---|---|---|---|---|

| 1 | Gallons for Which Tax Applies | L00001 | GA | Billed |

| X | Gallons For Which Tax Applies or Refund Is Due at Rate by Product | L00031 | GA | Billed |

| 4 | Excess Tax Collected | L00032 | USD | Tax |

| 5 | Total Tax Due Or Refund Claimed | L00002 | USD | Tax |

| 6 | Penalty | L00003 | USD | Pen |

| 7 | Interest | L00004 | USD | Int |

| 8 | Total Amount Due and Payable | L00005 | USD | Total |

| Report Type = DLR Gallons at Rate (Ref Line No. X) is reported once for the current rate and repeated up to four times for additional rates. | ||||

Table 12 Diesel Fuel Tax Claim for Refund Sales to Ultimate Purchasers FLT File Form Descriptors

| Ref Line No | Description | FG10 Line Item Code | FG11 UOM | FG12 UOM Qualifier |

|---|---|---|---|---|

| X | Gallons for Which Refund Is Due at Rate by Product | L00031 | GA | Billed |

| 4 | Total Gallons for Which Refund Is Due | L00001 | GA | Billed |

| 5 | Total Amount of Refund Claimed | L00002 | USD | Tax |

| Report Type = DVW | ||||

Table 13 Diesel Fuel Ultimate Vendor Report/Claim for Refund FLT File Form Descriptors

| Ref Line No | Description | FG10 Line Item Code | FG11 UOM | FG12 UOM Qualifier |

|---|---|---|---|---|

| X | Gallons for Which Refund Is Due at Rate by Product | L00031 | GA | Billed |

| 4 | Total Gallons for Which Refund Is Due | L00001 | GA | Billed |

| 5 | Total Amount of Refund Claimed | L00002 | USD | Tax |

| Report Type = DVM Gallons at Rate (Ref Line No. X) is reported once for the current rate and repeated up to four times for additional rates. | ||||

Table 14 Claim for Refund on Nontaxable Sales and Exports of Diesel Fuel FLT File Form Descriptors

| Ref Line No | Description | FG10 Line Item Code | FG11 UOM | FG12 UOM Qualifier |

|---|---|---|---|---|

| X | Gallons for Which Refund Is Due at Rate by Product | L00031 | GA | Billed |

| 4 | Total Gallons for Which Refund Is Due | L00001 | GA | Billed |

| 5 | Total Amount of Refund Claimed | L00002 | USD | Tax |

| Report Type = DZC Gallons at Rate (Ref Line No. X) is reported once for the current rate and repeated up to four times for additional rates. | ||||

Table 15 Diesel Fuel Claim for Refund on Nontaxable Uses FLT File Form Descriptors

| Ref Line No | Description | FG10 Line Item Code | FG11 UOM | FG12 UOM Qualifier |

|---|---|---|---|---|

| X | Gallons for Which Refund Is Due at Rate by Product | L00031 | GA | Billed |

| 4 | Total Gallons for Which Refund Is Due | L00001 | GA | Billed |

| 5 | Total Amount of Refund Claimed | L00002 | USD | Tax |

| Report Type = DUC Gallons at Rate (Ref Line No. X) is reported once for the current rate and repeated up to four times for additional rates. | ||||

Attribute Conventions and Separator Requirements

Table 16 Flat File List of Attribute Conventions

| Attribute | Definition | |

|---|---|---|

| Data Element Type | Nn Numeric | Numeric type data element is symbolized by the two-position representation (Nn). "N" indicates a numeric, and "n" indicates the decimal places to the right of a fixed, implied decimal point. N0 (N Zero) is a numeric with no decimal places. |

| R Decimal (Real) | The decimal point is optional for integer values, but is required for fractional values. For negative values, the leading minus (-) sign is used. Absence of this sign indicates a positive value. The plus (+) sign should not be transmitted. | |

| ID Identifier | An identifier data element must always contain a value from a predefined list of values that is maintained by ASC X12 or by other bodies that are recognized by ASC X12 or as developed specifically for the flat file format by the CDTFA. | |

| AN String | A string (alphanumeric) is a sequence of any characters from the basic or extended character sets. It must contain at least one non-space character. The significant characters must be left justified. Leading spaces, if any, are assumed to be significant. Trailing spaces should be suppressed. | |

| DT Date | Format for the date type is YYYYMMDD. YYYY is the four digits of the year (2019), MM is the numeric value of the month (01-12), and DD for the day (01-31). | |

| TM Time | Format for the time type is HHMMSS, expressed in 24-hour clock format. HH is the numeric value for hour (00-23), MM for minute (00-59), and SS for second (00-59). | |

| Requirement Designator | Defines how the data element is used in a segment | |

| M Mandatory | This element must appear in the segment. | |

| O Optional | The appearance of this data element is at the option of the sending party or is based on a mutual agreement of the interchange parties. | |

| X Relational | Relational conditions may exist between two or more data elements. If one is present the other(s) is (are) required. The relational condition is displayed under the Syntax Notes. | |

| S Situational | Situational conditions may exist with one or more data elements. The data element may be required to be populated only in certain situations. When a data element is not required to be populated, a "Filler Tab" must be entered in its place. The situational condition is displayed under the Syntax Notes. | |

| N Not Required | Not Required conditions may exist with one or more data elements. The data element may not be required to be populated for certain tax forms. When a data element is not required to be populated, a "Filler Tab" must be entered in its place. The Not Required condition is displayed under the Syntax Notes. | |

| Data Element Length | x / x Minimum and Maximum lengths | The number of character positions assigned to a data element. Example: Data element length of 2/10. You must have at least 2 characters but no more than 10 characters for this element (minimum of 2/ maximum of 10). |

Table 17 Flat File Separator Requirements

| Type | ASCII Value | EBCDIC Value | Character | Character Name |

|---|---|---|---|---|

| Record Separator | 1310 | 1321 | <cr> | Carriage Return (Paragraph) |

| Element Separator | 9 | 5 | <tab> | Tab |

| Padding Character | 32 | 64 | <sp> | Space |

Motor Fuels FLT File Reporting Map

| Key: | |

| Notes | Note: important to read all notes |

| Syntax Notes | Translation Syntax Requirements The California translator will enforce these rules. |

Table 18 FLT File Filing Format Identifier Record Type

| Filing Format Identifier Type (Required) | ||||||

|---|---|---|---|---|---|---|

| Field No | Field Status | Field Name | Field Type | Length | Field Description | |

| Min. | Max. | |||||

| FLT01 | M | Electronic Return Record Type | AN | 3 | 3 | "FLT" = Flat File Type |

| FLT02 | M | Version | AN | 3 | 5 | "4.0" = CDTFA Version |

| FLT03 | M | CDTFA DUNS Number | AN | 9 | 9 | "116725470" = CDTFA DUNS Number |

| FLT04 | M | Interchange Control Number Unique Number for This Filing | AN | 4 | 9 | Filer defined unique control number for this filing. This control number should never be reused for any future filings. |

| FLT<tab>4.0<tab>116725470<tab>123456789<cr> | ||||||

| SYNTAX NOTES: None | ||||||

Table 19 FLT File Header Record Type

| Header Record Type (Required) | ||||||

|---|---|---|---|---|---|---|

| Field No | Field Status | Field Name | Field Type | Length | Field Description | |

| Min. | Max. | |||||

| FE01 | M | Record Type | AN | 2 | 2 | "FE" = Identifies header record type |

| FE02 | M | Account Number | N | 9 | 9 | CDTFA Account Number |

| FE03 | M | Alternate ID Type | AN | 2 | 2 | Identifies the type of Alternate ID. May be either 24 for FEIN, or 34 for SSN. |

| FE04 | M | Alternate ID | AN | 9 | 9 | FEIN or SSN |

| FE05 | M | Report End Date | DT | 8 | 8 | End date of the reporting period that the tax form represents. Format is YYYYMMDD. |

| FE06 | M | Report Start Date | DT | 8 | 8 | Start date of the reporting period that the tax form represents. Format is YYYYMMDD. |

| FE07 | M | Purpose Code | AN | 2 | 2 | Identifies the Information Provider's purpose. Values are 00 Original; "Filler Tab" Replacement or Supplemental |

| FE08 | M | Purpose Transaction Type | AN | 2 | 2 | Identifies the Information Provider's purpose for the transaction. Values are a "Filler Tab" Original, 6R Replacement; 6S Supplemental. |

| FE09 | M | Report Type | AN | 3 | 3 | Type of return or report being filed. Refer to the Motor Fuels FLT File Tax Form Descriptors section for the correct value. |

| FE10 | M | "Filler Tab" | AN | 9 | 9 | "Filler Tab" |

| FE11 | M | No Activity Flag | AN | 1 | 9 | Identifies if the tax form is reporting any activity. Value = "1" indicates no activity. Else, "Filler Tab" |

| FE12 | M | Record ID Qualifier | AN | 9 | 9 | "Filler Tab" |

| FE13 | M | Record ID | AN | 9 | 9 | "Filler Tab" |

| FE14 | M | "Filler Tab" | AN | 9 | 9 | "Filler Tab" |

| FE15 | M | Authorization Code | AN | 10 | 10 | Enter the 10-character Authorization Code provided to the filer by the CDTFA or 0000000000 |

| FE16 | M | Security Code | AN | 10 | 10 | Enter the 10-character Password provided by the filer to the CDTFA in the filer's Trading Partner Agreement or 0000000000 |

| FE17 | M | Sender ID | AN | 9 | 9 | Sender's FEIN or SSN [xxxxxxxxx] |

| FE18 | M | "Filler Tab" | AN | 10 | 10 | "Filler Tab" |

| FE19 | M | Test or Production Indicator | AN | 1 | 1 | "P" = Production Data |

| FE20 | M | Sender ID | AN | 9 | 9 | Sender's FEIN or SSN [xxxxxxxxx] |

| FE21 | M | Interchange Control Number Unique Number for This Filing | AN | 4 | 9 | Filer-defined unique control number for this filing. This control number should never be reused for any future filings. |

| FE22 | M | Information Provider Type | AN | 2 | 2 | "TP" = Information Provider - Taxpayer (PS, DD, MJ, DU, DZ, DV, & DVW filers) "L9" = Information Provider Other (PO, PC, & PT filers) |

| FE23 | M | Information Provider Name | AN | 1 | 35 | Name |

| FE24 | O | Information Provider's DBA Line 1 |

AN | 1 | 70 | DBA |

| FE25 | O | Information Provider's DBA Line 2 |

AN | 1 | 70 | DBA |

| FE26 | M | Information Provider's Address Line 1 | AN | 1 | 35 | First Line Street Address |

| FE27 | O | Information Provider's Address Line 2 | AN | 1 | 35 | Second Line Street Address |

| FE28 | M | Information Provider's City | AN | 1 | 30 | Name of City |

| FE29 | M | Information Provider's State | AN | 2 | 2 | State |

| FE30 | M | Information Provider's ZIP | AN | 5 | 5 | ZIP Code |

| FE31 | O | Information Provider's ZIP +4 | AN | 4 | 4 | ZIP Plus 4 Code |

| FE32 | M | Information Provider's General Contact Type | AN | 2 | 2 | CN = General Contact |

| FE33 | O | Information Provider's General Contact Name | AN | 1 | 35 | Contact Name |

| FE34 | X | General Contact's Area Code | AN | 3 | 3 | Contact's Area Code |

| FE35 | X | General Contact's Phone Number | AN | 7 | 7 | Contact's Voice Telephone Number |

| FE36 | X | General Contact's Extension | AN | 1 | 4 | Contact's Extension |

| FE37 | X | General Contact's Fax Area Code | AN | 3 | 3 | Contact's Fax Area Code |

| FE38 | X | General Contact's Fax Number | AN | 7 | 7 | Contact's Fax Telephone Number |

| FE39 | X | General Contact's Fax Extension | AN | 1 | 4 | Contact's Extension |

| FE40 | O | General Contact's Email Address | AN | 1 | 80 | Contact's Email Address |

| FE41 | M | Information Provider's Online Filing Contact Type | AN | 2 | 2 | EA = Online Filing Contact |

| FE42 | O | Information Provider's Online Filing Contact Name | AN | 1 | 35 | Contact Name |

| FE43 | X | Online Filing Contact's Area Code | AN | 3 | 3 | Contact's Area Code |

| FE44 | X | Online Filing Contact's Phone Number | AN | 7 | 7 | Contact's Voice Telephone Number |

| FE45 | X | Online Filing Contact's Extension | AN | 4 | 4 | Contact's Extension |

| FE46 | X | Online Filing Contact's Fax Area Code | AN | 3 | 3 | Contact's Fax Area Code |

| FE47 | X | Online Filing Contact's Fax Number | AN | 7 | 7 | Contact's Fax Telephone Number |

| FE48 | X | Online Filing Contact's Fax Extension | AN | 1 | 4 | Contact's Extension |

| FE49 | O | Online Filing Contact's Email Address | AN | 1 | 80 | Contact's Email Address |

| FE<tab>012345678<tab>24<tab>123456789<tab>20190731<tab>20190701<tab>00<tab><tab>SDR<tab><tab><tab><tab> <tab><tab>AUTHCODE12<tab>PASSWORD12<tab>123456789<tab><tab>P<tab>123456789<tab>123456789<tab>TP <tab>ABC Supplier Company<tab>ABC Supplier Company<tab>ABC Company<tab>48 Washington Street<tab> HQ Building<tab>Any Town<tab>CA<tab>25421<tab>5555<tab>CN<tab>John J. Doe<tab>916<tab>5551212<tab>4444 <tab>916<tab>5554488<tab>7777<tab>jjdoe@abc.com<tab>EA<tab>Bob T. Doe<tab>916<tab>5553245<tab>4444<tab> 916<tab>5554488<tab>7777<tab>btdoe@abc.com<cr> |

||||||

| SYNTAX NOTES: 01 If FE34 or FE35 is present, then the other is required. 02 If FE36 is present, then FE34 and FE35 are required. 03 If FE37 or FE38 is present, then the other is required. 04 If FE39 is present, then FE37 and FE38 are required. 05 If FE43 or FE44 is present, then the other is required. 06 If FE45 is present, then FE43 and FE44 are required. 07 If FE46 or FE47 is present, then the other is required. 08 If FE48 is present, then FE46 and FE48 are required. | ||||||

| FE04 must be the FEIN if the Information Provider has one. Submit a SSN only for sole proprietorships that have not been issued a FEIN. FE24, FE25, FE27, FE33, FE40, FE42, and FE49 are optional fields. If no data is provided, a "Filler Tab" is required. | ||||||

Table 20 FLT File Payment Order/Remittance Advice Record Type

| Line Item Record Type (Optional) | ||||||

|---|---|---|---|---|---|---|

| Field No | Field Status | Field Name | Field Type | Length | Field Description | |

| Min. | Max. | |||||

| FP01 | M | Record Type | AN | 2 | 2 | "FP" = Identifies payment record type |

| FP02 | M | Account Number | N | 9 | 9 | CDTFA Account Number |

| FP03 | M | Alternate ID Type | AN | 2 | 2 | Identifies the type of Alternate Id. May be either 24 for FEIN, or 34 for SSN. |

| FP04 | M | Alternate ID | AN | 9 | 9 | FEIN or SSN |

| FP05 | M | Report End Date | DT | 8 | 8 | End date of the reporting period that the tax form represents. Format is YYYYMMDD. |

| FP06 | M | Report Start Date | DT | 8 | 8 | Start date of the reporting period that the tax form represents. Format is YYYYMMDD. |

| FP07 | M | Purpose Code | AN | 2 | 2 | Identifies the Information Provider's purpose. Values are: 00 Original; "Filler Tab" Replacement or Supplemental. |

| FP08 | M | Purpose Transaction Type | AN | 2 | 2 | Identifies the Information Provider's purpose for the transaction. Values are: "Filler Tab" Original; 6R Replacement; 6S Supplemental. |

| FP09 | M | Report Type | AN | 3 | 3 | Type of return or report being filed. Refer to the Motor Fuels FLT File Tax Form Descriptors section for the correct value. |

| FP10 | M | Payment Warehouse Date | DT | 8 | 8 | Date the payment is to be processed by the CDTFA. Format is YYYYMMDD. |

| FP11 | M | Routing Transit Number | AN | 3 | 12 | The bank routing number from which the payment will be made. |

| FP12 | M | Bank Account Number Qualifier | AN | 6 | 6 | Identifies the type of bank account. Values are: DBTCHK Business checking; DBTSAV Business savings; DBTCCK Personal checking; DBTCSV Personal savings |

| FP13 | M | Bank Account Number | AN | 1 | 17 | The bank account number from which the payment will be made. |

| FP14 | M | Monetary Amount | N | 1 | 11 | Amount of tax payment. Must be whole dollars. |

| FP15 | M | Online Filing Payment Contact Name | AN | 1 | 35 | Contact Name |

| FP16 | M | Online Filing Payment Contact's Area Code | AN | 3 | 3 | Contact's Area Code |

| FP17 | M | Online Filing Payment Contact's Phone Number | AN | 7 | 7 | Contact's Voice Telephone Number |

| FP18 | O | Online Filing Payment Contact's Extension | AN | 1 | 4 | Contact's Extension |

| FP<tab>012345678<tab>24<tab>123456789<tab>20190731<tab>20190701<tab>00<tab><tab>SDR<tab>20190729<tab> 654321234567<tab> DBTCHK<tab>432112345<tab> 5874<tab> John J. Doe<tab>916<tab>5551212<tab>4444<cr> |

||||||

| SYNTAX NOTES: 01 Monetary Amount is the payment amount remitted for the period. It may include payment for applicable interest and penalties. The payment amount must be rounded to the nearest whole dollar. Do not report a decimal or cents. | ||||||

| This segment is only used in SDR and DLR reports. If no data is provided, a "Filler Tab" is required. | ||||||

Table 21 FLT File Line Item Record Type

| Line Item Record Type (Required) | ||||||

|---|---|---|---|---|---|---|

| Field No | Field Status | Field Name | Field Type | Length | Field Description | |

| Min. | Max. | |||||

| FG01 | M | Record Type | AN | 2 | 2 | "FG" = Identifies line item record type |

| FG02 | M | Account Number | N | 9 | 9 | CDTFA Account Number |

| FG03 | M | Alternate ID Type | AN | 2 | 2 | Identifies the type of Alternate Id. May be either 24 for FEIN, or 34 for SSN. |

| FG04 | M | Alternate ID | AN | 9 | 9 | FEIN or SSN |

| FG05 | M | Report End Date | DT | 8 | 8 | End date of the reporting period that the tax form represents. Format is YYYYMMDD. |

| FG06 | M | Report Start Date | DT | 8 | 8 | Start date of the reporting period that the tax form represents. Format is YYYYMMDD. |

| FG07 | M | Purpose Code | AN | 2 | 2 | Identifies the Information Provider's purpose. Values are: 00 Original; "Filler Tab" Replacement or Supplemental. |

| FG08 | M | Purpose Transaction Type | AN | 2 | 2 | Identifies the Information Provider's purpose for the transaction. Values are: "Filler Tab" Original; 6R Replacement; 6S Supplemental. |

| FG09 | M | Report Type | AN | 3 | 3 | Type of return or report being filed. Refer to the Motor Fuels FLT File Tax Form Descriptors section for the correct value. |

| FG10 | M | Line Item Code | AN | 6 | 6 | Identifies line on tax form being reported. Refer to the Motor Fuels FLT File Tax Form Descriptors section to identify the codes for the tax form being filed. |

| FG11 | M | Unit of Measure | AN | 2 | 3 | "GA" = Gallons "USD" = Dollars |

| FG12 | M | Unit of Measure Qualifier | AN | 3 | 6 | Identifies what on tax form is being reported and relates to the line item code. Refer to the Motor Fuels FLT File Tax Form Descriptors section to identify the codes for the tax form being filed. |

| FG13 | M | Amount | N | 1 | 15 | The amount reported as identified by the Unit of Measure. |

| FG14 | M | Unit of Measure | AN | 2 | 3 | "USD" = Dollars |

| FG15 | M | Unit of Measure Qualifier | AN | 3 | 6 | Identifies what on tax form is being reported and relates to the line item code. Refer to the Motor Fuels FLT File Tax Form Descriptors section to identify the codes for the tax form being filed. |

| FG16 | M | Amount | N | 1 | 15 | The amount reported as identified by the Unit of Measure. This amount is the gallons of product multiplied by the rate and rounded to the nearest whole dollar. |

| FG17 | M | Tax Rate | N | 4 | 4 | The tax rate when reporting gallons at a rate. The tax rate should be in an .nnn format (e.g., .473 or .360). |

| FG18 | M | Product Code | AN | 3 | 3 | Identifies the product code for the fuel item being reported |

| FG<tab>012345678<tab>24<tab>123456789<tab>20190731<tab>20190701<tab>00<tab><tab>SDR<tab>L00031<tab>GA <tab>Billed<tab>100000<tab>USD<tab>TAX<tab>47300<tab>.473<tab>065<cr> |

||||||

| SYNTAX NOTES: 01 FG10, FG11, FG12, and FG13 are required for each line item code. Repeat this record type as often as needed to report every product at each rate for every line on the tax form being reported. 02 FG14, FG15, FG16, FG17, and FG18 are required when reporting line item code L00031. | ||||||

| Do not use this segment when reporting TOR, CCR, or PTR. If no data is provided, a "Filler Tab" is required. | ||||||

Table 22 FLT File Schedule Record Type for the Train Operator Report (PTR)

| Schedule Record Type (Required) | ||||||

|---|---|---|---|---|---|---|

| Field No | Field Status | Field Name | Field Type | Length | Field Description | |

| Min. | Max. | |||||

| FS01 | M | Record Type | AN | 2 | 2 | "FS" = Identifies schedule record type |

| FS02 | M | Account Number | N | 9 | 9 | CDTFA Account Number |

| FS03 | M | Alternate ID Type | AN | 2 | 2 | Identifies the type of Alternate ID. May be either 24 for FEIN, or 34 for SSN. |

| FS04 | M | Alternate ID | AN | 9 | 9 | FEIN or SSN |

| FS05 | M | Report End Date | DT | 8 | 8 | End date of the reporting period that the tax form represents. Format is YYYYMMDD. |

| FS06 | M | Report Start Date | DT | 8 | 8 | Start date of the reporting period that the tax form represents. Format is YYYYMMDD. |

| FS07 | M | Purpose Code | AN | 2 | 2 | Identifies the Information Provider's purpose. Values are: 00 Original; "Filler Tab" Replacement or Supplemental. |

| FS08 | M | Purpose Transaction Type | AN | 2 | 2 | Identifies the Information Provider's purpose for the transaction. Values are: "Filler Tab" Original; 6R Replacement; 6S Supplemental. |

| FS09 | M | Report Type | AN | 3 | 3 | Type of return or report being filed. Refer to the Motor Fuels FLT File Tax Form Descriptors section for the correct value. |

| FS10 | M | Schedule Code | AN | 1 | 6 | Identifies the schedule code for the fuel item being reported |

| FS11 | M | Product Code | AN | 3 | 3 | Identifies the product code for the fuel item being reported |

| FS12 | N | Position Holder Tax ID Type | AN | 2 | 2 | Not required for this report. A "Filler Tab" is required. |

| FS13 | N | Position Holder Tax ID | AN | 9 | 9 | Not required for this report. A "Filler Tab" is required. |

| FS14 | N | Receiving Party Tax ID Type | AN | 2 | 2 | Not required for this report. A "Filler Tab" is required. |

| FS15 | N | Receiving Party Tax ID | AN | 9 | 9 | Not required for this report. A "Filler Tab" is required. |

| FS16 | M | Consignor Tax ID Type | AN | 2 | 2 | Not required for this report. A "Filler Tab" is required. |

| FS17 | M | Consignor Tax ID | AN | 9 | 9 | Not required for this report. A "Filler Tab" is required. |

| FS18 | N | Carrier Tax ID Type | AN | 2 | 2 | 24 = FEIN 34 = SSN 49 = CDTFA Account Number |

| FS19 | N | Carrier Tax ID | AN | 9 | 9 | Carrier's FEIN or SSN or CDTFA Account Number |

| FS20 | M | Mode | AN | 1 | 3 | The transportation mode code |

| FS21 | S | Origin State/Country | AN | 2 | 2 | Enter the two character abbreviation for the origin state or country |

| FS22 | S | Origin Terminal Control Number | AN | 9 | 9 | Enter the TCN for the originating terminal |

| FS23 | S | Destination State/Country | AN | 2 | 2 | Enter the two character abbreviation for the destination state or country |

| FS24 | S | Destination Terminal Control Number | AN | 9 | 9 | Enter the TCN for the destination terminal |

| FS25 | N | Seller Tax ID Type | AN | 2 | 2 | 24 = FEIN 34 = SSN 49 = CDTFA Account Number |

| FS26 | N | Seller Tax ID | AN | 9 | 9 | Seller's FEIN or SSN or CDTFA Account Number |

| FS27 | N | Buyer Tax ID Type | AN | 2 | 2 | Not required for this report. A "Filler Tab" is required. |

| FS28 | N | Buyer Tax ID | AN | 9 | 9 | Not required for this report. A "Filler Tab" is required. |

| FS29 | M | Document Date | DT | 8 | 8 | The date the transaction occurred (YYYYMMDD) |

| FS30 | M | Document Number | AN | 1 | 15 | Document Number |

| FS31 | M | Net Quantity Unit of Measure | AN | 2 | 2 | "GA" = Gallons |

| FS32 | M | Net Quantity | N | 1 | 15 | Net Quantity |

| FS33 | N | Gross Quantity Unit of Measure | AN | 2 | 2 | "GA" = Gallons |

| FS34 | N | Gross Quantity | N | 1 | 15 | Gross Quantity |

| FS35 | N | Billed Quantity Unit of Measure | AN | 2 | 2 | "GA" = Gallons |

| FS36 | N | Billed Quantity | N | 1 | 15 | Billed Quantity |

| FS37 | M | Interchange Control Number Unique Number For This Filing | AN | 4 | 9 | Filer-defined unique control number for this filing. This control number should never be reused for any future filings |

| FS38 | N | Seller's Name | AN | 1 | 35 | Seller's Name |

| FS39 | N | Position Holder's Name | AN | 1 | 35 | Not required for this report. A "Filler Tab" is required. |

| FS40 | N | Receiving Party Name | AN | 1 | 35 | Not required for this report. A "Filler Tab" is required. |

| FS41 | M | Consignor's Name | AN | 1 | 35 | Not required for this report. A "Filler Tab" is required. |

| FS42 | N | Carrier's Name | AN | 1 | 35 | Carrier's Name |

| FS43 | N | Buyer's Name | AN | 1 | 35 | Not required for this report. A "Filler Tab" is required. |

| FS44 | N | Purchase Date | DT | 8 | 8 | Not required for this report. A "Filler Tab" is required. |

| FS45 | N | Tax Rate | N | 4 | 4 | Not required for this report. A "Filler Tab" is required. |

| FS<tab>012345678<tab>24<tab>123456789<tab>20190731<tab>20190701<tab>00<tab><tab>PTR<tab>TO<tab>167<tab><tab><tab><tab><tab><tab><tab>24<tab>222444333<tab>J<tab><tab>CA555TCN1<tab>CA<tab><tab>24<tab> 987654321<tab><tab><tab>20190703<tab>DOC1234<tab>GA<tab>7856<tab>GA<tab>7900<tab>GA<tab>7856<tab> 705547806<tab>XYZ Fuel Supplier <tab><tab><tab><tab>Another Carrier<tab><tab><tab><cr> | ||||||

| SYNTAX NOTES: 01 Use FS21 if the origin is not a terminal with a TCN. Otherwise, use a "Filler Tab" and Use FS22 to report the TCN. 02 Use FS22 if the origin is a terminal with a TCN. Otherwise, use a "Filler Tab" and Use FS21 to report the origin state. 03 Use FS23 if the destination is not a terminal with a TCN. Otherwise, use a "Filler Tab" and Use FS24 to report the TCN. 04 Use FS24 if the destination is a terminal with a TCN. Otherwise, use a "Filler Tab" and Use FS23 to report the destination state. 05 No data is required for fields FS12, FS13, FS14, FS15, FS16, FS17, FS27, FS28, FS39, FS40, FS41, FS43, FS44, and FS45. A "Filler Tab" is required. | ||||||

| If no data is provided, a "Filler Tab" is required. | ||||||

Table 23 FLT File Schedule Record Type for the Petroleum Carrier Report (CCR)

| Schedule Record Type (Required) | ||||||

|---|---|---|---|---|---|---|

| Field No | Field Status | Field Name | Field Type | Length | Field Description | |

| Min. | Max. | |||||

| FS01 | M | Record Type | AN | 2 | 2 | "FS" = Identifies schedule record type |

| FS02 | M | Account Number | N | 9 | 9 | CDTFA Account Number |

| FS03 | M | Alternate ID Type | AN | 2 | 2 | Identifies the type of Alternate ID. May be either 24 for FEIN, or 34 for SSN. |

| FS04 | M | Alternate ID | AN | 9 | 9 | FEIN or SSN |

| FS05 | M | Report End Date | DT | 8 | 8 | End date of the reporting period that the tax form represents. Format is YYYYMMDD. |

| FS06 | M | Report Start Date | DT | 8 | 8 | Start date of the reporting period that the tax form represents. Format is YYYYMMDD. |

| FS07 | M | Purpose Code | AN | 2 | 2 | Identifies the Information Provider's purpose. Values are: 00 Original; "Filler Tab" Replacement or Supplemental. |

| FS08 | M | Purpose Transaction Type | AN | 2 | 2 | Identifies the Information Provider's purpose for the transaction. Values are: "Filler Tab" Original; 6R Replacement; 6S Supplemental. |

| FS09 | M | Report Type | AN | 3 | 3 | Type of return or report being filed. Refer to the Motor Fuels FLT File Tax Form Descriptors section for the correct value. |

| FS10 | M | Schedule Code | AN | 1 | 6 | Identifies the schedule code for the fuel item being reported |

| FS11 | M | Product Code | AN | 3 | 3 | Identifies the product code for the fuel item being reported |

| FS12 | N | Position Holder Tax ID Type | AN | 2 | 2 | Not required for this report. A "Filler Tab" is required. |

| FS13 | N | Position Holder Tax ID | AN | 9 | 9 | Not required for this report. A "Filler Tab" is required. |

| FS14 | N | Receiving Party Tax ID Type | AN | 2 | 2 | Not required for this report. A "Filler Tab" is required. |

| FS15 | N | Receiving Party Tax ID | AN | 9 | 9 | Not required for this report. A "Filler Tab" is required. |

| FS16 | M | Consignor Tax ID Type | AN | 2 | 2 | 24 = FEIN 34 = SSN 49 = CDTFA Account Number |

| FS17 | M | Consignor Tax ID | AN | 9 | 9 | Consignor's FEIN or SSN or CDTFA Account Number |

| FS18 | N | Carrier Tax ID Type | AN | 2 | 2 | Not required for this report. A "Filler Tab" is required. |

| FS19 | N | Carrier Tax ID | AN | 9 | 9 | Not required for this report. A "Filler Tab" is required. |

| FS20 | M | Mode | AN | 1 | 3 | The transportation mode code |

| FS21 | S | Origin State/Country | AN | 2 | 2 | Enter the two character abbreviation for the origin state or country |

| FS22 | S | Origin Terminal Control Number | AN | 9 | 9 | Enter the TCN for the originating terminal |

| FS23 | S | Destination State/Country | AN | 2 | 2 | Enter the two character abbreviation for the destination state or country |

| FS24 | S | Destination Terminal Control Number | AN | 9 | 9 | Enter the TCN for the destination terminal |

| FS25 | N | Seller Tax ID Type | AN | 2 | 2 | Not required for this report. A "Filler Tab" is required. |

| FS26 | N | Seller Tax ID | AN | 9 | 9 | Not required for this report. A "Filler Tab" is required. |

| FS27 | N | Buyer Tax ID Type | AN | 2 | 2 | Not required for this report. A "Filler Tab" is required. |

| FS28 | N | Buyer Tax ID | AN | 9 | 9 | Not required for this report. A "Filler Tab" is required. |

| FS29 | M | Document Date | DT | 8 | 8 | The date the transaction occurred (YYYYMMDD) |

| FS30 | M | Document Number | AN | 1 | 15 | Document Number |

| FS31 | M | Net Quantity Unit of Measure | AN | 2 | 2 | "GA" = Gallons |

| FS32 | M | Net Quantity | N | 1 | 15 | Net Quantity |

| FS33 | N | Gross Quantity Unit of Measure | AN | 2 | 2 | Not required for this report. A "Filler Tab" is required. |

| FS34 | N | Gross Quantity | N | 1 | 15 | Not required for this report. A "Filler Tab" is required. |

| FS35 | N | Billed Quantity Unit of Measure | AN | 2 | 2 | Not required for this report. A "Filler Tab" is required. |

| FS36 | N | Billed Quantity | N | 1 | 15 | Not required for this report. A "Filler Tab" is required. |

| FS37 | M | Interchange Control Number Unique Number For This Filing | AN | 4 | 9 | Filer-defined unique control number for this filing. This control number should never be reused for any future filings |

| FS38 | N | Seller's Name | AN | 1 | 35 | Not required for this report. A "Filler Tab" is required. |

| FS39 | N | Position Holder's Name | AN | 1 | 35 | Not required for this report. A "Filler Tab" is required. |

| FS40 | N | Receiving Party Name | AN | 1 | 35 | Not required for this report. A "Filler Tab" is required. |

| FS41 | M | Consignor's Name | AN | 1 | 35 | Consignor's Name |

| FS42 | N | Carrier's Name | AN | 1 | 35 | Not required for this report. A "Filler Tab" is required. |

| FS43 | N | Buyer's Name | AN | 1 | 35 | Not required for this report. A "Filler Tab" is required. |

| FS44 | N | Purchase Date | DT | 8 | 8 | Not required for this report. A "Filler Tab" is required. |

| FS45 | N | Tax Rate | N | 4 | 4 | Not required for this report. A "Filler Tab" is required. |

| FS<tab>012345678<tab>24<tab>123456789<tab>20190731<tab>20190701<tab>00<tab><tab>CCR<tab>14E<tab>167 <tab><tab>123456789<tab><tab><tab>24<tab>998877665<tab>24<tab>112233445<tab>J<tab><tab>CA555TCN1<tab> <tab><tab><tab><tab><tab><tab>20190715<tab>JCL25498X<tab>GA<tab>5000<tab><tab><tab><tab><tab>123456789 <tab><tab><tab><tab>XYZ Consignors<tab><tab><tab><tab><cr> | ||||||

| SYNTAX NOTES: 01 Use FS21 if the origin is not a terminal with a TCN. Otherwise, use a "Filler Tab" and Use FS22 to report the TCN. 02 Use FS22 if the origin is a terminal with a TCN. Otherwise, use a "Filler Tab" and Use FS21 to report the origin state. 03 Use FS23 if the destination is not a terminal with a TCN. Otherwise, use a "Filler Tab" and Use FS24 to report the TCN. 04 Use FS24 if the destination is a terminal with a TCN. Otherwise, use a "Filler Tab" and Use FS23 to report the destination state. 05 No data is required for fields FS12, FS13, FS18, FS19, FS25, FS26, FS27, FS28, FS33, FS34, FS35, FS36, FS38, FS39, FS40, FS42, FS43, FS44, and FS45. A "Filler Tab" is required. | ||||||

| If no data is provided, a "Filler Tab" is required. | ||||||

Table 24 FLT File Schedule Record Type for the Train Operator s Petroleum Carrier Report (CCR)

| Schedule Record Type (Required) | ||||||

|---|---|---|---|---|---|---|

| Field No | Field Status | Field Name | Field Type | Length | Field Description | |

| Min. | Max. | |||||

| FS01 | M | Record Type | AN | 2 | 2 | "FS" = Identifies schedule record type |

| FS02 | M | Account Number | N | 9 | 9 | CDTFA Account Number |

| FS03 | M | Alternate ID Type | AN | 2 | 2 | Identifies the type of Alternate ID. May be either 24 for FEIN, or 34 for SSN. |

| FS04 | M | Alternate ID | AN | 9 | 9 | FEIN or SSN |

| FS05 | M | Report End Date | DT | 8 | 8 | End date of the reporting period that the tax form represents. Format is YYYYMMDD. |

| FS06 | M | Report Start Date | DT | 8 | 8 | Start date of the reporting period that the tax form represents. Format is YYYYMMDD. |

| FS07 | M | Purpose Code | AN | 2 | 2 | Identifies the Information Provider's purpose. Values are: 00 Original; "Filler Tab" Replacement or Supplemental. |

| FS08 | M | Purpose Transaction Type | AN | 2 | 2 | Identifies the Information Provider's purpose for the transaction. Values are: "Filler Tab" Original; 6R Replacement; 6S Supplemental. |

| FS09 | M | Report Type | AN | 3 | 3 | Type of return or report being filed. Refer to the Motor Fuels FLT File Tax Form Descriptors section for the correct value. |

| FS10 | M | Schedule Code | AN | 1 | 6 | Identifies the schedule code for the fuel item being reported |

| FS11 | M | Product Code | AN | 3 | 3 | Identifies the product code for the fuel item being reported |

| FS12 | N | Position Holder Tax ID Type | AN | 2 | 2 | Not required for this report. A "Filler Tab" is required. |

| FS13 | N | Position Holder Tax ID | AN | 9 | 9 | Not required for this report. A "Filler Tab" is required. |

| FS14 | N | Receiving Party Tax ID Type | AN | 2 | 2 | Not required for this report. A "Filler Tab" is required. |

| FS15 | N | Receiving Party Tax ID | AN | 9 | 9 | Not required for this report. A "Filler Tab" is required. |

| FS16 | M | Consignor Tax ID Type | AN | 2 | 2 | 24 = FEIN 34 = SSN 49 = CDTFA Account Number |

| FS17 | M | Consignor Tax ID | AN | 9 | 9 | Consignor's FEIN or SSN or CDTFA Account Number |

| FS18 | N | Carrier Tax ID Type | AN | 2 | 2 | Not required for this report. A "Filler Tab" is required. |

| FS19 | N | Carrier Tax ID | AN | 9 | 9 | Not required for this report. A "Filler Tab" is required. |

| FS20 | M | Mode | AN | 1 | 3 | The transportation mode code |

| FS21 | S | Origin State/Country | AN | 2 | 2 | Enter the two character abbreviation for the origin state or country |

| FS22 | S | Origin Terminal Control Number | AN | 2 | 9 | Enter the TCN for the originating terminal or the name of the origin city if the TCN does not exist or is unknown |

| FS23 | S | Destination State/Country | AN | 2 | 2 | Enter the two character abbreviation for the destination state or country |

| FS24 | S | Destination Terminal Control Number | AN | 2 | 9 | Enter the TCN for the destination terminal or the name of the destination city if the TCN does not exist or is unknown |

| FS25 | N | Seller Tax ID Type | AN | 2 | 2 | Not required for this report. A "Filler Tab" is required. |

| FS26 | N | Seller Tax ID | AN | 9 | 9 | Not required for this report. A "Filler Tab" is required. |

| FS27 | N | Buyer Tax ID Type | AN | 2 | 2 | Not required for this report. A "Filler Tab" is required. |

| FS28 | N | Buyer Tax ID | AN | 9 | 9 | Not required for this report. A "Filler Tab" is required. |

| FS29 | M | Document Date | DT | 8 | 8 | The date the transaction occurred (YYYYMMDD) |

| FS30 | M | Document Number | AN | 1 | 15 | Document Number |

| FS31 | M | Net Quantity Unit of Measure | AN | 2 | 2 | "GA" = Gallons |

| FS32 | M | Net Quantity | N | 1 | 15 | Net Quantity |

| FS33 | N | Gross Quantity Unit of Measure | AN | 2 | 2 | Not required for this report. A "Filler Tab" is required. |

| FS34 | N | Gross Quantity | N | 1 | 15 | Not required for this report. A "Filler Tab" is required. |

| FS35 | N | Billed Quantity Unit of Measure | AN | 2 | 2 | Not required for this report. A "Filler Tab" is required. |

| FS36 | N | Billed Quantity | N | 1 | 15 | Not required for this report. A "Filler Tab" is required. |

| FS37 | M | Interchange Control Number Unique Number For This Filing | AN | 4 | 9 | Filer-defined unique control number for this filing. This control number should never be reused for any future filings |

| FS38 | N | Seller's Name | AN | 1 | 35 | Not required for this report. A "Filler Tab" is required. |

| FS39 | N | Position Holder's Name | AN | 1 | 35 | Not required for this report. A "Filler Tab" is required. |

| FS40 | N | Receiving Party Name | AN | 1 | 35 | Not required for this report. A "Filler Tab" is required. |

| FS41 | M | Consignor's Name | AN | 1 | 35 | Consignor's Name |

| FS42 | N | Carrier's Name | AN | 1 | 35 | Not required for this report. A "Filler Tab" is required. |

| FS43 | N | Buyer's Name | AN | 1 | 35 | Not required for this report. A "Filler Tab" is required. |

| FS44 | N | Purchase Date | DT | 8 | 8 | Not required for this report. A "Filler Tab" is required. |

| FS45 | N | Tax Rate | N | 4 | 4 | Not required for this report. A "Filler Tab" is required. |

| FS<tab>012345678<tab>24<tab>123456789<tab>20190731<tab>20190701<tab>00<tab><tab>CCR<tab>14E<tab>167 <tab>24<tab><tab><tab><tab>24<tab>998877665<tab>24<tab>112233445<tab>J<tab><tab>CA555TCN1<tab><tab><tab><tab><tab><tab><tab>20190715<tab>JCL25498X<tab>GA<tab>5000<tab><tab><tab><tab><tab>123456789<tab><tab> <tab><tab>XYZ Consignors<tab><tab><tab><tab><cr> | ||||||

| SYNTAX NOTES: 01 Use FS21 if the origin is not a terminal with a TCN. Otherwise, use a "Filler Tab" and Use FS22 to report the TCN. 02 Use FS22 if the origin is a terminal with a TCN. Otherwise, use a "Filler Tab" and Use FS21 to report the origin state. 03 Use FS23 if the destination is not a terminal with a TCN. Otherwise, use a "Filler Tab" and Use FS24 to report the TCN. 04 Use FS24 if the destination is a terminal with a TCN. Otherwise, use a "Filler Tab" and Use FS23 to report the destination state. 05 No data is required for fields FS12, FS13, FS18, FS19, FS25, FS26, FS27, FS28, FS33, FS34, FS35, FS36, FS38, FS39, FS40, FS42, FS43, FS44, and FS45. A "Filler Tab" is required. | ||||||

| If no data is provided, a "Filler Tab" is required. | ||||||

Table 25 FLT File Schedule Record Type for the Terminal Operator Report (TOR)

| Schedule Record Type (Required) | ||||||

|---|---|---|---|---|---|---|

| Field No | Field Status | Field Name | Field Type | Length | Field Description | |

| Min. | Max. | |||||

| FS01 | M | Record Type | AN | 2 | 2 | "FS" = Identifies schedule record type |

| FS02 | M | Account Number | N | 9 | 9 | CDTFA Account Number |

| FS03 | M | Alternate ID Type | AN | 2 | 2 | Identifies the type of Alternate ID. May be either 24 for FEIN, or 34 for SSN. |

| FS04 | M | Alternate ID | AN | 9 | 9 | FEIN or SSN |

| FS05 | M | Report End Date | DT | 8 | 8 | End date of the reporting period that the tax form represents. Format is YYYYMMDD. |

| FS06 | M | Report Start Date | DT | 8 | 8 | Start date of the reporting period that the tax form represents. Format is YYYYMMDD. |

| FS07 | M | Purpose Code | AN | 2 | 2 | Identifies the Information Provider's purpose. Values are: 00 Original; "Filler Tab" Replacement or Supplemental. |

| FS08 | M | Purpose Transaction Type | AN | 2 | 2 | Identifies the Information Provider's purpose for the transaction. Values are: "Filler Tab" Original; 6R Replacement; 6S Supplemental. |

| FS09 | M | Report Type | AN | 3 | 3 | Type of return or report being filed. Refer to the Motor Fuels FLT File Tax Form Descriptors section for the correct value. |

| FS10 | M | Schedule Code | AN | 1 | 6 | Identifies the schedule code for the fuel item being reported |

| FS11 | M | Product Code | AN | 3 | 3 | Identifies the product code for the fuel item being reported |

| FS12 | S | Position Holder Tax ID Type | AN | 2 | 2 | 24 = FEIN 34 = SSN 49 = CDTFA Account Number |

| FS13 | S | Position Holder Tax ID | AN | 9 | 9 | Position Holder's FEIN or SSN or CDTFA Account Number |

| FS14 | S | Receiving Party Tax ID Type | AN | 2 | 2 | 24 = FEIN 34 = SSN 49 = CDTFA Account Number |

| FS15 | S | Receiving Party Tax ID | AN | 9 | 9 | Receiving Party's FEIN or SSN or CDTFA Account Number |

| FS16 | N | Consignor Tax ID Type | AN | 2 | 2 | Not required for this report. A "Filler Tab" is required. |

| FS17 | N | Consignor Tax ID | AN | 9 | 9 | Not required for this report. A "Filler Tab" is required. |

| FS18 | M | Carrier Tax ID Type | AN | 2 | 2 | 24 = FEIN 34 = SSN 49 = CDTFA Account Number |

| FS19 | M | Carrier Tax ID | AN | 9 | 9 | Carrier's FEIN or SSN or CDTFA Account Number |

| FS20 | M | Mode | AN | 1 | 3 | The transportation mode code |

| FS21 | N | Origin State/Country | AN | 2 | 2 | Not required for this report. A "Filler Tab" is required. |

| FS22 | N | Origin Terminal Control Number | AN | 9 | 9 | Not required for this report. A "Filler Tab" is required. |

| FS23 | S | Destination State/Country | AN | 2 | 2 | Enter the two character abbreviation for the destination state or country |

| FS24 | S | Destination Terminal Control Number | AN | 9 | 9 | Enter the TCN for the destination terminal |

| FS25 | N | Seller Tax ID Type | AN | 2 | 2 | Not required for this report. A "Filler Tab" is required. |

| FS26 | N | Seller Tax ID | AN | 9 | 9 | Not required for this report. A "Filler Tab" is required. |

| FS27 | N | Buyer Tax ID Type | AN | 2 | 2 | Not required for this report. A "Filler Tab" is required. |

| FS28 | N | Buyer Tax ID | AN | 9 | 9 | Not required for this report. A "Filler Tab" is required. |

| FS29 | M | Document Date | DT | 8 | 8 | The date the transaction occurred (YYYYMMDD) |

| FS30 | M | Document Number | AN | 1 | 15 | Document Number |

| FS31 | M | Net Quantity Unit of Measure | AN | 2 | 2 | "GA" = Gallons |

| FS32 | M | Net Quantity | N | 1 | 15 | Net Quantity |

| FS33 | S | Gross Quantity Unit of Measure | AN | 2 | 2 | "GA" = Gallons |

| FS34 | S | Gross Quantity | N | 1 | 15 | Gross Quantity |

| FS35 | N | Billed Quantity Unit of Measure | AN | 2 | 2 | Not required for this report. A "Filler Tab" is required. |

| FS36 | N | Billed Quantity | N | 1 | 15 | Not required for this report. A "Filler Tab" is required. |

| FS37 | M | Interchange Control Number Unique Number For This Filing | AN | 4 | 9 | Filer-defined unique control number for this filing. This control number should never be reused for any future filings |

| FS38 | N | Seller's Name | AN | 1 | 35 | Not required for this report. A "Filler Tab" is required. |

| FS39 | S | Position Holder's Name | AN | 1 | 35 | Position Holder's Name |

| FS40 | S | Receiving Party Name | AN | 1 | 35 | Receiving Party s Name |

| FS41 | N | Consignor's Name | AN | 1 | 35 | Not required for this report. A "Filler Tab" is required. |

| FS42 | M | Carrier's Name | AN | 1 | 35 | Carrier's Name |

| FS43 | N | Buyer's Name | AN | 1 | 35 | Not required for this report. A "Filler Tab" is required. |

| FS44 | N | Purchase Date | DT | 8 | 8 | Not required for this report. A "Filler Tab" is required. |

| FS45 | N | Tax Rate | N | 4 | 4 | Not required for this report. A "Filler Tab" is required. |

| FS<tab>012345678<tab>24<tab>123456789<tab>20190731<tab>20190701<tab>00<tab><tab>TOR<tab>15B<tab>167<tab>24<tab>123456789<tab>24<tab>555666777<tab><tab><tab>24<tab>112233445<tab>J<tab><tab><tab>CA<tab><tab> <tab><tab><tab><tab>20190715<tab>JCL25498X<tab>GA<tab>5000<tab>GA<tab>5020<tab><tab><tab>123456789<tab><tab>ABC Supplier Company<tab>D Receiver<tab><tab>XXX Fuel Carrier<tab><tab><tab><cr> |

||||||

| SYNTAX NOTES: 01 FS12, FS13, and FS39 are only required for Terminal Disbursement (15B) schedules. Enter "Filler Tab"s if Terminal Receipts (15A) schedules. 02 FS14, FS15, and FS40 are only required when reporting two-party exchange transactions on a Terminal Disbursement (15B) schedule. Enter "Filler Tab"s if not reporting a two-party exchange or reporting a Terminal Receipt (15A). 03 FS23 is only required for Terminal Disbursement (15B) schedules. Use FS23 if the destination is not a terminal with a TCN. Otherwise, use a "Filler Tab" and Use FS24 to report the TCN. 04 FS24 is only required for Terminal Disbursement (15B) schedules. Use FS24 if the destination is a terminal with a TCN. Otherwise, use a "Filler Tab" and Use FS23 to report the destination state. 05 FS33 and FS34 are only required for Terminal Disbursement (15B) schedules. 06 No data is required for fields FS14, FS15, FS16, FS17, FS21, FS22, FS25, FS26, FS27, FS28, FS35, FS36, FS38, FS41, FS43, FS44, and FS45. A "Filler Tab" is required. | ||||||

| If no data is provided, a "Filler Tab" is required. | ||||||

Table 26 FLT File Schedule Record Type for the Supplier of Diesel Fuel Tax Return or Supplier of Motor Vehicle Fuel Tax Return (SDR)

| Schedule Record Type (Required) | ||||||

|---|---|---|---|---|---|---|

| Field No | Field Status | Field Name | Field Type | Length | Field Description | |

| Min. | Max. | |||||

| FS01 | M | Record Type | AN | 2 | 2 | "FS" = Identifies schedule record type |

| FS02 | M | Account Number | N | 9 | 9 | CDTFA Account Number |

| FS03 | M | Alternate ID Type | AN | 2 | 2 | Identifies the type of Alternate ID. May be either 24 for FEIN, or 34 for SSN. |

| FS04 | M | Alternate ID | AN | 9 | 9 | FEIN or SSN |

| FS05 | M | Report End Date | DT | 8 | 8 | End date of the reporting period that the tax form represents. Format is YYYYMMDD. |

| FS06 | M | Report Start Date | DT | 8 | 8 | Start date of the reporting period that the tax form represents. Format is YYYYMMDD. |

| FS07 | M | Purpose Code | AN | 2 | 2 | Identifies the Information Provider's purpose. Values are: 00 Original; "Filler Tab" Replacement or Supplemental. |

| FS08 | M | Purpose Transaction Type | AN | 2 | 2 | Identifies the Information Provider's purpose for the transaction. Values are: "Filler Tab" Original; 6R Replacement; 6S Supplemental. |

| FS09 | M | Report Type | AN | 3 | 3 | Type of return or report being filed. Refer to the Motor Fuels FLT File Tax Form Descriptors section for the correct value. |

| FS10 | M | Schedule Code | AN | 1 | 6 | Identifies the schedule code for the fuel item being reported |

| FS11 | M | Product Code | AN | 3 | 3 | Identifies the product code for the fuel item being reported |

| FS12 | N | Position Holder Tax ID Type | AN | 2 | 2 | Not required for this report. A "Filler Tab" is required. |

| FS13 | N | Position Holder Tax ID | AN | 9 | 9 | Not required for this report. A "Filler Tab" is required. |

| FS14 | N | Receiving Party Tax ID Type | AN | 2 | 2 | Not required for this report. A "Filler Tab" is required. |

| FS15 | N | Receiving Party Tax ID | AN | 9 | 9 | Not required for this report. A "Filler Tab" is required. |

| FS16 | N | Consignor Tax ID Type | AN | 2 | 2 | Not required for this report. A "Filler Tab" is required. |

| FS17 | N | Consignor Tax ID | AN | 9 | 9 | Not required for this report. A "Filler Tab" is required. |

| FS18 | S | Carrier Tax ID Type | AN | 2 | 2 | 24 = FEIN 34 = SSN 49 = CDTFA Account Number |

| FS19 | S | Carrier Tax ID | AN | 9 | 9 | Carrier's FEIN or SSN or CDTFA Account Number |

| FS20 | M | Mode | AN | 1 | 3 | The transportation mode code |

| FS21 | S | Origin State/Country | AN | 2 | 2 | Enter the two character abbreviation for the origin state or country |

| FS22 | S | Origin Terminal Control Number | AN | 9 | 9 | Enter the TCN for the originating terminal |

| FS23 | S | Destination State/Country | AN | 2 | 2 | Enter the two character abbreviation for the destination state or country |

| FS24 | S | Destination Terminal Control Number | AN | 9 | 9 | Enter the TCN for the destination terminal |

| FS25 | S | Seller Tax ID Type | AN | 2 | 2 | 24 = FEIN 34 = SSN 49 = CDTFA Account Number |

| FS26 | S | Seller Tax ID | AN | 9 | 9 | Seller's FEIN or SSN or CDTFA Account Number |

| FS27 | S | Buyer Tax ID Type | AN | 2 | 2 | 24 = FEIN 34 = SSN 49 = CDTFA Account Number |

| FS28 | S | Buyer Tax ID | AN | 9 | 9 | Buyer's FEIN or SSN or CDTFA Account Number |

| FS29 | M | Document Date | DT | 8 | 8 | The date the transaction occurred (YYYYMMDD) |

| FS30 | M | Document Number | AN | 1 | 15 | Document Number |

| FS31 | M | Net Quantity Unit of Measure | AN | 2 | 2 | "GA" = Gallons |

| FS32 | M | Net Quantity | N | 1 | 15 | Net Quantity |

| FS33 | X | Gross Quantity Unit of Measure | AN | 2 | 2 | "GA" = Gallons |

| FS34 | X | Gross Quantity | N | 1 | 15 | Gross Quantity |

| FS35 | X | Billed Quantity Unit of Measure | AN | 2 | 2 | "GA" = Gallons |

| FS36 | X | Billed Quantity | N | 1 | 15 | Billed Quantity |

| FS37 | M | Interchange Control Number Unique Number For This Filing | AN | 4 | 9 | Filer-defined unique control number for this filing. This control number should never be reused for any future filings |

| FS38 | S | Seller's Name | AN | 1 | 35 | Seller's Name |

| FS39 | N | Position Holder's Name | AN | 1 | 35 | Not required for this report. A "Filler Tab" is required. |

| FS40 | N | Receiving Party Name | AN | 1 | 35 | Not required for this report. A "Filler Tab" is required. |

| FS41 | N | Consignor's Name | AN | 1 | 35 | Not required for this report. A "Filler Tab" is required. |

| FS42 | M | Carrier's Name | AN | 1 | 35 | Carrier's Name |

| FS43 | S | Buyer's Name | AN | 1 | 35 | Buyer's Name |

| FS44 | S | Purchase Date | DT | 8 | 8 | The date the product was purchased (YYYYMMDD) |

| FS45 | S | Tax Rate | N | 4 | 4 | The tax rate when reporting gallons at a rate. The tax rate should be in an .nnn format (e.g., .473 or .360). |

| FS<tab>012345678<tab>24<tab>123456789<tab>20190731<tab>20190701<tab>00<tab><tab>SDR<tab>5<tab>167<tab> <tab><tab><tab><tab><tab><tab>24<tab>112233445<tab>J<tab>CA<tab>CA555TCN1<tab>CA<tab><tab><tab><tab> 34<tab>885522559<tab>20190715<tab>JCL25498X<tab>GA<tab>5000<tab>GA<tab>5020<tab>GA<tab>5000<tab> 123456789<tab><tab><tab><tab><tab>XXX Fuel Carrier<tab>AAA Gas Station<tab><tab><cr> |

||||||