Laws, Regulations, and Annotations

Lawguide Search

Business Taxes Law Guide—Revision 2026

Sales And Use Tax Regulations

Title 18. Public Revenues

Division 2. California Department of Tax and Fee Administration — Business Taxes

Chapter 4. Sales and Use Tax

Article 11. Interstate and Foreign Commerce

Regulation 1620.1

Regulation 1620.1. Sales of Certain Vehicles and Trailers for Use in Interstate or Out-of-State Commerce.

Reference: Sections 6388, 6388.3, 6388.5, and 6421, Revenue and Taxation Code.

(a) Definitions.

(1) Permanent Trailer Identification (PTI) Program. A registration program for commercial trailers as defined in Vehicle Code section 5014.1 administered by the Department of Motor Vehicles (DMV). Assessments made pursuant to the PTI program constitute a flat fee and are not based on the weight of a commercial trailer subject to the PTI program. In lieu of annual registration, DMV assesses a service fee every five (5) years.

(2) Purchaser's Agent. For purposes of this regulation, a purchaser's agent means a person authorized by the purchaser of a trailer to act on the purchaser's behalf in providing an exemption certificate from the sales or use tax to the seller of the trailer. To establish that a particular person is acting as the purchaser's agent, the purchaser must: 1) clearly disclose in writing to the seller the purchaser's intent to use an agent in the transaction, including the name of the purchaser's agent, and 2) obtain and retain, prior to the use of the agent, written evidence of the agent's status with the purchaser. An agent may include a registration service company engaged by either the purchaser or dealer who sells trailers. A dealer, manufacturer or remanufacturer may not act as the purchaser's agent with respect to a trailer that it sells or delivers to a purchaser.

(3) Remanufacturer and Remanufactured Vehicles. A remanufacturer of vehicles or trailers means a person who is licensed by the DMV pursuant to Vehicle Code section 507.8. A remanufactured vehicle means a vehicle constructed by a remanufacturer and meeting the criteria of Vehicle Code section 507.5. A vehicle purchased from an out-of-state company will qualify as a remanufactured vehicle if the out-of-state company is licensed as a remanufacturer by the appropriate governmental agency in that state and the vehicle meets the criteria established by that state for a remanufactured vehicle. The sale of a used vehicle or trailer alone does not qualify as a sale of a remanufactured vehicle unless the vehicle or trailer otherwise qualifies as a remanufactured vehicle or trailer pursuant to applicable state laws.

(4) Single State Registration System (SSRS). A federally regulated program under which states monitor a motor carrier's compliance with federal registration and insurance requirements. Motor carriers generally must register with the state in which they have their principal place of business. In California, the program is administered by the DMV and covers only motor carriers of property. Compliance with the SSRS program requires eligible motor carriers to register annually with the DMV, report the number of vehicles operating in other states participating in the SSRS program, and to pay the requisite fees. "Vehicles" for purposes of SSRS registration means only self-propelled units and not trailers. SSRS filings do not identify individual vehicles.

(5) Trailer. For purposes of this regulation, trailer means a new or remanufactured trailer or semi-trailer with an unladen weight of 6,000 pounds or more. Any vehicle not designed for carrying persons or property on its own structure, such as an auxiliary dolly, does not qualify as a trailer for purposes of this regulation. Qualified trailers may be manufactured or remanufactured either inside or outside this state.

(6) United States Department of Transportation (USDOT) Number. A number issued by the Federal Motor Carrier Safety Administration (FMCSA) to any motor carrier located in the United States that is engaged in the transportation of property in interstate or foreign commerce. A USDOT number is assigned to a motor carrier and not to the motor carrier's individual vehicles.

(7) United States—Federal Maritime Commission (FMC) Number. A number issued by the Federal Maritime Commission to entities operating as common carriers in U.S. foreign commerce. An FMC number is assigned to an ocean carrier and to the ocean carrier's individual trailers.

(8) Vehicle. For purposes of this regulation, the term vehicle means a new or remanufactured truck, truck tractor, semitrailer, or trailer with an unladen weight of 6,000 pounds or more; or a new or remanufactured trailer coach, or auxiliary dolly, manufactured or remanufactured in this state and purchased from an out-of-state dealer for delivery in this state.

(b) Application of Tax.

(1) In General. Tax applies to the sale or storage, use, or other consumption of vehicles and trailers in this state except as provided in subdivisions (b)(2) and (b)(3).

(2) Exempt Sales of Vehicles for Use in Out-of-state or Foreign Commerce.

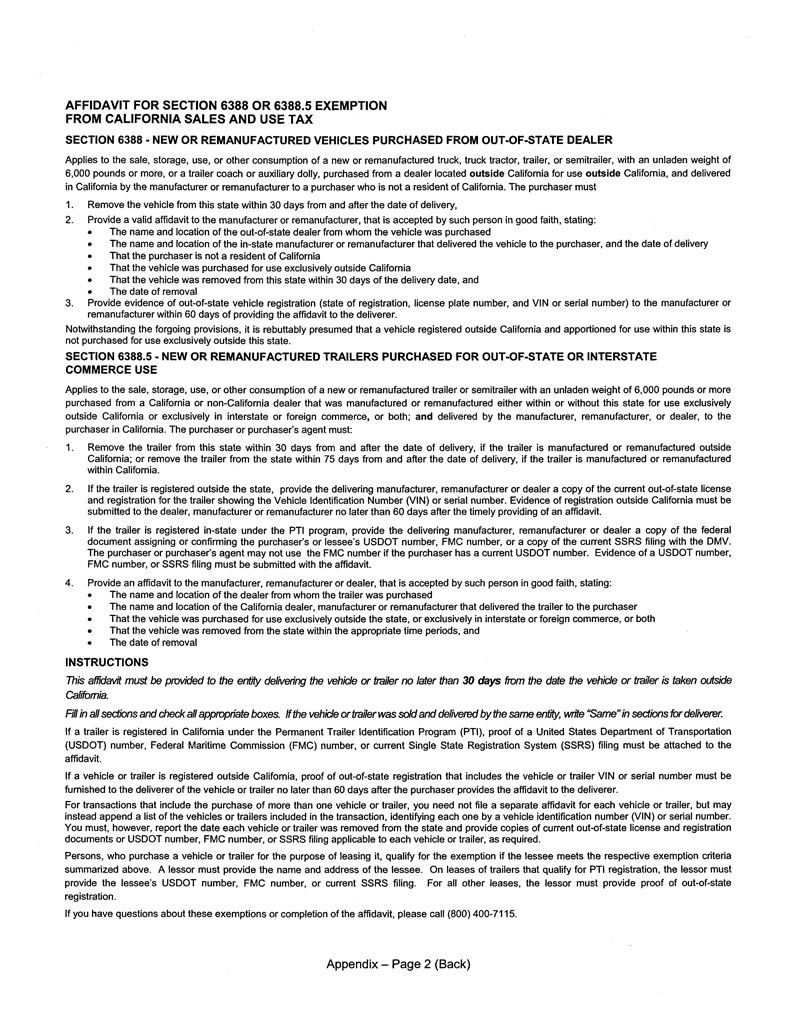

(A) Notwithstanding subdivision (b)(1), tax does not apply to the sale or storage, use, or other consumption of a vehicle delivered in this state by the vehicle manufacturer or remanufacturer to a purchaser who is not a resident of California for use exclusively in out-of-state or foreign commerce where the purchaser:

1. Purchases the vehicle from a dealer located outside this state,

2. Removes the vehicle from this state within 30 days from and after the date of delivery,

3. Provides a valid affidavit to the manufacturer or remanufacturer, that is accepted by such person in good faith, stating:

a. The name and location of the out-of-state dealer from whom the vehicle was purchased,

b. The name and location of the in-state manufacturer or remanufacturer that delivered the vehicle to the purchaser and the date of delivery

c. That the purchaser is not a resident of California,

d. That the vehicle was purchased for use exclusively outside California,

e. That the vehicle was removed from this state within 30 days of the delivery date, and

f. The date of removal.

4. Provides evidence of out-of-state vehicle registration (state of registration, license plate number and VIN or serial number) to the manufacturer or remanufacturer within 60 days of providing the affidavit to the deliverer.

(B) Notwithstanding the forgoing provisions, it is rebuttably presumed that a vehicle registered outside California and apportioned for use within this state is not purchased for use exclusively outside this state.

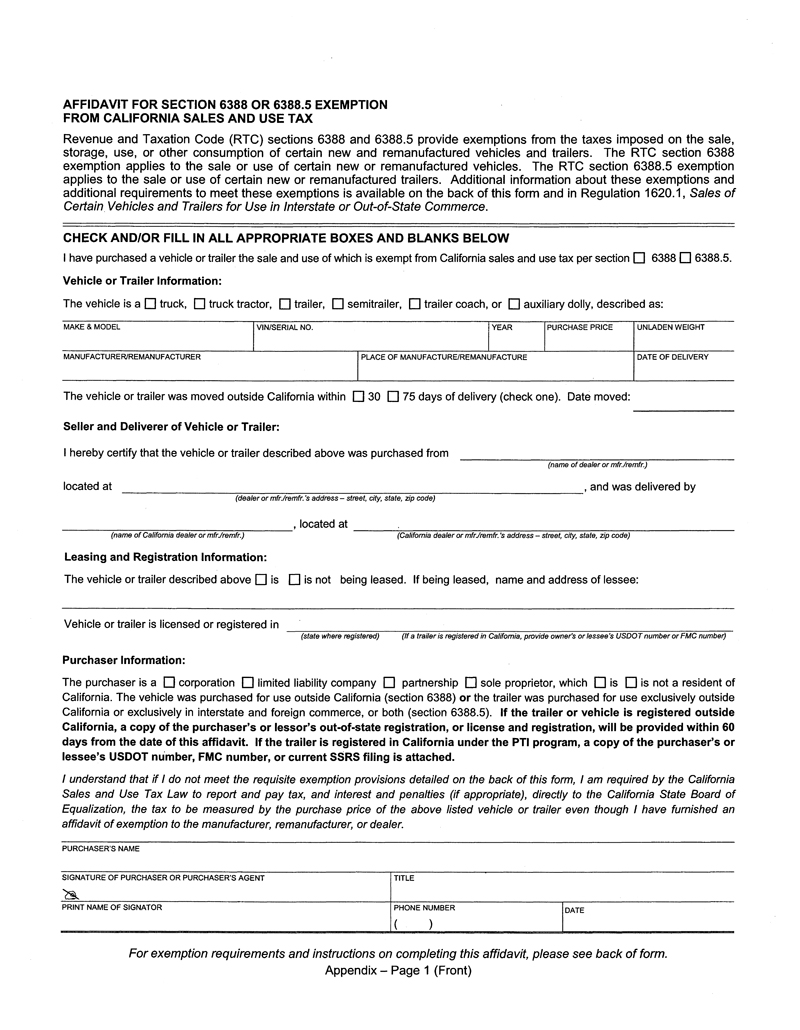

(C) An affidavit for the providing of the information set forth in subdivision (b)(2)(A) is set forth in the Appendix to this regulation.

(3) Exempt Sales of Trailers for Use in Interstate, Out-of-state or Foreign Commerce.

(A) Notwithstanding the provisions of subdivisions (b)(1) and (b)(2), tax does not apply to the sale or storage, use, or other consumption of a trailer delivered in this state by the manufacturer, remanufacturer or dealer to a purchaser for use exclusively in interstate, out-of-state, or foreign commerce where all the following criteria are met:

1. The trailer is manufactured or remanufactured outside California and is removed from this state within 30 days from and after the date of delivery; or the trailer is manufactured or remanufactured within California and is removed from the state within 75 days from and after the date of delivery,

2. If the trailer is registered outside the state, the purchaser or purchaser's agent provides the delivering manufacturer, remanufacturer, or dealer a copy of the current out-of-state license and registration for the trailer showing the Vehicle Identification Number (VIN) or serial number; or, if the trailer is registered in-state under the PTI program, the purchaser or purchaser's agent provides the delivering manufacturer, remanufacturer, or dealer a copy of the federal document assigning or confirming the purchaser's or lessee's USDOT number, FMC number, or a copy of the current SSRS filing with the DMV. A purchaser or purchaser's agent may not use an FMC number if the purchaser has a current USDOT number. Evidence of registration outside California must be submitted to the dealer, manufacturer, or remanufacturer no later than 60 days after the timely providing of an affidavit described in subdivision (b)(3)(A)3. Evidence of a USDOT number, FMC number, or SSRS filing must be submitted with the affidavit,

3. The purchaser or purchaser's agent provides a valid affidavit to the manufacturer, remanufacturer, or dealer, that is accepted by such person in good faith, stating:

a. The name and location of the dealer from whom the trailer was purchased,

b. The name and location of the California dealer, manufacturer or remanufacturer that delivered the trailer to the purchaser and the date of delivery,

c. That the vehicle was purchased for use exclusively outside the state, or exclusively in interstate or foreign commerce, or both,

d. That the vehicle was removed from the state within the appropriate time periods provided for in subdivision (b)(3)(A)(1), and

e. The date of removal.

(B) An affidavit for the providing of the information set forth in subdivision (b)(3) to the deliverer is set forth in the Appendix to this regulation.

(c) Affidavit. An affidavit is valid where a purchaser or, in the case of a claimed section 6388.5 exemption, a purchaser or purchaser's agent, provides all information required by subdivisions (b)(2) or (b)(3), signs and dates the affidavit, and provides it to the manufacturer or remanufacturer that delivered the vehicle to the purchaser or to the manufacturer, remanufacturer, or dealer that delivered the trailer to the purchaser within 30 days after the vehicle or trailer is removed from the state.

For transactions that include the purchase of more than one vehicle or trailer, the purchaser need not file a separate affidavit for each vehicle or trailer, but may instead append a list of the vehicles or trailers included in the transaction, identifying each one by a VIN or serial number. The purchaser must, however, report the date each vehicle or trailer was delivered and the date each was removed from the state and provide current out-of-state license and registration or USDOT number, FMC number, or SSRS filing applicable to each vehicle or trailer, as required by subdivisions (b)(2) and (b)(3).

For purposes of this regulation it is presumed that the person who delivers a vehicle or trailer to the purchaser accepted the affidavit in good faith in the absence of evidence to the contrary.

(d) Lessors. The sale of a vehicle or trailer to a lessor qualifies for the exemptions from sales and use tax provided by Revenue and Taxation Code sections 6388 and 6388.5 provided the sale and subsequent use of the vehicle or trailer as leased tangible personal property meets the appropriate criteria detailed in subdivisions (b)(2) and (b)(3). In addition to the information required in these subdivisions, a lessor must provide the name and address of the lessee on the affidavit and, when applicable, documentation showing that the vehicle or trailer was registered outside the state on behalf of the lessor or lessee. If a leased trailer is registered under the PTI program, the lessor must provide the lessee's USDOT number, FMC number, or current SSRS filing.

(e) Documentation to Be Maintained by Purchasers. Purchasers of vehicles shall maintain internal records documenting that a vehicle qualifying for the Revenue and Taxation Code section 6388 exemption was taken out of California within the time mandated by statute and was used exclusively outside the state. Purchasers of trailers shall maintain internal records documenting that a trailer qualifying for the Revenue and Taxation Code section 6388.5 exemption was taken out of California within the time mandated by statute and was used exclusively in out-of-state, foreign or interstate commerce. A purchaser must provide the supporting documentation to the Board upon request.

History—Adopted on July 9, 2003, effective October 16, 2003.