Laws, Regulations, and Annotations

Lawguide Search

Business Taxes Law Guide—Revision 2026

Sales And Use Tax Regulations

Title 18. Public Revenues

Division 2. California Department of Tax and Fee Administration — Business Taxes

Chapter 4. Sales and Use Tax

Article 11. Interstate and Foreign Commerce

- 1620 Interstate and Foreign Commerce

- 1620.1 Sales of Certain Vehicles and Trailers for Use in Interstate or Out-of-State Commerce

- 1620.2 Beverages Sold or Served by Carriers

- 1621 Sales to Common Carriers

Regulation 1620. Interstate and Foreign Commerce.

Reference: Sections 6006, 6008, 6009.1, 6051, 6201, 6247, 6248, 6352, 6366.2, 6368.5, 6387, 6396 and 6405, Revenue and Taxation Code.

(a) Sales Tax.

(1) In General. When a sale occurs in this state, the sales tax, if otherwise applicable, is not rendered inapplicable solely because the sale follows a movement of the property into this state from a point beyond its borders, or precedes a movement of the property from within this state to a point outside its borders. Such movements prevent application of the tax only when conditions exist under which the taxing of the sale, or the gross receipts derived therefrom, is prohibited by the United States Constitution or there exists a statutory exemption. If title to the property sold passes to the purchaser at a point outside this state, or if for any other reason the sale occurs outside this state, the sales tax does not apply, regardless of the extent of the retailer's participation in California in relation to the transaction. The retailer has the burden of proving facts establishing his right to exemption.

(2) Sales Following Movement of Property into State from Point Outside State.

(A) From Other States—When Sales Tax Applies. Sales tax applies when the order for the property is sent by the purchaser to, or delivery of the property is made by, any local branch, office, outlet or other place of business of the retailer in this state, or agent or representative operating out of or having any connection with, such local branch, office, outlet or other place of business and the sale occurs in this state. The term "other place of business" as used herein includes the homes of district managers, service representatives, and other resident employees, who perform substantial services in relation to the retailer's functions in the state. It is immaterial that the contract of sale requires or contemplates that the goods will be shipped to the purchaser from a point outside the state. Participation in the transaction in any way by the local office, branch, outlet or other place of business is sufficient to sustain the tax.

(B) From Other States—When Sales Tax Does Not Apply. Sales tax does not apply when the order is sent by the purchaser directly to the retailer at a point outside this state, or to an agent of the retailer in this state, and the property is shipped to the purchaser, pursuant to the contract of sale, from a point outside this state directly to the purchaser in this state, or to the retailer's agent in this state for delivery to the purchaser in this state, provided there is no participation whatever in the transaction by any local branch, office, outlet or other place of business of the retailer or by any agent of the retailer having any connection with such branch, office, outlet, or place of business.

(C) Imports. Sales tax applies to sales of property imported into this state from another country when the sale occurs after the process of importation has ceased, regardless of whether the property is in its original package, if the transaction is otherwise subject to sales tax under subdivision (a)(2)(A) of this regulation.

(3) Sales Preceding Movement of Goods from Within State to Points Outside State.

(A) To Other States—When Sales Tax Applies. Except as otherwise provided in (B) below, sales tax applies when the property is delivered to the purchaser or the purchaser's representative in this state, whether or not the disclosed or undisclosed intention of the purchaser is to transport the property to a point outside this state, and whether or not the property is actually so transported. It is immaterial that the contract of sale may have called for the shipment by the retailer of the property to a point outside this state, or that the property was made to specifications for out-of-state jobs, that prices were quoted including transportation charges to out-of-state points, or that the goods are delivered to the purchaser in this state via a route a portion of which is outside this state. Regardless of the documentary evidence held by the retailer (see (3)(D) below) to show delivery of the property was made to a carrier for shipment to a point outside the state, tax will apply if the property is diverted in transit to the purchaser or his representative in this state, or for any other reason it is not delivered outside this state.

(B) Shipments Outside the State—When Sales Tax Does Not Apply. Sales tax does not apply when the property pursuant to the contract of sale, is required to be shipped and is shipped to a point outside this state by the retailer, by means of:

1. Facilities operated by the retailer, or

2. Delivery by the retailer to a carrier, customs broker or forwarding agent, whether hired by the purchaser or not, for shipment to such out-of-state point. As used herein the term "carrier" means a person or firm regularly engaged in the business of transporting for compensation tangible personal property owned by other persons, and includes both common and contract carriers. The term "forwarding agent" means a person or firm regularly engaged in the business of preparing property for shipment or arranging for its shipment. An individual or firm not otherwise so engaged does not become a "carrier" or "forwarding agent" within the meaning of this regulation simply by being designated by a purchaser to receive and ship goods to a point outside this state. (This subsection is effective on and after September 19, 1970, with respect to deliveries in California to carriers, etc., hired by the purchasers for shipment to points outside this state that are not in another state or foreign country, e.g., to points in the Pacific Ocean.)

(C) Exports.

1. When Sales Tax Applies. Except for certain new motor vehicles delivered to a foreign country pursuant to paragraph (b)(2)(D) of Regulation 1610 (18 CCR 1610), sales tax applies when the property is delivered in this state to the purchaser or the purchaser's representative prior to an irrevocable commitment of the property into the process of exportation. It is immaterial that the disclosed or undisclosed intention of the purchaser is to ship or deliver the property to a foreign country or that the property is actually transported to a foreign country.

Sales of property such as fuel oil and other items consumed during a voyage to a foreign country are not exempt even though they are transported out of, and are not returned to this country. It is immaterial that the ship to which the property is delivered is of foreign registry.

2. When Sales Tax Does Not Apply. Sales tax does not apply when the property is sold to a purchaser for shipment abroad and is shipped or delivered by the retailer to the foreign country. To be exempt as an export the property must be intended for a destination in a foreign country, it must be irrevocably committed to the exportation process at the time of sale, and must actually be delivered to the foreign country prior to any use of the property. Movement of the property into the process of exportation does not begin until the property has been shipped, or entered with a common carrier for transportation to another country, or has been started upon a continuous route or journey which constitutes the final and certain movement of the property to its foreign destination.

There has been an irrevocable commitment of the property to the exportation process when the property is sold to a purchaser for shipment abroad and is shipped or delivered by the retailer in a continuous route or journey to the foreign country by means of:

a. Facilities operated by the retailer,

b. A carrier, forwarding agent, export packer, customs broker or other person engaged in the business of preparing property for export, or arranging for its export, or

c. A ship, airplane, or other conveyance furnished by the purchaser for the purpose of carrying the property in a continuous journey to the foreign country, title to and control of the property passing to the purchaser upon delivery. Delivery by the retailer of property into a facility furnished by the purchaser constitutes an irrevocable commitment of the property into the exportation process only in those instances where the means of transportation and character of the property shipped provide certainty that the property is headed for its foreign destination and will not be diverted for domestic use. The following are examples of deliveries by the retailer into facilities furnished by the purchaser which demonstrate an irrevocable commitment of the property into the exportation process:

Example 1. Sale of fuel oil delivered into the hold of a vessel provided by the purchaser. The fuel is to be unloaded at the foreign destination.

Example 2. Sale of jewelry delivered aboard a scheduled airline with a scheduled departure to a foreign destination.

Example 3. Sale of equipment, designed specifically for use in the foreign destination, delivered to a foreign purchaser's aircraft. The foreign purchaser has filed a flight plan showing that the aircraft will be transporting the property on a continuous journey to its foreign destination.

The following are examples of sales which do not demonstrate sufficient indicia of an irrevocable commitment to the exportation process and do not qualify as exports:

Example 4. Sale of jewelry delivered to a foreign purchaser at the retailer's place of business or to the purchaser or his representative at the airport prior to boarding the plane. The tax applies even though the purchaser may hold tickets for the foreign destination.

Example 5. Sale of a television set delivered into the trunk of a passenger vehicle or into the storage area of a pickup truck.

Example 6. Sale of equipment delivered to a foreign purchaser's aircraft even though a flight plan had been filed showing that the aircraft was to be flown to a foreign destination. If the equipment sold had been altered or specifically designed for use in the foreign destination, then the combined factors of the character of the property and the means of transportation would provide certainty of export and the sale would qualify as an export as described in (3) above.

Export has not begun where property is transported from a point within this state to a warehouse or other collecting point in this state even though it is intended that the property then be transported, and in fact is transported, to another country. Nevertheless, sales of property are exempt if transported under the circumstances described in 2.b. above to a warehouse or other collecting point of a carrier, forwarding agent, export packer, customs broker, or other person engaged in the business of preparing property for export, or arranging for its export. Property is regarded as transported under the circumstances described in 2.b. above, when the property is sold to a purchaser for shipment abroad and is shipped or delivered to a point in this state to a person who is not the purchaser, whether or not that person is a legal entity related to the purchaser, who ships or delivers the property to a foreign destination as provided in paragraph (a)(3)(C)2.b. of this regulation.

(D) Proof of Exemption. Bills of lading or other documentary evidence of the delivery of the property to a carrier, customs broker, or forwarding agent for shipment outside this state must be retained by the retailer to support deductions taken under (B) above. Bills of lading, import documents of a foreign country or other documentary evidence of export must be obtained and retained by retailers to support deductions taken under (C) above.

(E) Particular Applications.

1. Property Mailed to Persons in the Armed Forces. Tax does not apply to sales of property which is mailed by the retailer, pursuant to the contract of sale, to persons in the armed forces at points outside the United States, notwithstanding the property is addressed in care of the postmaster at a point in this state and forwarded by him to the addressee.

When mail is addressed to Army Post Offices (A.P.O.'s) or to Fleet Post Offices (F.P.O.'s) in care of the postmaster, it will be presumed that it is forwarded outside California. The retailer must keep records showing the names and addresses as they appear on the mailed matter and should keep evidence that the mailing was done by him.

2. Property for Defense Purposes Delivered to Offices of the United States. Tax does not apply to sales of property shipped to a point outside this state pursuant to the contract of sale when the property is marked for export and delivered by retailer to the "contracting officer," "officer in charge," "port quartermaster," or other officer of the United States for transportation and delivery to the purchaser at such a point.

3. Airplanes Delivered to Agencies of the United States. Tax does not apply to sales of airplanes and parts and equipment for airplanes transported to a point outside this state pursuant to the contract of sale when such property is delivered to the United States Air Force or any other agency or instrumentality of the United States for transportation and delivery to the purchaser or someone designated by him at that point.

4. Repairers. When repairers of property in California, in fulfillment of their repair contracts with their customers, ship the repaired property to points outside this state by one of the methods set forth under (a)(3)(B) and (C) above, tax does not apply to the sale by the repairer of the repair parts and materials affixed to and becoming a component part of the repaired property so shipped.

(b) Use Tax.

(1) In General. Use tax applies to the use of any property purchased for storage, use, or other consumption and stored, used, or consumed in this state, the sale of which is exempt from sales tax under this regulation.

(2) Exceptions.

(A) Use tax does not apply to the use of property held or stored in this state for sale in the regular course of business nor to the use of property held for the purposes designated in subparagraph (b)(9) below.

(B) Interstate and Foreign Commerce.

1. In General. Use tax does not apply to the use of property purchased for use and used in interstate or foreign commerce prior to its entry into this state, and thereafter used continuously in interstate or foreign commerce both within and without California and not exclusively in California.

2. Intermodal Cargo Containers. Intermodal cargo containers are containers that are used to transport freight during a continuous movement of that freight from the origin shipper to the destination receiver by the use of two or more of the following modes of transportation: railroad, vehicle, or vessel. The use of an intermodal cargo container in California is exempt from tax if the use meets the requirements of subdivision (b)(2)(B)1 of this regulation. An intermodal cargo container is regarded as first used in interstate or foreign commerce prior to its entry into California if the container is loaded with freight outside California and then first enters California during a continuous movement of that freight from the origin shipper to the destination receiver. For purposes of the requirements set forth in subdivision (b)(2)(B)1 of this regulation, an intermodal cargo container is also regarded as first used in interstate or foreign commerce prior to its entry into California if all of the following conditions are satisfied:

a. The contract for the sale or lease of the intermodal cargo container requires that the container be used in interstate or foreign commerce and such sales contract or lease contract is entered into prior to the entry of the intermodal cargo container into California;

b. The purchaser or lessee transports the intermodal cargo container into California with the specific intent that such intermodal cargo container will then be loaded with freight for transport in a continuous movement to a destination outside California, whether or not the purchaser knows which particular freight will be loaded into the intermodal cargo container at the time the intermodal cargo container first enters California; and

c. The intermodal cargo container is, in fact, first loaded with freight for transport in a continuous movement to a destination outside California, and the intermodal cargo container is thereafter used continuously in interstate or foreign commerce both within and without California and not exclusively in California.

(C) Use tax does not apply to the use of certain new motor vehicles purchased for subsequent delivery to a foreign country and so delivered pursuant to paragraph (b)(2)(D) of Regulation 1610 (18 CCR 1610).

(D) Hand-Carried from a Foreign Country.

1. Prior to January 1, 2008, use tax does not apply to the storage, use, or other consumption in this state of the first four hundred dollars ($400) of tangible personal property purchased in a foreign country by an individual from a retailer and personally hand-carried into this state from the foreign country within any 30-day period. This subdivision shall not apply to property sent or shipped to this state.

2. On and after January 1, 2008, use tax does not apply to the storage, use, or other consumption in this state of the first eight hundred dollars ($800) of tangible personal property purchased in a foreign country by an individual from a retailer and personally hand-carried into this state from the foreign country within any 30-day period. This subdivision shall not apply to property sent or shipped to this state.

(3) Purchase for Use in This State. Property delivered outside of California to a purchaser known by the retailer to be a resident of California is regarded as having been purchased for use in this state unless a statement in writing, signed by the purchaser or the purchaser's authorized representative, that the property was purchased for use at a designated point or points outside this state is retained by the vendor.

Notwithstanding the filing of such a statement, property purchased outside of California which is brought into California is regarded as having been purchased for use in this state if the first functional use of the property is in California. For purposes of this regulation, "functional use" means use for the purposes for which the property was designed. Except as provided in subdivision (b)(5) of this regulation, when property is first functionally used outside of California, the property will nevertheless be presumed to have been purchased for use in this state if it is brought into California within 90 days after its purchase, unless the property is used, stored, or both used and stored outside of California one-half or more of the time during the six-month period immediately following its entry into this state. Except as provided in subdivision (b)(5) of this regulation, prior out-of-state use not exceeding 90 days from the date of purchase to the date of entry into California is of a temporary nature and is not proof of an intent that the property was purchased for use elsewhere. Except as provided in subdivision (b)(5) of this regulation, prior out-of-state use in excess of 90 days from the date of purchase to the date of entry into California, exclusive of any time of shipment to California, or time of storage for shipment to California, will be accepted as proof of an intent that the property was not purchased for use in California.

(4) Purchase for Use in This State—Vehicles, Vessels and Aircraft.—90-Day Test (Prior to October 2, 2004, and from July 1, 2007, Through September 30, 2008). The provisions of subdivision (b)(4) apply prior to October 2, 2004, and from July 1, 2007, through September 30, 2008. A vehicle, vessel or aircraft purchased outside of California which is brought into California is regarded as having been purchased for use in this state if the first functional use of the vehicle, vessel or aircraft is in California. When the vehicle, vessel or aircraft is first functionally used outside of California, the vehicle, vessel or aircraft will nevertheless be presumed to have been purchased for use in this state if it is brought into California within 90 days after its purchase, exclusive of any time of shipment to California or time of storage for shipment to California, unless:

(A) Physically Located Outside California. Use tax will not apply if the vehicle, vessel or aircraft is used, stored, or both used and stored outside of California one-half or more of the time during the six-month period immediately following its entry into this state.

(B) Used in Interstate or Foreign Commerce.

1. If the property is a vehicle, use tax will not apply if one-half or more of the miles traveled by the vehicle during the six month period immediately following its entry into this state are commercial miles traveled in interstate or foreign commerce.

2. If the property is a vessel, use tax will not apply if one-half or more of the nautical miles traveled by the vessel during the six-month period immediately following its entry into the state are commercial miles traveled in interstate or foreign commerce.

3. If the property is an aircraft, use tax will not apply if one-half or more of the flight time traveled by the aircraft during the six-month period immediately following its entry into the state is commercial flight time traveled in interstate or foreign commerce.

Such use will be accepted as proof of an intent that the property was not purchased for use in California. For purposes of subdivision (b)(4), the term "commercial" applies to business uses and excludes personal use. However, the term "commercial" is not limited to for-profit business.

(5) Purchase for Use in This State Vehicles, Vessels, and Aircraft—12-Month Test (from October 2, 2004, through June 30, 2007, and after September 30, 2008).

(A) Purchased for Use in California. Except as provided in subdivision (b)(5)(D) below, the provisions of subdivision (b)(5) apply from October 2, 2004, through June 30, 2007 , and after September 30, 2008. A vehicle, vessel, or aircraft purchased outside of California which is brought into California is regarded as having been purchased for use in this state if the first functional use of the vehicle, vessel, or aircraft is in California. When a vehicle, vessel, or aircraft is purchased outside of California, is first functionally used outside of California, and is brought into California within 12 months from the date of its purchase, it is rebuttably presumed that the vehicle, vessel, or aircraft was acquired for storage, use, or other consumption in this state and is subject to use tax if any of the following occur:

1. The vehicle, vessel, or aircraft was purchased by a California resident as defined in section 516 of the Vehicle Code, as that section now reads or is hereinafter amended. For purposes of subdivision (b)(5), a closely held corporation or limited liability company shall also be considered a California resident if 50 percent or more of the shares or membership interests are held by shareholders or members who are residents of California as defined in section 516 of the Vehicle Code.

2. In the case of a vehicle, the vehicle was subject to registration under Chapter 1 (commencing with section 4000) of Division 3 of the Vehicle Code during the first 12 months of ownership.

3. In the case of a vessel or aircraft, that vessel or aircraft was subject to property tax in this state during the first 12 months of ownership.

4. If purchased by a nonresident of California, the vehicle, vessel, or aircraft is used or stored in this state more than one-half of the time during the first 12 months of ownership.

(B) Evidence Rebutting Presumption. This presumption may be controverted by documentary evidence that the vehicle, vessel, or aircraft was purchased for use outside of this state during the first 12 months of ownership. This evidence may include, but is not limited to, evidence of registration of that vehicle, vessel, or aircraft, with the proper authority, outside of this state.

Operative September 20, 2006 , through June 30, 2007, and after September 30, 2008, in the case of a vehicle, this presumption also may be controverted by documentary evidence that the vehicle was brought into this state for the exclusive purpose of warranty or repair service and was used or stored in this state for that purpose for 30 days or less. The 30-day period begins when the vehicle enters this state, includes any time of travel to and from the warranty or repair facility, and ends when the vehicle is returned to a point outside the state. The documentary evidence shall include a work order stating the dates that the vehicle is in the possession of the warranty or repair facility and a statement by the owner of the vehicle specifying dates of travel to and from the warranty or repair facility.

(C) Used in Interstate or Foreign Commerce.

1. If the property is a vehicle, use tax will not apply if one-half or more of the miles traveled by the vehicle during the six-month period immediately following its entry into this state are commercial miles traveled in interstate or foreign commerce.

2. If the property is a vessel, use tax will not apply if one-half or more of the nautical miles traveled by the vessel during the six-month period immediately following its entry into the state are commercial miles traveled in interstate or foreign commerce.

3. If the property is an aircraft, use tax will not apply if one-half or more of the flight time traveled by the aircraft during the six-month period immediately following its entry into the state is commercial flight time traveled in interstate or foreign commerce.

Such use will be accepted as proof of an intent that the property was not purchased for use in California. For purposes of subdivision (b)(5)(C), the term "commercial" applies to business uses and excludes personal use. However, the term "commercial" is not limited to for-profit businesses.

(D) Repair, Retrofit, or Modification of Vessels or Aircraft.

Notwithstanding subdivision (b)(5)(A) above, aircraft or vessels, the purchase and use of which are subject to the 12-month test described in subdivision (b)(5), that are brought into this state exclusively for the purpose of repair, retrofit, or modification shall not be deemed to be acquired for storage, use, or other consumption in this state if the repair, retrofit, or modification is, in the case of a vessel, performed by a repair facility that holds an appropriate permit issued by the Board and is licensed to do business by the city, county, or city and county in which it is located if the city, county, or city and county so requires, or, in the case of an aircraft, performed by a repair station certified by the Federal Aviation Administration or manufacturer's maintenance facility.

(E) Binding Purchase Contract. Subdivision (b)(5) does not apply to any vehicle, vessel, or aircraft that is either purchased, or is the subject of a binding purchase contract that is entered into, on or before October 1, 2004, or from July 1, 2007, through September 30, 2008.

(6) Purchase for Use in This State—Locomotives—90-Day Test. A locomotive purchased outside of California which is brought into California is regarded as having been purchased for use in this state if the first functional use of the locomotive is in California. When the locomotive is first functionally used outside of California, the locomotive will nevertheless be presumed to have been purchased for use in this state if it is brought into California within 90 days after its purchase, exclusive of any time of shipment to California or time of storage for shipment to California, unless:

(A) Physically Located Outside California. Use tax will not apply if the locomotive is used, stored, or both used and stored outside of California one-half or more of the time during the six-month period immediately following its entry into this state.

(B) Used in Interstate or Foreign Commerce. Use tax will not apply to transactions involving locomotives if one-half or more of the miles traveled by the locomotive during the six-month period immediately following its entry into California are commercial miles traveled in interstate or foreign commerce.

Such use will be accepted as proof of an intent that the property was not purchased for use in California. For purposes of subdivision (b)(6), the term "commercial" applies to business uses and excludes personal use. However, the term "commercial" is not limited to for-profit businesses.

(7) Examples of Interstate and Foreign Commerce.

Examples of what constitutes interstate or foreign commerce include, but are not limited to the following:

Example 1. A sightseeing tour bus group (charter) or regularly scheduled bus service (per capita) originates in California and travels to another state or country for a single day or several days, then returns to California where the charter or schedule terminates.

Example 2. A charter bus, vessel or aircraft deadheads under contract to another state, picks up the group and operates the charter without entering the State of California, drops the group in the other state, and deadheads back into the State of California. (The charter was quoted round trip.)

Example 3. A commercial vehicle deadheads to another state or country or transports property to another state or country and delivers that property within the other state or country or to another state or country. The vehicle then returns to California, either loaded or empty.

Example 4. A charter bus group tours under contract to another state or country for a day or several days, drops the passengers in the other state or country, and then deadheads back under contract to its terminal or next assignment.

Example 5. Property arriving in California via plane, train, or vessel from another state or country is picked up by a commercial vehicle, vessel or aircraft and transported to another state or country for a day or several days. The commercial vehicle, vessel or aircraft then returns to California, either loaded or empty.

Example 6. A sightseeing tour bus group (charter) arriving in California via plane, train, or ship from another state or country is picked up by bus and tours California for a number of days, goes to another state or country for a number of days, and then terminates service either in another state, country, or California.

Example 7. Property arriving in California via plane, train, or vessel from another state or country is picked up by a commercial vehicle, vessel or aircraft, which may be operating wholly within California, and transported for further distribution to one or more California locations or to locations in another state or country. The vehicle, vessel or aircraft then returns empty to pick up another load arriving in California via plane, train, or vessel from another state or country.

Example 8. A commercial vehicle, vessel, aircraft, or regularly scheduled bus service operating wholly within California is picking up or feeding passengers or property arriving from, or destined to, a state or country other than California to another form of transportation be it plane, train, ship, or bus. (Example: an airport bus service or a bridge carrier for Amtrak.)

Example 9. Property is transported by a commercial vehicle, vessel, aircraft, or locomotive from another state or country to California or from California to another state or country. While engaged in this transportation, the commercial vehicle, vessel, aircraft, or locomotive also transports property from one point in California to another.

Example 10. A commercial vehicle, vessel, aircraft, or locomotive is dispatched from one location in California to another location in California to pick up property and transport it to another state or country.

Example 11. A commercial vehicle, vessel or aircraft, sightseeing tour bus group (charter), or regularly scheduled bus service operating in interstate or foreign commerce experiences a mechanical failure and is replaced by another vehicle, vessel or aircraft. The replacement vehicle, vessel or aircraft is also deemed to be operating in interstate or foreign commerce as a continuation of the original trip.

Example 12. A vehicle, vessel, aircraft, or locomotive transports persons or property for commercial purposes (a) from California to another state or country; (b) from another state or country to California; (c) entirely within California, but the vehicle, vessel, aircraft, or locomotive picks up persons or property arriving in California via train, bus, truck, vessel, or aircraft from another state or country and then transports the persons or property in a continuous route or journey to one or more California locations or to locations in another state or country.

Example 13. A vessel transports persons or property for commercial purposes (a) from a California port to a port in another state or country; or (b) from a port in another state or country to a port in California.

(8) Imports. Use tax applies with respect to purchases of property imported into this state from another country when the use occurs after the process of importation has ceased and when sales tax is not applicable, regardless of whether the property is in its original package.

(9) "Storage" and "Use"—Exclusions. "Storage" and "use" do not include the keeping, retaining or exercising any right or power over property for the purpose of subsequently transporting it outside the state for use thereafter solely outside the state, or for the purpose of being processed, fabricated or manufactured, into, attached to, or incorporated into, other property to be transported outside the state and thereafter used solely outside the state.

The following examples are illustrative of the meaning of the exclusion:

Example 1. An engine installed in an aircraft which is flown directly out of the state for use thereafter solely outside the state qualifies for the exclusion. The use of the engine in the transporting process does not constitute a use for purposes of the exclusion. However, if any other use is made of the aircraft during removal from this state, such as carrying passengers or property, the exclusion does not apply.

Example 2. An engine installed in a truck which is transported by rail or air directly out of the state for use thereafter solely outside the state qualifies for the exclusion.

Example 3. An engine transported outside the state and installed on an aircraft which returns to the state does not qualify for the exclusion. It does not matter whether the use of the aircraft in California is exclusively interstate or intrastate commerce or both.

Example 4. An engine transported outside the state and installed on an aircraft which does not return to the state qualifies for the exclusion.

(c) Rail Freight Cars. Sales tax does not apply to the sale of, and the use tax does not apply to the storage, use or other consumption in this state of rail freight cars for use in interstate or foreign commerce.

History—Effective September 9, 1953.

Amended September 14, 1955.

Amended September 18, 1963.

Amended and renumbered December 9, 1970, effective January 15, 1971.

Amended July 27, 1976, effective August 28, 1976. Noted "original package" doctrine was overruled and that goods held for export are not yet in export stream.

Amended December 7, 1977, effective January 19, 1978. In (a)(3)(D) changed "export declarations" to "bills of lading" and "import documents."

Amended September 28, 1978, effective November 18, 1978. Amends (b)(1); adds (b)(2) and (3); renumbers (b)(2) to (b)(4) and (b)(3) to (b)(5).

Amended November 6, 1985, effective February 8, 1986. In subdivision (a)(3)(C), "Exports", added language to more clearly define what constitutes an export for sales and use tax purposes, and gives specific examples of what constitutes an exempt sale in foreign commerce and examples of what does not qualify. In subdivision (a)(3)(C)(2), amended language expands the definition of the requirements for a sale to qualify as a sale in foreign commerce when the property is delivered to the purchaser's conveyance in this state. Amended language includes examples of exempt and taxable sales. In subdivision (b)(5), "Storage and 'Use'—Exclusions", language amended to reflect court decision in Stockton Kenworth, Inc. v. State Board of Equalization 157 Cal. App. 3d 344. Amendment explains certain uses that may be made of property which is to be subsequently transported outside this state that do not constitute a taxable use of the property in this state.

Amended February 7, 1990, effective April 18, 1990. Paragraph (a)(3)(C) which explains that sales tax applies to property delivered to the purchaser in California prior to export was amended and paragraph (b)(2)(C) was added to explain that deliveries of certain motor vehicles to foreign tourists are exempt. Amended (a)(3)(C)2.(c) and (b)(2)(A) to correct erroneous references in the California Administrative Code.

Amended May 3, 1994, effective June 14, 1994. Amended paragraph (a)(2)(A) to define when sales tax will apply to sales which follow the movement of tangible personal property into California by adding "independent contractor" to the term "other place of business" and "installation" and "assembly" to the functions performed.

Amended June 28, 1995, effective November 4, 1995. Amended paragraph (a)(2)(A) to delete the term "independent contractor" from the term "other place of business" and deleting "installation" and "assembly" from the functions performed as amended in error.

Amended November 18, 1998, effective February 7, 1999. Subdivision (a)(2)(C) amended by adding phrase ", if … regulation." Sentence "Property … regulation" added to last unnumbered paragraph of subdivision (a)(3)(C).

Amended November 19, 1999, effective February 23, 2000. Subdivision (a)(3)(c)2.c.—The word "Example" added before examples 1 through 6. Subdivision (b)(3)—new language "All … California." added to first unnumbered paragraph; also new unnumbered paragraph with examples 1 through 11 added. Subdivision (b)(5)—word "Example" added before examples 1 through 4.

Amended August 30, 2000, effective December 17, 2000. Revenue and Taxation Code sections 6051 and 6201 added to the Reference section. Subdivision (b)(2)(A)—"(b)(5)" corrected to read "(b)(6)." Subdivision (b)(3)—definition for "functional use" moved from the very end of this subdivision to be second sentence of first unnumbered paragraph and word "subparagraph" changed to "regulation." The language "All … California." taken from first unnumbered paragraph and moved to new subdivision (b)(4). First sentence—word "All" replaced with "A;" word "are" replaced with "is;" phrase "or aircraft" added. Second sentence—phrases "or aircraft," "exclusive … vehicle," and ", or … commerce" added. Phrase "or aircraft" added to Examples 2, 5, 7, and 9–11, word "aircraft" added to Example 8, and Example 12 added. Subdivisions (b)(4) and (5) renumbered (5) and (6) accordingly.

Amended March 28, 2001, effective July 6, 2001. Subdivision (b)(1)—phrase "with respect" deleted and phrase "the use of" added. Subdivision (b)(2)(A)—phrase "the use of" added twice. Both amendments were to clarify that the use tax attaches to the use of the property, not the property itself. Subdivision (b)(2)(B) entitled "Interstate and Foreign Commerce" and its language transferred to new subdivision (b)(2)(B)1., which was entitled "In General" with phrase "the use of" added to clarify that the use tax attaches to the use of the property, not to the property itself. New paragraph (b)(2)(B)2. added to state rules for intermodal cargo containers. Subdivision (b)(2)(C)—word "however" deleted and phrase "the use of" added to clarify that the use tax attaches to the use of the property, not the property itself.

Amended October 24, 2001, Effective February 7, 2002. Subdivision (b)(2)(B)2., first un-numbered paragraph, last line—word "satisfying" deleted and words "are satisfied" added. Subdivision (b)(3)—second paragraph, phrase "unless the property is used or stored outside of California" was replaced with "unless the property is used, stored, or both used and stored outside of California". Subdivision (b)(4)—word "Vessels" added to title, and word "vessel," added to each of the first two sentences and colon added after "unless"; substance of second sentence after "unless" and before "(B)" transferred to new subdivision (A) and words "Physically … if" and ", vessel" and ", or both used and stored" added and semi-colon and word "or" replaced by period; new subdivision (B) added and entitled "Used in Interstate or Foreign Commerce"; substance of second sentence from "(B)" through first "commerce" transferred to new subdivision (B)1. with word "if" capitalized and words "the property is" and "use tax will not apply if" and "or foreign" added and "; or" replaced with period; new subdivision (B)2. added; substance of second sentence from "or" through end transferred to new subdivision (B)3. with word "if" capitalized and words "the property is" and "use tax will not apply if" and "or foreign" added; last sentence made into new unnumbered paragraph and new sentence added; word, ", vessel" added to introduction to Examples and to Examples 2, 5, 7–12; new Example 13 added.

Amended December 14, 2004, effective March 3, 2005. Subdivision (a)(3)(C), Example 6—Deleted the parentheses from around "b." after "2." throughout the text of the example. Subdivision (b)(3)—Added the phrase "Except as provided in subdivision (b)(5) of this regulation," to the beginning of the second sentence, changed the original first word in the sentence to lower case, and deleted "the" after that original first word. Added the phrase "Except as provided in subdivision (b)(5) of this regulation," to the beginning of the third and fourth sentences and changed the original first word in each sentence to lower case. The phrase was added as a cross-reference to new subdivision (b)(5) of the regulation. Subdivision (b)(4)—Added the words "—90-DAY TEST (PRIOR TO OCTOBER 2, 2004, AND AFTER JUNE 30, 2006)." to the title of the subdivision and added a new first sentence to the first paragraph of the subdivision. These additions were added as a cross-reference to new subdivision (b)(5) of the regulation. With the addition of new subdivision (b)(5), subdivision (b)(4) is applicable only to purchases made prior to October 2, 2004 and to purchases made after June 30, 2006. Subdivision (b)(5)—A new subdivision was added to the regulation to implement the provisions of SB 1100 (Stats. 2004, Ch. 226, § 2, hereinafter "SB 1100"), which amended section 6248 of the Revenue and Taxation Code. Amended section 6248 is operative October 2, 2004. Consequently, new subdivision (b)(5) of Regulation 1620 is applicable to purchases made from October 2, 2004, through June 30, 2006. Subdivision (b)(6)—A new subdivision (b)(6) was created by setting off the examples of transactions in interstate and foreign commerce from subdivision (b)(4) and adding the title "EXAMPLES OF INTERSTATE AND FOREIGN COMMERCE." Made a spacing correction to Example 2. Previous subdivisions (b)(5) and (b)(6) were re-numbered as subdivisions (b)(7) and (b)(8), respectively.

Amended October 25, 2005, effective January 28, 2006. Subdivision (b)(6) is added to apply the 90-day test provisions in subdivision 1620(b)(4) specifically to locomotive purchases. Current subdivision (b)(6), "EXAMPLES OF INTERSTATE AND FOREIGN COMMERCE," is re-numbered (b)(7) accordingly, and references to locomotives are added to Examples 9, 10, and 12.

Amended July 18, 2006, effective September 15, 2006. Amended subdivisions (b)(4) and (b)(5) to show that the sunset date for the 12-month test for out-of-state purchases of vehicles, vessels and aircraft was extended to June 30, 2007.

Amended November 20, 2006, effective April 25, 2007. Added paragraph to subdivision (b)(5)(B) to incorporate a statutory provision regarding evidence rebutting the presumption that a vehicle was purchased for use in California.

Amended February 1, 2008, effective April 23, 2008. Added subdivision (b)(2)(D) to incorporate statutory provisions regarding the exemption from use tax for the first $400 of tangible personal property purchased in a foreign country and hand-carried into this state, and the subsequent increase in the exempted amount to $800 as of January 1, 2008.

Amended December 17, 2008, effective February 6, 2009. Amended subdivisions (b)(4) and (b)(5) to show that the 12-month test for out-of state purchases of vehicles, vessels and aircraft was reinstated operative October 1, 2008.

Amended July 21, 2009, effective September 29, 2009. Corrected cross-reference in subdivision (b)(2)(A).

Amended December 19, 2012, effective March 11, 2013. Amended subdivision (b)(5)(A)1 to include in the definition of "California resident" a "closely held corporation or limited liability company," as defined. Amended subdivision (b)(5)(A)4 to clarify that the rebuttable presumption applies "if purchased by a nonresident of California." Amended subdivision (b)(5)(D) to clarify that the exception only applies to aircraft and vessels brought into the state "exclusively" for repair, retrofit, or modification services, and the services are performed by a licensed facility, as defined. Deleted subdivision (b)(5)(D)2. The revisions incorporate statutory amendments to Revenue and Taxation Code section 6248.

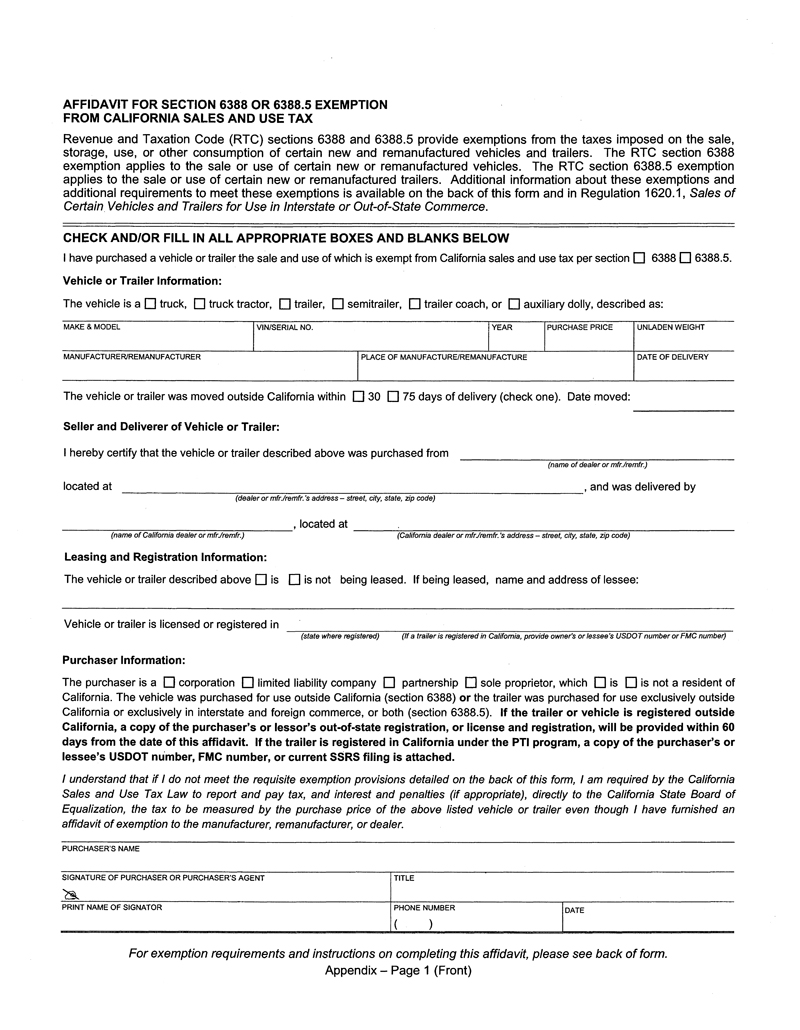

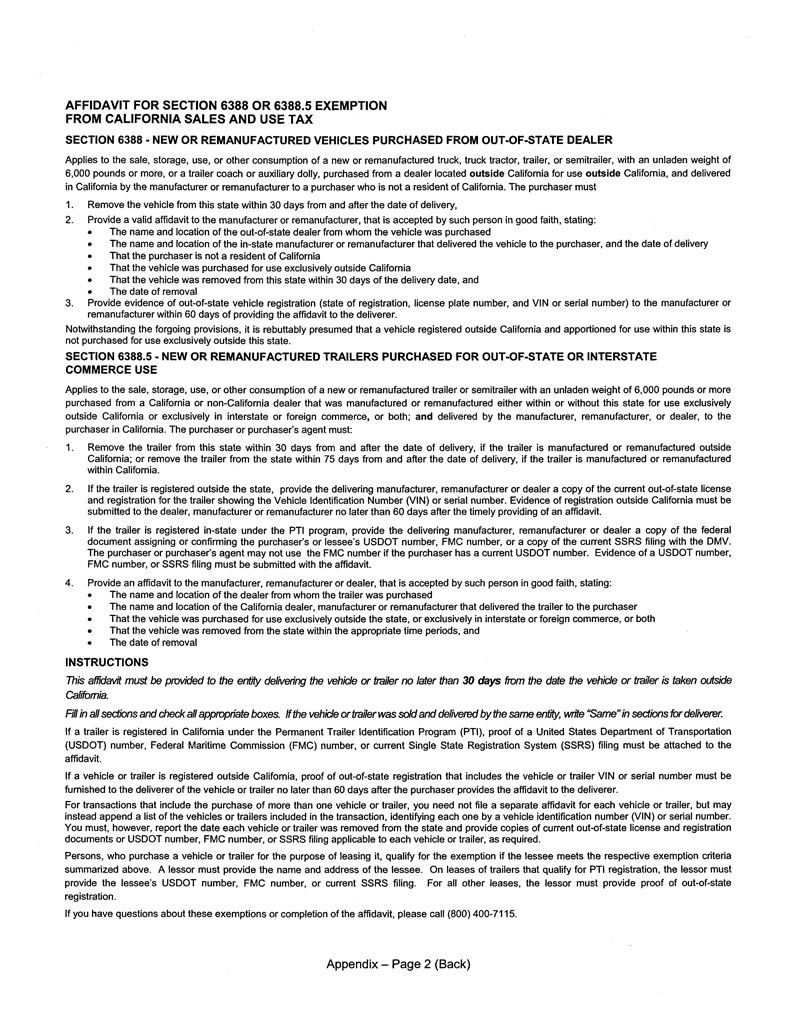

Regulation 1620.1. Sales of Certain Vehicles and Trailers for Use in Interstate or Out-of-State Commerce.

Reference: Sections 6388, 6388.3, 6388.5, and 6421, Revenue and Taxation Code.

(a) Definitions.

(1) Permanent Trailer Identification (PTI) Program. A registration program for commercial trailers as defined in Vehicle Code section 5014.1 administered by the Department of Motor Vehicles (DMV). Assessments made pursuant to the PTI program constitute a flat fee and are not based on the weight of a commercial trailer subject to the PTI program. In lieu of annual registration, DMV assesses a service fee every five (5) years.

(2) Purchaser's Agent. For purposes of this regulation, a purchaser's agent means a person authorized by the purchaser of a trailer to act on the purchaser's behalf in providing an exemption certificate from the sales or use tax to the seller of the trailer. To establish that a particular person is acting as the purchaser's agent, the purchaser must: 1) clearly disclose in writing to the seller the purchaser's intent to use an agent in the transaction, including the name of the purchaser's agent, and 2) obtain and retain, prior to the use of the agent, written evidence of the agent's status with the purchaser. An agent may include a registration service company engaged by either the purchaser or dealer who sells trailers. A dealer, manufacturer or remanufacturer may not act as the purchaser's agent with respect to a trailer that it sells or delivers to a purchaser.

(3) Remanufacturer and Remanufactured Vehicles. A remanufacturer of vehicles or trailers means a person who is licensed by the DMV pursuant to Vehicle Code section 507.8. A remanufactured vehicle means a vehicle constructed by a remanufacturer and meeting the criteria of Vehicle Code section 507.5. A vehicle purchased from an out-of-state company will qualify as a remanufactured vehicle if the out-of-state company is licensed as a remanufacturer by the appropriate governmental agency in that state and the vehicle meets the criteria established by that state for a remanufactured vehicle. The sale of a used vehicle or trailer alone does not qualify as a sale of a remanufactured vehicle unless the vehicle or trailer otherwise qualifies as a remanufactured vehicle or trailer pursuant to applicable state laws.

(4) Single State Registration System (SSRS). A federally regulated program under which states monitor a motor carrier's compliance with federal registration and insurance requirements. Motor carriers generally must register with the state in which they have their principal place of business. In California, the program is administered by the DMV and covers only motor carriers of property. Compliance with the SSRS program requires eligible motor carriers to register annually with the DMV, report the number of vehicles operating in other states participating in the SSRS program, and to pay the requisite fees. "Vehicles" for purposes of SSRS registration means only self-propelled units and not trailers. SSRS filings do not identify individual vehicles.

(5) Trailer. For purposes of this regulation, trailer means a new or remanufactured trailer or semi-trailer with an unladen weight of 6,000 pounds or more. Any vehicle not designed for carrying persons or property on its own structure, such as an auxiliary dolly, does not qualify as a trailer for purposes of this regulation. Qualified trailers may be manufactured or remanufactured either inside or outside this state.

(6) United States Department of Transportation (USDOT) Number. A number issued by the Federal Motor Carrier Safety Administration (FMCSA) to any motor carrier located in the United States that is engaged in the transportation of property in interstate or foreign commerce. A USDOT number is assigned to a motor carrier and not to the motor carrier's individual vehicles.

(7) United States—Federal Maritime Commission (FMC) Number. A number issued by the Federal Maritime Commission to entities operating as common carriers in U.S. foreign commerce. An FMC number is assigned to an ocean carrier and to the ocean carrier's individual trailers.

(8) Vehicle. For purposes of this regulation, the term vehicle means a new or remanufactured truck, truck tractor, semitrailer, or trailer with an unladen weight of 6,000 pounds or more; or a new or remanufactured trailer coach, or auxiliary dolly, manufactured or remanufactured in this state and purchased from an out-of-state dealer for delivery in this state.

(b) Application of Tax.

(1) In General. Tax applies to the sale or storage, use, or other consumption of vehicles and trailers in this state except as provided in subdivisions (b)(2) and (b)(3).

(2) Exempt Sales of Vehicles for Use in Out-of-state or Foreign Commerce.

(A) Notwithstanding subdivision (b)(1), tax does not apply to the sale or storage, use, or other consumption of a vehicle delivered in this state by the vehicle manufacturer or remanufacturer to a purchaser who is not a resident of California for use exclusively in out-of-state or foreign commerce where the purchaser:

1. Purchases the vehicle from a dealer located outside this state,

2. Removes the vehicle from this state within 30 days from and after the date of delivery,

3. Provides a valid affidavit to the manufacturer or remanufacturer, that is accepted by such person in good faith, stating:

a. The name and location of the out-of-state dealer from whom the vehicle was purchased,

b. The name and location of the in-state manufacturer or remanufacturer that delivered the vehicle to the purchaser and the date of delivery

c. That the purchaser is not a resident of California,

d. That the vehicle was purchased for use exclusively outside California,

e. That the vehicle was removed from this state within 30 days of the delivery date, and

f. The date of removal.

4. Provides evidence of out-of-state vehicle registration (state of registration, license plate number and VIN or serial number) to the manufacturer or remanufacturer within 60 days of providing the affidavit to the deliverer.

(B) Notwithstanding the forgoing provisions, it is rebuttably presumed that a vehicle registered outside California and apportioned for use within this state is not purchased for use exclusively outside this state.

(C) An affidavit for the providing of the information set forth in subdivision (b)(2)(A) is set forth in the Appendix to this regulation.

(3) Exempt Sales of Trailers for Use in Interstate, Out-of-state or Foreign Commerce.

(A) Notwithstanding the provisions of subdivisions (b)(1) and (b)(2), tax does not apply to the sale or storage, use, or other consumption of a trailer delivered in this state by the manufacturer, remanufacturer or dealer to a purchaser for use exclusively in interstate, out-of-state, or foreign commerce where all the following criteria are met:

1. The trailer is manufactured or remanufactured outside California and is removed from this state within 30 days from and after the date of delivery; or the trailer is manufactured or remanufactured within California and is removed from the state within 75 days from and after the date of delivery,

2. If the trailer is registered outside the state, the purchaser or purchaser's agent provides the delivering manufacturer, remanufacturer, or dealer a copy of the current out-of-state license and registration for the trailer showing the Vehicle Identification Number (VIN) or serial number; or, if the trailer is registered in-state under the PTI program, the purchaser or purchaser's agent provides the delivering manufacturer, remanufacturer, or dealer a copy of the federal document assigning or confirming the purchaser's or lessee's USDOT number, FMC number, or a copy of the current SSRS filing with the DMV. A purchaser or purchaser's agent may not use an FMC number if the purchaser has a current USDOT number. Evidence of registration outside California must be submitted to the dealer, manufacturer, or remanufacturer no later than 60 days after the timely providing of an affidavit described in subdivision (b)(3)(A)3. Evidence of a USDOT number, FMC number, or SSRS filing must be submitted with the affidavit,

3. The purchaser or purchaser's agent provides a valid affidavit to the manufacturer, remanufacturer, or dealer, that is accepted by such person in good faith, stating:

a. The name and location of the dealer from whom the trailer was purchased,

b. The name and location of the California dealer, manufacturer or remanufacturer that delivered the trailer to the purchaser and the date of delivery,

c. That the vehicle was purchased for use exclusively outside the state, or exclusively in interstate or foreign commerce, or both,

d. That the vehicle was removed from the state within the appropriate time periods provided for in subdivision (b)(3)(A)(1), and

e. The date of removal.

(B) An affidavit for the providing of the information set forth in subdivision (b)(3) to the deliverer is set forth in the Appendix to this regulation.

(c) Affidavit. An affidavit is valid where a purchaser or, in the case of a claimed section 6388.5 exemption, a purchaser or purchaser's agent, provides all information required by subdivisions (b)(2) or (b)(3), signs and dates the affidavit, and provides it to the manufacturer or remanufacturer that delivered the vehicle to the purchaser or to the manufacturer, remanufacturer, or dealer that delivered the trailer to the purchaser within 30 days after the vehicle or trailer is removed from the state.

For transactions that include the purchase of more than one vehicle or trailer, the purchaser need not file a separate affidavit for each vehicle or trailer, but may instead append a list of the vehicles or trailers included in the transaction, identifying each one by a VIN or serial number. The purchaser must, however, report the date each vehicle or trailer was delivered and the date each was removed from the state and provide current out-of-state license and registration or USDOT number, FMC number, or SSRS filing applicable to each vehicle or trailer, as required by subdivisions (b)(2) and (b)(3).

For purposes of this regulation it is presumed that the person who delivers a vehicle or trailer to the purchaser accepted the affidavit in good faith in the absence of evidence to the contrary.

(d) Lessors. The sale of a vehicle or trailer to a lessor qualifies for the exemptions from sales and use tax provided by Revenue and Taxation Code sections 6388 and 6388.5 provided the sale and subsequent use of the vehicle or trailer as leased tangible personal property meets the appropriate criteria detailed in subdivisions (b)(2) and (b)(3). In addition to the information required in these subdivisions, a lessor must provide the name and address of the lessee on the affidavit and, when applicable, documentation showing that the vehicle or trailer was registered outside the state on behalf of the lessor or lessee. If a leased trailer is registered under the PTI program, the lessor must provide the lessee's USDOT number, FMC number, or current SSRS filing.

(e) Documentation to Be Maintained by Purchasers. Purchasers of vehicles shall maintain internal records documenting that a vehicle qualifying for the Revenue and Taxation Code section 6388 exemption was taken out of California within the time mandated by statute and was used exclusively outside the state. Purchasers of trailers shall maintain internal records documenting that a trailer qualifying for the Revenue and Taxation Code section 6388.5 exemption was taken out of California within the time mandated by statute and was used exclusively in out-of-state, foreign or interstate commerce. A purchaser must provide the supporting documentation to the Board upon request.

History—Adopted on July 9, 2003, effective October 16, 2003.

Regulation 1620.2. Beverages Sold or Served by Carriers.

Reference: Sections 6006, 6009, 6051, 6091, 6201, 6352, and 7053, Revenue and Taxation Code.

(a) Definitions.

(1) Carrier. "Carrier" means any person or firm who engages in the business of transporting by vehicle, train, vessel, or aircraft persons or property for hire or compensation. The term includes common and contract carriers engaged in intrastate, interstate or foreign commerce. It does not include, however, the National Railroad Passenger Corporation (Amtrak).

(2) Trans-State Trip. "Trans-state trip" means the act of crossing California territory or airspace during a continuous journey between points outside this state without stopping or landing in this state.

(3) Taxable Beverages. "Taxable Beverages" means all beverages sold or served by carriers except beverages described as food products in Section 6359 of the Revenue and Taxation Code and Regulation 1602.

(b) Application of Tax. Tax applies to the sale or use of taxable beverages in this state by carriers, except when the sale or use occurs during a trans-state trip. This includes taxable beverages sold or served on a complimentary no charge basis by carriers to passengers or crew.

(c) Acquisition of Taxable Beverages. Taxable beverages which will be sold to passengers or crew may be purchased for resale. Beverages which are served only on a complimentary no charge basis may not be purchased for resale. (See Regulation 1668 for provisions regarding the effect and form of resale certificates.)

(d) Reporting Methods.

(1) General. In reporting taxable measure, a carrier may utilize the California passenger mile method described in (d)(2) or any other reporting method which accurately reports the tax due on taxable beverages sold or used in this state. The carrier must be prepared to demonstrate by records which can be verified by audit that the method used accurately reflects the taxable measure. Carriers contemplating use of other reporting methods are encouraged to submit an outline of the proposed method to the nearest board office for review and formal approval prior to use of the method.

(2) California Passenger Miles Method. Under this method, a carrier may report its tax liability from the sale and consumption of taxable beverages in this state by allocating a portion of its total gross receipts and its total cost of taxable beverages served on a complimentary basis to California based on the ratio that its passenger miles in California bears to its total system-wide passenger miles.

The ratio of passenger miles in California to total passenger miles may be determined by tests. The test shall be representative of the carrier's operations. Further, new tests should be made when there is any significant change in routes, schedules, or other operating conditions. All detail and test data shall be retained for examination by Board representatives.

The California mileage used in computing the ratio should exclude trans-state trip mileage. Air carriers shall make no adjustment for ascent and descent miles unless total system wide mileage is adjusted for total ascent and descent miles.

(A) Determination of Taxable Receipts Under the Passenger Miles Method. In determining taxable receipts under this method, a carrier must apply the ratio to its total gross receipts from the sale of taxable beverages system-wide. As used in this subsection, "total gross receipts" means the total amount of the sales price of all taxable beverages including sales tax reimbursement. Since the taxable receipts determined under this method represents taxable receipts before adjustment for sales tax included therein, taxable receipts may be adjusted to compensate for California sales tax included in total gross receipts.

(B) Determination of Cost of Taxable Beverages Consumed Under the Passenger Miles Method. In determining the cost of taxable beverages consumed in this state, a carrier must apply the ratio to its total cost of beverages served on a complimentary basis system-wide.

Separate calculations must be made for taxable beverages of a kind which are resold and those of a kind not resold. For example, soft drinks normally are not resold, while beer, wine and liquor normally are resold.

1. Beverages of a Kind Not Generally Resold. The cost of taxable beverages consumed in this state may be determined by applying the passenger miles method to the cost of taxable beverages served on a complimentary basis system-wide. A credit may be taken for taxable beverages acquired on which California sales tax reimbursement was paid to the vendor. However, the credit may not exceed the total cost of taxable beverages consumed in California as determined by the passenger miles method.

2. Beverages of a Kind Generally Resold. The cost of taxable beverages of a kind normally resold but which are served on a complimentary basis may be determined on the passenger miles method. If the carrier has paid California sales tax reimbursement at the time of acquisition, a credit may be taken for taxable beverages so acquired.

History—Adopted March 6, 1985, effective May 31, 1985.

Regulation 1621. Sales to Common Carriers.

Reference: Sections 6357.5 and 6385, Revenue and Taxation Code.

(a) Definitions.

(1) Common Carrier. As used herein the term "common carrier" means any person who engages in the business of transporting persons or property for hire or compensation and who offers these services indiscriminately to the public or to some portion of the public. With respect to water transportation the term includes any vessel engaged, for compensation, in transporting persons or property in interstate or foreign commerce. This includes those vessels commonly called "ocean tramps," "trampers," or "tramp vessels."

(2) Foreign Air Carriers. As used herein, the term "foreign air carrier" means any person, not a citizen of the United States, who undertakes, whether directly or indirectly or by lease or any other arrangement, to engage in foreign air transportation.

(b) Application of Tax.

(1) Common Carriers. The sale of tangible personal property, other than fuel and petroleum products, to common carriers, including foreign air carriers, is exempt from sales tax pursuant to Section 6385(a) of the Revenue and Taxation Code when such property is:

(A) Shipped by the seller via the facilities of the purchasing carrier under a bill of lading, to an out-of-state point, and

(B) Actually transported by the common carrier to the out-of-state destination, pursuant to the bill of lading, over a route the California portion of which the purchasing carrier is authorized to transport cargo under common carrier rights, and

(C) Not put to use until after the transportation by the purchasing carrier to the out-of-state destination, and

(D) Used by the carrier in the conduct of its business as a common carrier.

(2) Foreign Air Carriers. The sale of tangible personal property, other than aircraft fuel and petroleum products, to foreign air carriers is exempt from sales tax pursuant to Section 6385(b) of the Revenue and Taxation Code when such property is:

(A) Transported by the foreign air carrier to a foreign destination, and

(B) Not put to use until after the transportation by the purchasing foreign air carrier to the foreign destination, and

(C) Used by the foreign air carrier in the conduct of its business as a common carrier by air of persons or property.

(3) Fuel and Petroleum Products.

(A) Operative July 15, 1991, sales of fuel and petroleum products delivered to the purchasing carriers in California are subject to sales tax except as provided in paragraph (b)(3)(B) and (b)(3)(C) of this regulation. Sales tax applies notwithstanding the fact that the purchaser may issue a bill of lading to the seller and notwithstanding the fact that the seller may purport to reserve a title to the property until the property arrives at an out-of-state destination.

(B) Operative January 1, 1989, the sale, storage, use, or other consumption of, fuel or petroleum products is exempt from sales and use tax pursuant to Section 6357.5 of the Revenue and Taxation Code when such property is:

1. sold to an air common carrier which holds a valid seller's permit or which has timely obtained a fuel exemption registration number,

2. for immediate consumption or shipment, and

3. shipped or consumed by the carrier in the conduct of its business as an air common carrier on a flight whose first destination is a foreign destination. Effective January 1, 1993, a flight which has an intermediate stop within the United States will qualify for the exemption if the final destination of that flight is a foreign destination.

For the period January 1, 1989 through December 31, 1992, the tax will not apply to the sale or use of fuel or petroleum products which are shipped or consumed on a flight to a foreign destination even though there is an intermediate stop at a point within the United States, provided no cargo, including mail, or passengers are loaded or discharged at such intermediate stop. The tax will not apply if crew members are loaded or discharged at such intermediate stop; however, the tax will apply if other airline personnel flying without charge (deadhead) are loaded or discharged. The tax also will not apply to fuel used on flights which are aborted for emergency purposes if such flights otherwise would have qualified for the exemption.

To qualify for the exemption, the sale of the fuel or other petroleum products must be for "immediate consumption or shipment".

A "sale" occurs when the purchaser takes either title to or possession of the fuel. "Immediate consumption or shipment" occurs when the delivery of fuel by the seller is directly to an aircraft for consumption in propulsion to a foreign destination or for transportation to a foreign destination and not for storage. Fuel is sold for storage, and not for immediate consumption or shipment, if title to the fuel passes to the purchaser while the fuel remains in storage facilities owned or leased by the seller. Fuel is sold for storage, and not for immediate consumption or shipment, if the fuel is transferred by the seller into a storage facility controlled by or leased to the purchaser or to any third party who takes delivery for the purchaser. Tax applies notwithstanding the contract of sale providing that the seller shall retain title to the fuel until the fuel is loaded onto the aircraft. In such cases, any attempt by the seller to retain title is limited in effect to the reservation of a security interest.

To qualify for the exemption, a common carrier which is not otherwise required to hold a valid seller's permit shall be required to register with the Department and obtain a fuel exemption registration number. The fuel exemption registration number will be considered obtained timely if the purchasing carrier receives such registration number from the Department no later than 45 days after taking the fuel on board.

In the event that the federal exemption provided in Section 1309 of Title 19 of the United States Code, relating to supplies for certain vessels and aircraft, is repealed, this exemption also is repealed as of that date.

(C) For the period January 1, 1993 through December 31, 2002, and for the period April 1, 2004 through December 31, 2028, the sale of fuel and petroleum products is exempt from sales tax pursuant to subdivision (c) of section 6385 of the Revenue and Taxation Code when such property is:

1. Sold to a water common carrier who holds a valid seller's permit or who has timely obtained a fuel exemption registration number,

2. For immediate shipment outside this state,

3. Consumed by the water carrier in the conduct of its business as a common carrier after the first out-of-state destination.

The sales tax applies with respect to sales of fuel and petroleum products which will be consumed in a voyage from the California point where the fuel is taken on to the first destination outside of California.

For purposes of this subdivision (b)(3)(C), the term "first destination outside of California" means the first point reached outside this state by a water common carrier in the conduct of its business as a common carrier at which cargo or passengers are loaded or discharged, cargo containers are added or removed, fuel is transferred, or docking fees are charged. The term also includes the entry point of the Panama Canal when the carrier is only transiting the canal in the conduct of its business as a common carrier.

To qualify for the exemption, the "sale" of the fuel (or other petroleum product) must be for "immediate shipment". A "sale" occurs when the purchaser takes either title to or possession of the fuel. An "immediate shipment" occurs when the delivery of fuel by the seller is directly to a vessel for transportation outside this state and not for storage.

Fuel is sold for storage and not for immediate shipment, if title to the fuel passes to the purchaser while the fuel remains in storage facilities owned or leased by the seller.

Fuel is sold for storage, and not for immediate shipment, if the fuel is transferred by the seller into a storage facility controlled by or leased to the purchaser or to any third party who takes delivery for the purchaser. Tax applies notwithstanding the contract of sale provides that the seller shall retain title to the fuel until the fuel is loaded onto the vessel. In such cases, any attempt by the seller to retain title is limited in effect to the reservation of a security interest.

Fuel is sold for immediate shipment, and not for storage, if the fuel is transferred by the seller into storage facilities maintained by a third party, the seller has contracted with the third party to store the fuel, and title does not pass to the purchaser until the fuel is loaded onto the vessel.

Fuel is sold for immediate shipment, and not for storage, if the fuel is transferred by the seller to storage facilities maintained by a third party, even though the purchaser may have contracted with the third party to store the fuel, if the sale occurs when the fuel is loaded onto the vessel and the seller has the legal obligation to deliver the fuel to the purchaser's vessel. If the obligation of the seller to deliver the fuel is complete upon transfer of the fuel to the third party, then any retention or reservation of title to the fuel after such transfer is limited in effect to a reservation of a security interest, and the fuel will be regarded as having been delivered to the purchaser for storage and not for immediate shipment outside this state. A mere recital in the contract of sale that the delivery will occur at the vessel, or that the seller will retain title to the fuel until delivery at the vessel, is insufficient of itself to establish that delivery of the fuel by the seller is directly into the vessel.

In determining whether the delivery occurs at the vessel, and not upon transfer of the fuel to the third party, the Department shall consider the following factors: whether the losses during storage are for the account of the seller; whether the seller has the right to remove the fuel from the storage facilities; whether the seller has the duty to remove the fuel from the storage facilities at the seller's expense should the seller's deliveries into the storage facilities exceed specified quantities, and whether the contract between the seller and purchaser is a requirements contract. The presence or absence of one or more factors is not conclusive.

A sale of fuel, otherwise qualifying as a sale for immediate shipment under the above rules, will qualify for the exemption even though the fuel is delivered to a fuel truck or barge from which the fuel is delivered directly into the vessel.

(c) Proof of Exemption.

(1) Common Carrier. Any seller claiming a transaction as exempt from sales tax under Section 6385(a) must receive at the time of the transaction, and retain, a properly executed bill of lading, or copy thereof, pursuant to which the goods are shipped. The bill of lading must show the seller as consignor. It must indicate that the described goods are consigned to the common carrier at a specified destination outside this state. Where the form of the transaction is "freight collect," no specific freight charge need be shown on the bill of lading, inasmuch as such charges are not ordinarily shown thereon in "freight collect" transactions. Furthermore, the carrier need not actually collect freight charges from itself. The form and language of the bill of lading should be similar to the form and language normally used where the purchaser and carrier are not the same. A bill of lading will be considered obtained at the time of the transaction if it is received either before the seller bills the purchaser for the property, within the seller's normal billing and payment cycle, or upon delivery of the property to the purchaser.

In addition to a bill of lading, the seller must obtain from the purchaser prior to or at the time of the transaction, and retain, a certificate in writing that the property shall be transported and used in the manner described in subdivision (b)(1) of this regulation. The certificate shall be in substantially the same form as Certificate A or B, appearing in the appendix of this regulation. Certificate B may be used when multiple transactions claimed as exempt are made between a seller and a carrier and may be included as part of a transaction by reference to the certificate on the purchase order or other appropriate documentation for each transaction.

(2) Foreign Air Carrier. Any seller claiming a transaction as exempt from sales tax pursuant to Section 6385(b) of the Revenue and Taxation Code must receive from the purchaser a certificate in writing that the property shall be transported and used in the manner described in section (b)(2) of this regulation. The certificate shall be in substantially the same form as Certificate C, appearing in the appendix to this regulation. Effective January 1, 1990, if a seller does not have a certificate on hand at the time the Department requests it be made available for verification of a transaction claimed to be exempt from sales tax, the seller will have 45 calendar days from the date of the Department's written request to obtain the certificate from the purchasing foreign air carrier. A "blanket" certificate, i.e., one issued to cover future transactions, may be issued by a foreign air carrier and included as part of a transaction by reference to the certificate on the purchase order or other appropriate documentation for each transaction.

The provisions of (c)(3) and (d)(3) of this regulation shall apply with respect to sales of aircraft fuel and petroleum products to foreign air carriers.

(3) Fuel and Petroleum Products. Any seller claiming a transaction as exempt from sales tax pursuant to Section 6357.5 or 6385(c) of the Revenue and Taxation Code should timely obtain an exemption certificate in writing from the purchasing common carrier. The exemption certificate will be considered timely if obtained by the seller within the seller's normal billing and payment cycle or within 45 days from the date of delivery, whichever is later. The exemption certificate must show either the purchaser's seller's permit number, or if the purchaser is not required to hold a seller's permit, the purchaser's fuel exemption registration number. The exemption certificate must conform in substance with one of the following, appearing in the appendix to this regulation.

(A) Certificate D is to be used for purchases of fuel or petroleum products within Section 6357.5 by air common carriers (including foreign air carriers) operating under authority from the Federal Aviation Administration. One certificate may be provided for each regularly scheduled flight number which has a foreign destination as its final destination. Such certificate will remain valid until revoked in writing.

(B) Certificate E is to be used for purchases of fuel or petroleum products within Section 6385(c) by a steamship company which is a common carrier. This includes any vessel engaged, for compensation, in transporting persons or property in interstate or foreign commerce.

(d) Effect of Exemption Documents.