Laws, Regulations, and Annotations

Lawguide Search

Business Taxes Law Guide—Revision 2026

Sales And Use Tax Regulations

Title 18. Public Revenues

Division 2. California Department of Tax and Fee Administration — Business Taxes

Chapter 4. Sales and Use Tax

Article 16. Resale Certificates; Demonstration, Gifts and Promotions

- 1667 Exemption Certificates

- 1668 Sales for Resale

- 1669 Demonstration, Display and Use of Property Held for Resale—General

- 1669.5 Demonstration, Display, and Use of Property Held for Resale—Vehicles

- 1670 Gifts, Marketing Aids, Premiums and Prizes

- 1671 Trading Stamps and Related Promotional Plans

- 1671.1 Discounts, Coupons, Rebates, and Other Incentives

Regulation 1667. Exemption Certificates.

Reference: Sections 6385 and 6421, Revenue and Taxation Code.

(A) Construction Contractors, see Regulation 1521.

Regulations that prescribe certificate forms:

Factory-built housing, see Regulation 1521.4.

Printed Sales Messages, See Regulation 1541.5.

Motor Vehicle and Aircraft Fuels, see Regulation 1598.

Mobilehomes and Commercial Coaches, see Regulation 1610.2.

Direct Payment Permits, see Regulation 1699.5.

(B) Other related regulations:

Interstate and foreign commerce, see Regulation 1620.

(a) In General. The law provides that for the purpose of the proper administration of the sales and use tax and to prevent evasion of the sales tax it shall be presumed that all gross receipts are subject to the tax until the contrary is established.

This presumption may be rebutted by the seller as to any sale by establishing to the satisfaction of the Board that the gross receipts from the sale are not subject to the tax or by timely taking a resale certificate as provided in Regulation 1668 or by taking a certificate as provided in this regulation.

(b) Effect.

(1) Except as stated hereinafter, a seller is relieved of the liability for sales tax if the purchaser timely certifies in writing to the seller that the property will be used in a manner or for a purpose entitling the seller to regard the gross receipts from the sale to be exempted from the sales tax by one or more of the provisions of Chapter 4 (commencing with Section 6351) of the Sales and Use Tax Law. A certificate will be considered timely if it is given at any time before the seller bills the purchaser for the property, or any time within the seller's normal billing and payment cycle, or any time at or prior to delivery of the property to the purchaser.

The certificate shall relieve the seller from liability for the sales tax only if it is taken in good faith.

Invoices on sales claimed by a seller as exempt should specify the names of the purchasers in order to relate them to exemption certificates.

(2) Effective January 1, 1990, a certificate of exemption from the sales tax for the sale of tangible personal property, other than fuel or petroleum products, to a foreign air carrier need not be received timely. A seller will be allowed 45 days from the date of the Board's written request to obtain an exemption certificate from the purchasing foreign air carrier as provided in Regulation 1621(c)(2), 18 CCR 1621.

(3) If a purchaser certifies in writing to a seller that the property purchased will be used in a manner or for a purpose entitling the seller to regard the gross receipts from the sale as exempt from the sales tax and uses the property in some other manner or for some other purpose, the purchaser shall be liable for payment of sales tax as if the purchaser were a retailer making a retail sale of the property at the time of such use and the sales price of the property to the purchaser shall be deemed the gross receipts from such retail sale.

The term "use" is the same as defined in Section 6009 of the Sales and Use Tax Law without the exclusion defined in Section 6009.1.

(c) Issuance of Certificates.

(1) Form of Certificates. Certain other regulations prescribe the form of exemption certificates to be used with respect to several specific kinds of transactions. Where no specific form of certificate is prescribed, the certification must be in writing and include the date; the signature of the purchaser, the purchaser's agent, or the purchaser's employee; the name and address of the purchaser; the number of the purchaser's seller's permit, or if the purchaser is not required to hold a seller's permit, a notation to that effect and the reason; a description of the property purchased under the certificate; and a statement of the manner in which or the purpose for which the property will be used so as to make the sales tax inapplicable to the sale.

To relieve the seller from liability for the sales tax, the statement of the manner in which or the purpose for which the property will be used must be one which under the provisions of Chapter 4 (commencing with Section 6351) of the Sales and Use Tax Law does entitle the seller to regard the gross receipts from the sale as exempted from the sales tax.

(2) Issuance of Certificates Where Not Appropriate. There are several cases in which certification will not relieve the seller of liability for the sales tax. In such cases, an exemption certificate should not be obtained but rather the facts and documentation of the transaction must support the exemption. For example, a certification to the effect that sales tax does not apply because the property purchased will be exported and shipped out of state, does not relieve the seller of liability for the sales tax. A sale is exempt from sales tax as a sale in interstate or foreign commerce only if the conditions set forth in Regulation 1620 are met, and the seller should obtain the documentation required by that regulation in order to support the exemption.

History—Adopted April 6, 1977, effective July 1, 1977.

Amended December 7, 1977, effective January 19, 1978. In (b)(1) changed "exempt when received with knowledge of falsity" to "good faith" requirement, and in (b)(2) defined "use".

Amended July 31, 1991, effective October 19, 1991. Amended pursuant to Chapter 230, Statutes of 1989. Amended paragraph (a) to eliminate "timely". Renumbered paragraph (b)(2) to (b)(3) and added new paragraph (b)(2).

Regulation 1668. Sales for Resale.

Reference: Sections 6007, 6009.2, 6012.8, 6012.9, 6072, 6091–6095, 6241–6245, 6484, 6485, and 7153, Revenue and Taxation Code.

Automobile Dealers, effect of accepting from nondealer retailer, see Regulation 1566.

Construction Contractors, use by, see Regulation 1521.

Demonstration and Display, use of property purchased under resale certificates for, see Regulation 1669.

Drapery hardware installers accepting, see Regulation 1521.

Newspapers and Periodicals, for component parts of, see Regulation 1590.

Salt used by food processors, giving for, see Regulation 1525.

Vending machine operators furnishing, see Regulation 1574.

(a) Resale Certificate.

The burden of proving that a sale of tangible personal property is not at retail is upon the seller unless the seller timely takes in good faith a certificate from the purchaser that the property is purchased for resale. If timely taken in proper form as set forth in subdivision (b) and in good faith from a person who is engaged in the business of selling tangible personal property and who holds a California seller's permit as required by Regulation 1699, Permits, the certificate relieves the seller from liability for the sales tax and the duty of collecting the use tax. A certificate will be considered timely if it is taken at any time before the seller bills the purchaser for the property, or any time within the seller's normal billing and payment cycle, or any time at or prior to delivery of the property to the purchaser. A resale certificate remains in effect until revoked in writing.

(b) Form of Certificate.

(1) Any document, such as a letter or purchase order, timely provided by the purchaser to the seller will be regarded as a resale certificate with respect to the sale of the property described in the document if it contains all of the following essential elements:

(A) The signature of the purchaser, purchaser's employee or authorized representative of the purchaser.

(B) The name and address of the purchaser.

(C) The number of the seller's permit held by the purchaser. If the purchaser is not required to hold a permit because the purchaser sells only property of a kind the retail sale of which is not taxable, e.g., food products for human consumption, or because the purchaser makes no sales in this state, the purchaser must include on the certificate a sufficient explanation as to the reason the purchaser is not required to hold a California seller's permit in lieu of a seller's permit number.

(D) A statement that the property described in the document is purchased for resale. The document must contain the phrase "for resale." The use of phrases such as "non-taxable," "exempt," or similar terminology is not acceptable. The property to be purchased under the certificate must be described either by an itemized list of the particular property to be purchased for resale, or by a general description of the kind of property to be purchased for resale.

(E) Date of execution of document. (An otherwise valid resale certificate will not be considered invalid solely on the ground that it is undated.)

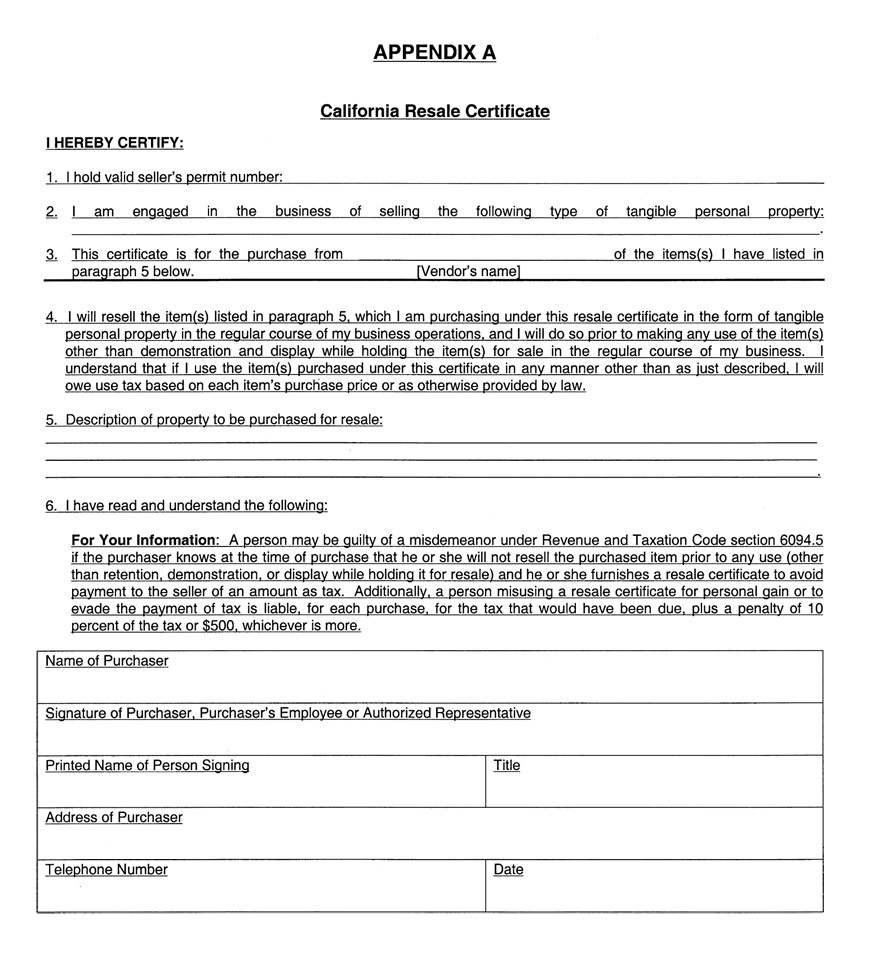

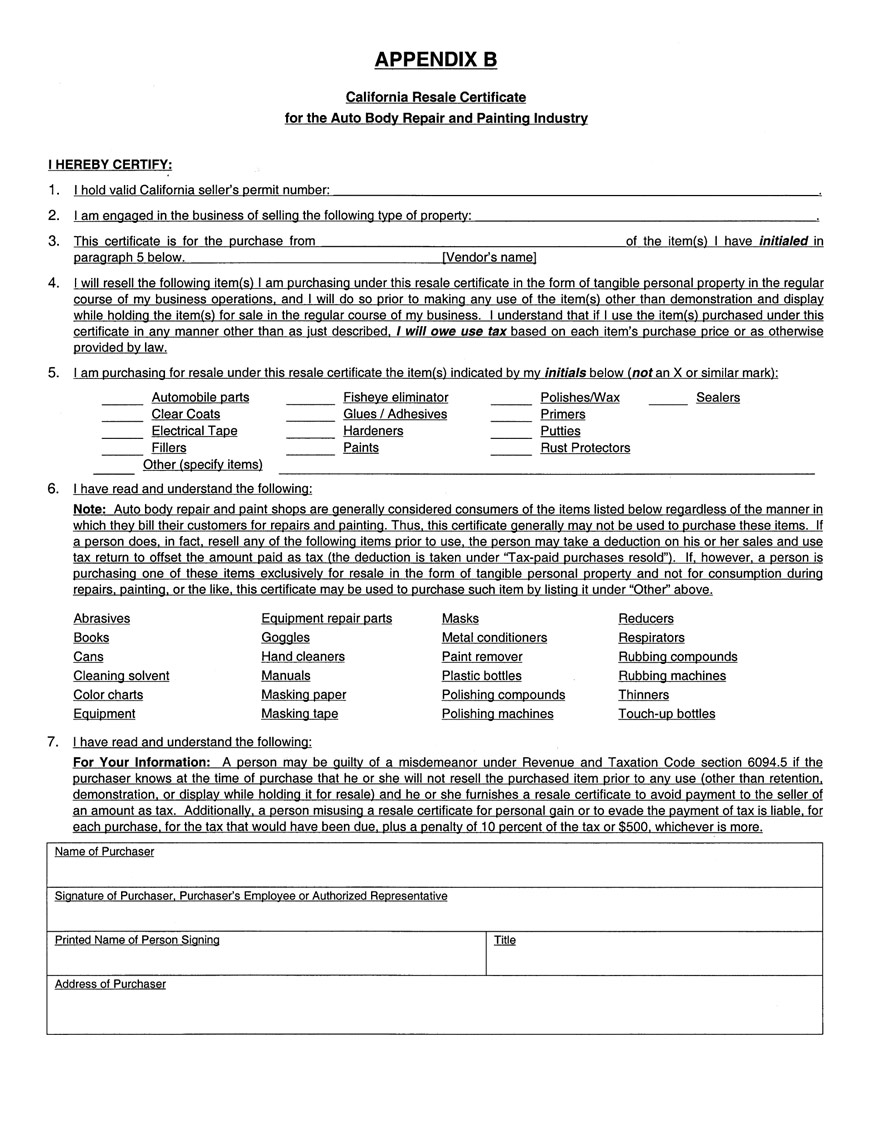

(2) A document containing the essential elements described in subdivision (b)(1) is the minimum form which will be regarded as a resale certificate. However, in order to preclude potential controversy, the seller should timely obtain from the purchaser a certificate substantially in the form shown in Appendix A of this regulation. If a purchaser operates an auto body repair and/or paint business, a specific resale certificate in substantially the same form as shown in Appendix B of this regulation should be used, rather than the general resale certificate shown in Appendix A.

(3) Blanket Resale Certificate. If a purchaser issues a general (blanket) resale certificate which provides a general description of the items to be purchased, and subsequently issues a purchase order which indicates that the transaction covered by the purchase order is taxable, the resale certificate does not apply with respect to that transaction. However, the purchaser will bear the burden of establishing either that the purchase order was sent to and received by the seller within the seller's billing cycle or prior to delivery of the property to the purchaser (whichever is the later), or that the tax or tax reimbursement was paid to the seller. The purchaser may avoid this burden by using the procedures described in subdivision (b)(4) below.

(4) Qualified Resale Certificate. If a purchaser wishes to designate on each purchase order whether the property being purchased is for resale, the seller should obtain a qualified resale certificate, i.e., one that states "see purchase order" in the space provided for a description of the property to be purchased. Each purchase order must then specify whether or not the property covered by the order is purchased for resale. The use of the phrases "for resale," "resale = yes," "nontaxable," "taxable = no," or similar terminology on a purchase order, indicating that tax or tax reimbursement should not be added to the sales invoice will be regarded as designating that the property described is purchased for resale provided the combination of the purchase order and the qualified resale certificate contains all the essential elements provided in subdivision (b)(1). However, a purchase order where the applicable amount of tax is shown as $0 or is left blank will not be accepted as designating that the property is purchased for resale, unless the purchase order also includes the phrase "for resale" or other terminology described above to specify that the property is purchased for resale. If each purchase order does not so specify, or is not issued timely within the meaning of subdivision (a), it will be presumed that the property covered by that purchase order was not purchased for resale and that sale or purchase is subject to tax. If the purchase order includes both items to be resold and items to be used, the purchase order must specify which items are purchased for resale and which items are purchased for use. For example, a purchase order issued for raw materials for resale and also for tooling used to process the raw materials should specify that the raw materials are purchased for resale and that the sale of the tooling is subject to tax.

The seller shall retain copies of the purchase orders along with the qualified resale certificates in order to support the sales for resale.

(5) If the seller does not timely obtain a resale certificate, the fact that the purchaser deletes the tax or tax reimbursement from the seller's billing, provides a seller's permit number to the seller, or informs the seller that the transaction is "not taxable" does not relieve the seller from liability for the tax nor from the burden of proving the sale was for resale.

(c) Good Faith. In absence of evidence to the contrary, a seller will be presumed to have taken a resale certificate in good faith if the resale certificate contains the essential elements as described in subdivision (b)(1) and otherwise appears to be valid on its face. If the purchaser insists that the purchaser is buying for resale property of a kind not normally resold in the purchaser's business, the seller should require a resale certificate containing a statement that the specific property is being purchased for resale in the regular course of business.

(d) Improper Use of Certificate. Except when a resale certificate is issued in accordance with subdivisions (h), (i) or (j):

(1) A purchaser, including any officer or employee of a corporation, is guilty of a misdemeanor punishable as provided in section 7153 if the purchaser, for the purpose of evading payment to the seller of tax or tax reimbursement, gives a resale certificate for property which the purchaser knows at the time of purchase will be used rather than resold.

(2) Any person, including any officer or employee of a corporation, who gives a resale certificate for property which he or she knows at the time of purchase is not to be resold by him or her or the corporation in the regular course of business is liable to the state for the amount of tax that would be due if he or she had not given such resale certificate. In addition to the tax, the person shall be liable to the state for a penalty of 10 percent of the tax or five hundred dollars ($500), whichever is greater, for each purchase made for personal gain or to evade the payment of taxes, as provided in sections 6072 and 6094.5.

(3) In addition to the penalty of 10 percent or five hundred dollars ($500), whichever is greater, if the person fails to report and pay the use tax due on the use of the property purchased improperly with a resale certificate, the person may be liable for the 10 percent penalty for negligence or the 25 percent penalty for fraud, as provided in sections 6484 and 6485.

(e) Other Evidence to Rebut Presumption of Taxability. A sale for resale is not subject to sales tax. A person who purchases property for resale and who subsequently uses the property owes tax on that use. A resale certificate which is not timely taken is not retroactive and will not relieve the seller of the liability for the tax. Consequently, if the seller does not timely obtain a resale certificate containing the essential elements as described in subdivision (b)(1), the seller will be relieved of liability for the tax only where the seller shows that the property:

(1) Was in fact resold by the purchaser and was not used by the purchaser for any purpose other than retention, demonstration, or display while holding it for sale in the regular course of business, or

(2) Is being held for resale by the purchaser and has not been used by the purchaser for any purpose other than retention, demonstration, or display while holding it for sale in the regular course of business, or

(3) Was consumed by the purchaser and tax was reported directly to the Board by the purchaser on the purchaser's sales and use tax return, or

(4) Was consumed by the purchaser and tax was paid to the Board by the purchaser pursuant to an assessment against or audit of the purchaser developed either on an actual basis or test basis.

(f) Use of XYZ Letters. A seller who does not timely obtain a resale certificate may use any verifiable method of establishing that it should be relieved of liability for tax under subdivision (e). One method that the Board authorizes to assist a seller in satisfying its burden to show that the sale was for resale or that tax was paid, is the use of "XYZ letters." XYZ letters are letters in a form approved by the Board which are sent to some or all of the seller's purchasers inquiring as to the purchaser's disposition of the property purchased from the seller. An XYZ letter will include certain information and request responses to certain questions, set forth below. The XYZ letter may also be further customized by agreement between the Board's staff and the seller to reflect the seller's particular circumstances.

(1) An XYZ letter may include the following information: seller's name and permit number, date of invoice(s), invoice number(s), purchase order number(s), amount of purchase(s), and a description of the property purchased or other identifying information. A copy of the actual invoice(s) may be attached to the XYZ letter. The XYZ letter will request the purchaser to complete the statement and include the purchaser's name, seller's permit number and nature of the purchaser's business. The statement shall be signed by the purchaser, purchaser's employee or authorized representative, and include the printed name of the person signing the certificate, title, date, telephone number and city.

(2) An XYZ letter will request that the purchaser, purchaser's employee or authorized representative check one of the boxes provided inquiring as to whether the property in question was:

(A) Purchased for resale and resold in the form of tangible personal property, without any use other than retention, demonstration, or display while being held for sale in the regular course of business;

(B) Purchased for resale and presently in resale inventory, without having been used for any purpose other than retention, demonstration, or display while being held for sale in the regular course of business;

(C) Purchased solely for leasing and was so leased. Tax has been paid directly to the Board measured by the purchase price or rental receipts ("tangible personal property"); or tax has been paid measured by the purchase price or fair rental value ("mobile transportation equipment");

(D) Purchased for resale but consumed or used (whether or not subsequently resold); or

(E) Purchased for use.

(F) When the purchaser answers either (D) or (E) affirmatively (box checked), the XYZ letter will inquire further whether:

1. The tax was paid directly to the Board on the purchaser's Sales and Use Tax Return, and if so, in what amount;

2. The tax was added to the billing of the seller and remitted to the seller, and if so, in what amount;

3. The tax was paid directly to the Board by the purchaser pursuant to an assessment against or audit of the purchaser developed either on an actual basis or test basis; or

4. The purchaser confirms that the purchase is a taxable transaction and that tax is applicable.

(3) A response to an XYZ letter is not equivalent to a timely and valid resale certificate. A purchaser responding affirmatively to questions reflected in paragraphs (A), (B), (C), or (D) of subdivision (f)(2) will be regarded as confirming the seller's belief that a sale was for resale for purposes of subdivision (g). However, the Board is not required to relieve a seller from liability for sales tax or use tax collection based on a response to an XYZ letter. The Board may, in its discretion, verify the information provided in the response to the XYZ letter, including making additional contact with the purchaser or other persons to determine whether the purchase was for resale or for use, or whether tax was paid by the purchaser. When the Board accepts the purchaser's response to an XYZ letter as a valid response, the Board shall relieve the seller of liability for sales tax or use tax collection.

(4) When there is no response to an XYZ letter, the Board staff should consider whether it is appropriate to use an alternative method to ascertain whether the seller should be relieved of tax under subdivision (e) with respect to the questioned or unsupported transaction(s).

(g) Purchaser's Liability for Tax. A purchaser who issues a resale certificate containing the essential elements as described in subdivision (b)(1) and that otherwise appears valid on its face, or who otherwise purchases tangible personal property that is accepted by the Board as purchased for resale pursuant to subdivision (f) and who thereafter makes any storage or use of the property other than retention, demonstration, or display while holding it for sale in the regular course of business is liable for use tax on the cost of the property. The tax is due at the time the property is first stored or used and must be reported and paid by the purchaser with the purchaser's tax return for the period in which the property is first so stored or used. A purchaser cannot retroactively rescind or revoke a resale certificate and thereby cause the transaction to be subject to sales tax rather than use tax.

A purchaser who issues a resale certificate for property which the purchaser knows at the time of purchase is not to be resold in the regular course of business is liable for the sales tax on that purchase measured by the gross receipts from the sale to that purchaser. The tax is due as of the time the property was sold to the purchaser and must be reported and paid by the purchaser with the purchaser's tax return for the period in which the property was sold to the purchaser.

(h) Mobilehomes. A mobilehome retailer who purchases a new mobilehome for sale to a customer for installation for occupancy as a residence on a foundation system pursuant to section 18551 of the Health and Safety Code, or for installation for occupancy as a residence pursuant to section 18613 of the Health and Safety Code, and which mobilehome is thereafter subject to property taxation, may issue a resale certificate to the mobilehome vendor even though the retailer is classified as a consumer of the mobilehome by sections 6012.8 and 6012.9 of the Revenue and Taxation Code. Also, a mobilehome retailer, licensed as a mobilehome dealer under section 18002.6 of the Health and Safety Code, who purchases a new mobilehome for sale to a customer for installation for occupancy as a residence on a foundation system pursuant to section 18551 of the Health and Safety Code, may issue a resale certificate to the mobilehome vendor even though the mobilehome retailer may have the mobilehome installed on a foundation system as an improvement to realty prior to the retailer's sale of the mobilehome to the customer for occupancy as a residence.

Where the mobilehome is acquired by a mobilehome retailer, who is not licensed as a dealer pursuant to section 18002.6 of the Health and Safety Code, for affixation by the retailer to a permanent foundation, or for other use or consumption (except demonstration or display while holding for sale in the regular course of business), prior to sale, the mobilehome retailer may not issue a resale certificate. The mobilehome retailer shall notify the vendor that the purchase is for consumption and not for resale. When a mobilehome manufacturer or other vendor is informed or has knowledge that the purchaser will install the mobilehome on a permanent foundation prior to its resale, the manufacturer or other vendor is not making a sale for resale. Such vendor is making a taxable retail sale and cannot accept a resale certificate in good faith.

(i) Mobile Transportation Equipment. Any person, other than a person exempt from use tax, such as under Revenue and Taxation Code section 6352, who purchases mobile transportation equipment for the sole purpose of leasing that equipment, may issue a resale certificate for the limited purpose of reporting use tax based on fair rental value as provided in Regulation 1661.

(j) Counterfeit Goods. A sale of tangible personal property with a counterfeit mark on, or in connection with, that sale by a convicted seller is included in the definition of "retail sale" per Revenue and Taxation Code section 6007, and therefore taxable. "Storage" and "use" as defined in Revenue and Taxation Code section 6009.2, includes any purchase of tangible personal property with a counterfeit mark on, or in connection with, that purchase by a convicted purchaser and is subject to tax. This is regardless of whether the counterfeit goods were sold for resale or held with the intent to be resold. A "counterfeit mark" is a spurious mark that is used in a manner described in section 2320 of title 18 of the United States Code.

History—Effective July 1, 1939.

Adopted as of January 1, 1945, as a restatement of previous rulings.

Amended June 20, 1967, effective July 1, 1967.

Amended and renumbered November 3, 1969, effective December 5, 1969.

Amended April 6, 1977, effective July 1, 1977. Added new method of proof for resale, detailed what is adequate proof for resale, and clarified effect of purchase for use on a resale certificate.

Amended December 7, 1977, effective January 19, 1978. In (e) added the tax that would be due.

Amended July 28, 1982, effective June 26, 1983. Added new (e) and (f), renumbered (g) and (h), and added reference to Section 6072 to (g).

Amended April 9, 1985, effective June 27, 1985. In subdivision (g), amended to specify that the penalty provisions are also applicable to any officer or employee of a corporation who gives a resale certificate for property which he or she knows at the time of purchase will be used rather than resold. Added a reference to Section 6094.5 of the Revenue and Taxation Code with respect to the type of penalties a purchaser may be liable for if the purchaser makes an improper use of a resale certificate. Deleted subdivision (h) since it pertained to the effective date of amendments to the regulation which occurred in 1977.

Amended April 9, 1986, effective July 5, 1986. In subdivision (e), amended explanation under which mobilehome retailers may issue resale certificates to mobilehome vendors.

Amended March 28, 2001, effective July 6, 2001. Subdivision (b)(2)—The paragraph labeled "For Your Information" was added to the sample Resale Certificate currently in the regulation. A new paragraph was added providing a cross-reference to the resale certificate for the auto body repair and painting industry and the new certificate was added.

Amended December 20, 2001, effective May 17, 2002. Regulation re-titled "Sales for Resale." Word "subsection" replaced with "subdivision" throughout. Subdivision (a): re-titled "Resale Certificate; subdivision (a)(2) deleted and its language transferred to new subdivision (g) and expanded; designation (a)(1) deleted and its language transferred to subdivision (a) and rewritten. Subdivision (b): subdivision (b)(1)(A) words "or an agent or" deleted and words "purchaser's" and "authorized representative" added; subdivision (b)(1)(c) comma after word "purchaser" replaced by a period and word "or" deleted in first sentence; phrase "an … number." replaced with phrase "the … number." at the end of the subdivision. Subdivision (b)(1)(D)—new third sentence added. Subdivision (b)(2)—word "paragraph" added to first sentence and word "following" deleted from second sentence with new phrase "shown … regulation" and new third sentence added and sample resale certificates moved to new Appendices A and B. Subdivision (b)(3)—phrase "within … later)" added to second sentence. Subdivision (b)(4) word "that" replaced with "whether" in the first sentence; phrase "or … (a)" added to third sentence. Subdivision (c) deleted and its language transferred to new subdivision (e) with new fourth sub-paragraph added. Subdivision (d) re-designated (c) accordingly. Phrase "In … contrary," transferred to beginning of first sentence and capitalized and letter "A" changed to lower case, and phrase "if … face" added. New subdivisions (d)–(g) added. Former subdivision (e) re-designated (h) accordingly. Former subdivision (f) re-designated (i), accordingly; language "person … equipment" replaced with "person … 1661." Former subdivision (g) deleted.

Amended February 1, 2007, effective June 5, 2007. Amended subdivision (d) to clarify the penalties that may be applied for improper use of a resale certificate.

Amended May 27, 2009, effective August 29, 2009. Added titles to subdivisions (b)(3) and (b)(4). Amended subdivision (b)(4) to clarify the proper use of a qualified resale certificate. In subdivision (b)(2), changed "paragraph (1) above" to "subdivision (b)(1)," and in subdivisions (c) and (e), changed "(b)(1)" to "subdivision (b)(1)" to enhance consistency throughout the regulation.

Amended February 23, 2016, effective July 1, 2016. In subdivision (d) replaced "subdivision (h) or (i)" with "subdivisions (h), (i) or (j)" inserted "to show" between "burden" and "that" in subdivision (f); replaced the period with "; or" at the end of subdivision (f)(2)(F)3. In subdivision (h) replaced "Section" with "section" and "Sections" with "sections" throughout; deleted "effective September 19, 1985," from before "a mobilehome retailer" in the second sentence in subdivision (h); added new subdivision (j); and added references to Revenue and Taxation Code sections 6007 and 6009.2 to the reference note.

Note.—See Business Taxes General Bulletin 61-2 following Regulation 1525.

Regulation 1669. Demonstration, Display and Use of Property Held for Resale—General.

Reference: Sections 6092.1, 6094, 6243.1, 6244, and 6403, Revenue and Taxation Code.

Leases and Rentals in General, see Regulation 1660.

Demonstration and display—automobiles, see Regulation 1669.5.

(a) In General. A purchaser of tangible personal property who gives a resale certificate therefore, and who uses the property solely for demonstration or display while holding it for sale in the regular course of business, is not required to pay tax on account of such use. Except as otherwise provided in this regulation, if the property is used for any purpose other than or in addition to demonstration or display, such as making deliveries, personal use of employees, etc., the purchaser must include in the measure of the tax reported the purchase price of the property. Tax applies to the subsequent retail sale of the property.

(b) Sale to Sales Representatives for Demonstration. Tax applies to sales by dealers to their sales representatives of tangible personal property to be used for demonstration. It is presumed that any such tangible personal property will be used for purposes in addition to demonstration, and any resale certificates given for such property by sales representatives to dealers will be questioned, even if the sales representatives hold seller's permits.

(c) Rental to Sales Representatives for Demonstration. A dealer who rents property to sales representatives is regarded as making a continuous sale of the property and must collect and pay tax on the rental receipts unless tax has been paid measured by the purchase price of the property rented. The dealer must also include in the measure of the tax reported the gross receipts from the retail sale of such property following its rental to the sales representatives.

(d) Loans to Schools for Educational or Training Program. The loan by any retailer of any tangible personal property to any school district for an educational program conducted by the district is exempt from the use tax.

(e) Donations of Property.

(1) In General. Operative January 1, 1989, use tax does not apply to tangible personal property withdrawn from a resale inventory for the purpose of making a charitable contribution to a qualified organization located in this state. This exemption applies only to property which has been purchased for resale and subsequently donated without any use other than retention, demonstration or display while holding it for sale in the regular course of business. For purposes of this regulation, property purchased for the purpose of incorporation into a manufactured article is regarded as having been purchased for resale. For the period January 1, 1989 through October 1, 1989, this exemption is available only to retailers. Effective October 2, 1989 , this exemption is available to all sellers.

Property purchased specifically for donation to a qualified organization remains subject to the tax. As provided in Section 6094.5 of the Revenue and Taxation Code, a person is guilty of a misdemeanor if a resale certificate is issued for property which he or she knows at the time of purchase will be donated rather than resold. Such improper use of a certificate may cause the person to become liable for penalties called for by Sections 6072, 6094.5, 6484 or 6485 of the Revenue and Taxation Code.

(2) "Qualified Organization." For purposes of this regulation, "qualified organization" means and includes any organization described in Section 170(b)(1)(A) of the Internal Revenue Code including but not limited to:

(A) religious organizations, e.g., synagogues, churches and associations of churches;

(B) charitable organizations, e.g., the Red Cross, the Salvation Army, nonprofit schools and hospitals, and medical assistance and research groups;

(C) organizations operated for educational, scientific, or literary purposes including nonprofit museums, art galleries, and performing arts groups;

(D) organizations operated for the protection of children or animals;

(E) fraternal lodges if the donated property is to be used for charitable purposes and not for the benefit of the members; and

(F) the United States, this state and any political subdivision of this state.

Effective January 1, 1990, a nonprofit museum will not be considered a "qualified organization" unless the donated property is used exclusively for purposes of display to the public within the museum and the museum either:

(1) has a significant portion of its display space open to the public without charge during its normal operating hours;

(2) has its entire display space open to the public without charge for at least six of its normal operating hours during each month of operation; or

(3) has its entire display space open without charge to a segment of the student or adult population for educational purposes.

(f) Use of Rental Value as a Measure of Tax.

(1) Where Applicable.

(A) Accommodation Loans. If the use of property purchased under a resale certificate is limited to the loan of property to customers as an accommodation while awaiting delivery of property purchased or leased from the lender or while property is being repaired for customers by the lender, the measure of tax is the fair rental value of the property for the duration of each loan so made. The lender must also include in the measure of the tax reported the gross receipts from the retail sales of such property following its loan to customers.

(B) Property Used Both for Demonstration and Other Purposes. If property purchased under a resale certificate is used frequently for purposes of demonstration or display while holding it for sale in the regular course of business and is used partly for other purposes, the measure of tax is the fair rental value of the property for the period of such other use or uses. The gross receipts from the retail sale of the property after such use or uses must be included in the measure of tax.

This applies, for example, to a situation in which a dealer or lessor purchases property without tax paid on the purchase price and uses it personally, or allows sales representatives, sales managers, partners, corporate officers, or other authorized persons to use the property, for purposes in addition to demonstration and display.

The property must, in fact, be used frequently for demonstration or display. Mere incidental use for demonstration or display will not suffice. The dealer or lessor must maintain evidence substantiating the exempt use for examination by board auditors.

(C) Aircraft Dealers. The use of aircraft withdrawn from inventory for flight instruction and personal and business use is subject to tax. Tax may be reported on the fair hourly rental value of such use provided the requirements of (B) above are met.

(D) Mobile Transportation Equipment Leased While Being Held For Resale. If the use of mobile transportation equipment purchased under a resale certificate is limited to leasing the equipment, the purchaser may elect to pay use tax liability measured by the fair rental value if the election is made on or before the due date of a return for the period in which the equipment is first leased. The election must be made by reporting tax measured by the fair rental value on the return for that period. Tax must thereafter be paid with the return for each reporting period, measured by the fair rental value, whether the equipment is within or without this state. The election may not be revoked with respect to the equipment as to which it is made.

This election is available to any purchaser who leases mobile transportation equipment, other than a person exempt from use tax under Revenue and Taxation Code Section 6352, and such purchaser may properly issue a resale certificate for the limited purpose of reporting use tax liability based on fair rental value.

1. Fair Rental Value. "Fair rental value" means the rentals required by the lease, except where the Board determines the rental receipts are nominal. Fair rental value does not include any payment made by the lessee to reimburse the lessor for the lessor's use tax, whether or not the amount is separately stated, and regardless of how the charge is designated in the lease documentation and invoices. Lump-sum charges to the lessee will be assumed to include reimbursement for the lessor's use tax whether or not any statement to that effect is made to the lessee.

Example:

Assuming a 6 percent tax rate, if the invoice to the lessee states "rental $100, tax reimbursement to the lessor $6", "rental $100, sales and use taxes $6", or similar wording, the fair rental value is $100. If the invoice to the lessee states "rental $106" and makes no reference to reimbursement, the fair rental value is $100 ($106 divided by 1.06). Assuming a 6.5 percent tax rate, the fair rental value is $99.53 ($106 divided by 1.065).

Fair rental value includes any deficiency payment required from the lessee on disposition of mobile transportation equipment at the termination of an open-end lease and such payment is subject to tax. Any surplus rentals, however, which are returned to the lessee at the termination of an open-end lease may be deducted from the total fair rental value reported for the period in which the surplus rentals are returned. In the alternative, a refund may be claimed for any tax paid within the applicable statute of limitations period on such surplus rentals.

Fair rental value includes any capitalized cost reduction payment, which is a one-time payment by the lessee at the start of the lease to reduce the lessor's investment and the lessee's rentals. The payment may either be reported for the period in which it became due from the lessee or it may be reported in equal increments over the lease term. On early termination of such a lease, any unreported portion of the capitalized cost reduction payment shall be reported for the period in which termination occurred.

The term "fair rental value" includes any payments required by the lease, including amounts paid for personal property taxes on the leased property, whether assessed directly against the lessee or against the lessor, but does not include amounts paid to the lessor for:

(a) Collection costs, including attorney's fees, court costs, repossession charges, and storage fees; but tax does apply to any delinquent rental payments, including those collected in court action;

(b) Insuring, repairing or refurbishing the leased property following a default;

(c) Cost incurred in defending a court action or paying a tort judgement arising out of the lessee's operation of the leased property, or any premiums paid on insurance policies covering such court actions or tort judgements;

(d) Cost incurred in disposing of the leased property at expiration or earlier termination of the lease;

(e) Late charges and interest thereon for failing to pay the rentals timely;

(f) Separately stated optional [insurance charges,] maintenance or warranty contracts;

(g) Personal property taxes assessed against personal property where a bank or financial corporation is the lessor.

2. Tax Application. Tax applies to fair rental value for all periods during which the mobile transportation equipment is leased even though the lessee may not make the required rental payments.

Tax on fair rental value does not apply either (a) for periods during which the equipment is not leased and is merely held for lease; or (b), for periods after the lessor has formally demanded return of the equipment if the lessee wrongfully retains possession of the property and is not required to make rental payments under the lease.

(2) Measuring Fair Rental Value. The fair rental value for property other than mobile transportation equipment is the amount which normally is charged by the lender for the rental of similar property under similar circumstances. If the lender does not rent similar property, the rental rate which generally is charged by others in the area is to be used.

History—Effective July 1, 1939.

Adopted as of December 1, 1964, as a restatement of previous rulings.

Amended August 2, 1965, applicable on and after August 1, 1965.

Amended November 7, 1967, applicable on and after November 8, 1967.

Amended October 8, 1968, applicable on and after November 13, 1968.

Amended and renumbered November 3, 1969, effective December 5, 1969.

Amended October 6, 1970, effective October 9, 1970, applicable on and after September 2, 1970.

Amended December 15, 1971, applicable on and after January 1, 1972.

Amended February 16, 1972, effective March 25, 1972.

Amended June 24, 1976, effective July 30, 1976. Added reference and deleted areas duplicated by adopted Regulation 1669.5.

Amended December 7, 1978, effective January 28, 1979. Amends section (e)(1)(D) to provide that, with regard to leases of mobile transportation equipment held for resale, use tax liability may not be charged to the lessee as a separately stated tax.

Amended February 3, 1983, effective July 3, 1983. Deleted the last paragraph of Section (e)(1)(D) and inserted the language relating to the election to report and pay tax on fair rental value by dealers only prior to January 1, 1980 and all lessees of mobile transportation equipment on or after that date; defined "fair rental value"; and explains tax application. In subdivision (e)(2), inserted after "fair rental value" the language "for property other than mobile transportation equipment".

Amended May 9, 1985, effective September 22, 1985. In subdivision (e)(1)(D), added the definition of "fair rental value" in more specific terms and excluded from that term certain amounts paid by the lessee to the lessor which do not relate to the actual charge for the possession and use of the property by the lessee.

Amended May 1, 1991, effective July 17, 1991. Paragraph (e) was renumbered (f) and new paragraph (e) was added. Paragraphs (a), (c) and (f)(1)(A) were amended to replace the term "paid by him" with "reported". Renumbered paragraph (f) changed to delete dated information relating to leasing of mobile transportation equipment. Paragraphs (b), (c), and renumbered (f) amended to replace "salesmen" with "sales representatives". Paragraph (f)(1)(D)(3) was renumbered (f)(2).

Amended February 23, 2000, effective May 24, 2000. Added subdivision (f)(1)(D)1.g.

Regulation 1669.5. Demonstration, Display, and Use of Property Held for Resale—Vehicles.

Reference: Sections 6094, 6244, and 6403, Revenue and Taxation Code.

(a) Vehicle Dealers, Lessors, Manufacturers, and Distributors—In General.

(1) "Vehicle." Except as used in (a)(4), the term "vehicle" as used herein means passenger motor vehicles, as defined in Section 465 of the Vehicle Code, pickup trucks, and small vans.

(2) "Lessor." The term "lessor", as used herein, means only a lessor whose leases are continuing sales.

(3) Demonstration or Display. A purchaser of a vehicle under a resale certificate, who uses the vehicle solely for demonstration or display while holding it for sale in the regular course of business, is not required to pay tax on account of such use.

(4) Loans to Schools, Colleges, and Veterans' Institutions for Educational or Training Programs.

(A) The loan by any retailer of any tangible personal property to any school district for an educational program conducted by the district is exempt from the use tax.

(B) The loan by any retailer of any motor vehicle to the California State Universities or the University of California for exclusive use in an approved driver education teacher preparation certification program conducted by the state college or university is exempt from the use tax.

(C) The loan by any retailer of a motor vehicle to be used exclusively for driver training in an accredited private or parochial secondary school in a driver education and training program approved by the State Department of Education as a regularly conducted course of study is exempt from the use tax.

(D) The loan by any retailer of any motor vehicle to a veterans' hospital or such other nonprofit facility or institution to provide instruction in the operation of specially equipped motor vehicles to disabled veterans is exempt from the use tax.

(5) Donations of Vehicles. Operative January 1, 1989, vehicles withdrawn from resale inventory for donation to a qualified organization located in this state as described in paragraph (e) of Regulation 1669, (18 CCR 1669), are exempt from the use tax. For the period January 1, 1989 through October 1, 1989, this exemption is available only to retailers. Effective October 2, 1989, this exemption is available to all sellers.

(6) Personal or Business Use. Vehicles withdrawn from resale inventory for personal or business use are subject to use tax except as provided in paragraph (a)(5). If the vehicle is not frequently demonstrated or displayed while holding it for resale in conjunction with such business or personal use, the tax is measured by the purchase price of the vehicle.

(7) Vehicles Capitalized as Fixed Assets. Except for vehicles held for the purpose of leasing, vehicles which are capitalized in a fixed asset account and depreciated for income tax purposes are not held for sale in the regular course of business. Tax must be paid measured by the purchase price of such vehicles.

(8) Registration. If a vehicle manufacturer, distributor, dealer, or lessor registers a vehicle purchased for resale in a name other than that of the manufacturer, distributor, dealer, or lessor, while retaining title to the vehicle, the vehicle is not held for sale in the regular course of business, and the manufacturer, distributor, dealer, or lessor must pay use tax measured by his purchase price of the vehicle.

(9) Vehicles Used Both for Demonstration and Other Purposes. If vehicles purchased under a resale certificate are frequently demonstrated or displayed while being held for sale in the regular course of business, and are also used partly for other purposes, tax must be paid measured by the fair rental value of the vehicles for the periods of other use. Such interspersed demonstration or display and other use may occur when a dealer or lessor purchases vehicles without tax paid on the purchase price and uses them personally, or allows vehicle sales persons, vehicle sales managers, partners, corporate officers, or other persons to use them for purposes in addition to demonstration or display.

(10) Rental to Sales Persons for Demonstration. A dealer who rents vehicles which are not mobile transportation equipment to sales persons is regarded as making continuing sales of the vehicles and must collect and pay tax on the rental receipts, unless tax has been paid measured by the purchase price of the vehicles. However, if the rental receipts are less than 1/60th of the dealer's purchase price of the vehicle for each month of the rental, the transaction will not be considered a bona fide rental, and tax will be measured by 1/60th of the purchase price for each month of such use. For the application of tax to rentals of pickup trucks and other mobile transportation equipment, see Regulation 1661.

(11) Subsequent Retail Sales. The taxability of retail sales of vehicles is not affected by the fact that tax has been paid previously on the purchase price, rental receipts, or fair rental value because of the use or rental of the vehicles.

(12) Sales to Sales Persons for Demonstration. Tax applies to sales by dealers to their sales persons of vehicles to be used for demonstration and personal use.

(13) Presumptions. Any presumption established by this regulation may be rebutted only by clear and convincing evidence to the contrary. However, declarations after the fact are of little value as evidence because of their self-serving nature, and will be given little weight.

(b) New and Used Vehicle Dealers and Lessors—Specific Applications. The following provisions apply with respect to vehicles which are registered in the name of the dealer or lessor, and vehicles which are not registered. If vehicles are registered in the name of a person other than the dealer or lessor, see (a)(8) above.

(1) Types of Vehicles Not Ordinarily Sold. If a vehicle dealer or lessor purchases under a resale certificate a new vehicle of a type which he or she is not franchised to sell, or does not ordinarily sell or lease as a new vehicle, and uses the vehicle for any purpose other than, or in addition to, demonstration or display, it will be presumed that the vehicle is not being held for sale in the regular course of business and that tax is due measured by the purchase price of such vehicle.

(2) Vehicles Assigned to Vehicle Sales Personnel. When a vehicle dealer or lessor assigns a vehicle as a demonstrator to vehicle sales personnel for a period not exceeding 12 months, it will be presumed that such vehicles are frequently demonstrated or displayed, and that they are also used partly for other purposes. Under these circumstances, the measure of tax is the fair rental value of the vehicle for the periods of personal or business use which are interspersed with the demonstration or display. It will be further presumed that the fair rental value for such business and personal use is 1/60th of the purchase price of the vehicle for each month of combined demonstration or display and use. As used here, the term "sales personnel" is limited to vehicle sales persons and vehicle sales managers, and to sole proprietors, partners, or corporate officers who directly participate in negotiating sales.

(3) Vehicles Assigned to Others.

(A) When a vehicle dealer or lessor assigns a vehicle for a period not exceeding 12 months to employees or officers other than vehicle sales personnel, it will be presumed that such vehicles are frequently demonstrated or displayed, but less frequently than those assigned to vehicle sales personnel, and that they are also used for other purposes to a greater extent than those assigned to vehicle sales personnel. Under these circumstances, the measure of tax is the fair rental value of the vehicle for the periods of personal or business use which are interspersed with demonstration or display. It will be further presumed that the fair rental value for such business and personal use is 1/40th of the purchase price of the vehicle for each month of combined demonstration or display and use.

(B) When a vehicle dealer or lessor assigns a vehicle to persons other than employees or officers, such as relatives or business associates, it will be presumed that the vehicle is not frequently demonstrated or displayed. Tax must be paid measured by the purchase price of such vehicles.

(4) Vehicles Assigned for Extensive Periods of Time. It will be presumed that any vehicle assigned for more than 12 months to one or a series of persons for business or personal use in addition to demonstration or display is not held for sale in the regular course of business. Tax must be paid measured by the purchase price of such vehicles. If at the time the vehicle is assigned for such combined use the duration of the combined use is not known, the dealer or lessor may use either the 1/40th or 1/60th formula, as appropriate, to report use tax liability until the period of combined use exceeds 12 months. At that time he or she must report and pay tax on the difference between the purchase price of the vehicle and the measure of tax previously reported with respect to the vehicle under the formula.

(5) Unassigned Demonstrators. If no use is made of vehicles purchased under a resale certificate, other than demonstration or display while holding them for sale in the regular course of business, no tax liability arises. Such vehicles generally are not assigned to any individual. However, if such vehicles are registered in the name of the dealer, it will be presumed that they are used for other purposes in addition to demonstration or display. Under these circumstances, the measure of tax is the fair rental value of the vehicle for the periods of personal or business use which are interspersed with the demonstration or display. It will be further presumed that the fair rental value for such other use is 1/40th of the purchase price of the vehicle for each month of combined demonstration or display and use.

(6) Customer Loan Vehicles. If the use of a vehicle purchased under a resale certificate is limited to the loan, but not the rental, of the vehicle to customers while they are awaiting delivery of vehicles purchased or leased from the dealer, or while their vehicles are being repaired by the dealer, the measure of tax is the fair rental value of the vehicle for the duration of each loan so made. The fair rental value is the amount for which the dealer rents similar vehicles for similar periods to persons who are not customers awaiting delivery of vehicles purchased or leased from the dealer or being repaired by the dealer. If the dealer does not rent vehicles under such circumstances, the fair rental value is the amount for which other dealers in the area rent similar vehicles for similar periods to persons who are not customers awaiting delivery of vehicles purchased or leased from the other dealers or being repaired by the other dealers.

If a lessor loans a vehicle to a lessee while the lessee is awaiting delivery of the leased vehicle, or while the leased vehicle is being repaired, and the regular lease payments continue to accrue during the period of the loan, the regular lease payments will be considered to cover the use of the substitute loan vehicle. No additional tax beyond the tax measured by the regular lease payments will be due as a result of the loan.

(7) Other Loans of Vehicles. If a vehicle dealer or lessor removes a vehicle from resale inventory and loans it to persons other than those specified in (b)(6) above, and the vehicle is not frequently demonstrated or displayed, tax must be paid measured by the purchase price of the vehicle, unless the loan is of such short duration as to constitute only incidental use. If the loan constitutes only incidental use, preceded and followed by frequent demonstration or display, the measure of tax is the fair rental value of the vehicle for the period of such use as fair rental value is defined in (b)(6) above. A loan for a period of 30 days or less will be considered incidental use. Periods during which a vehicle is leased, pursuant to leases which constitute continuing sales, will be regarded as periods equivalent to periods of demonstration and display.

(c) Vehicle Manufacturers and Distributors—Specific Applications.

(1) Vehicles Assigned for Extensive Periods of Time. It will be presumed that any vehicle assigned for more than 12 months to one or a series of persons for business or personal use in addition to demonstration or display, or assigned for more than 12 months to "pool service", is not held for sale in the regular course of business. Tax must be paid by manufacturers measured by the purchase price of tangible personal property used to manufacture the vehicle, and tax must be paid by distributors measured by their purchase price of the vehicle.

(2) Vehicles Assigned for Limited Periods of Time. It will be presumed that any vehicle assigned to one or a series of employees or other persons for a period of time not exceeding 12 months in the aggregate is frequently demonstrated or displayed and that it is also used partly for other purposes. This same presumption will be made with respect to any vehicle registered in the name of the manufacturer or distributor, and any vehicle placed for a period of time not exceeding 12 months in a "pool" from which vehicles are assigned to various employees or loaned for short intervals to television studios, visiting dignitaries, automotive magazine editors, etc. Under these circumstances, the measure of tax is the fair rental value of the vehicle for the periods of personal or business use which are interspersed with the demonstration or display. It will be further presumed that the fair rental value for such personal or business use is 1/40th of the "net dealer price" of the vehicle for each month of such combined use. Since manufacturers' and distributors' sales personnel demonstrate vehicles less frequently than dealers' or lessors' sales personnel, no distinction is made in this presumption between sales personnel and others.

"Net dealer price" is the factory selling price to dealers, including optional extra cost equipment, before any discounts or rebates. It also includes federal excise tax, but it does not include destination, handling, and other charges.

Appendix

In determining 1/40th or 1/60th of the purchase price of vehicles, the following schedule may be used:

Purchase Price of Vehicle |

Median Cost |

1/40th |

1/60th |

|---|---|---|---|

$ 900 to $1,500 |

$1,200 |

$30 |

$20 |

1,500 to 2,100 |

1,800 |

45 |

30 |

2,100 to 2,700 |

2,400 |

60 |

40 |

2,700 to 3,300 |

3,000 |

75 |

50 |

3,300 to 3,900 |

3,600 |

90 |

60 |

3,900 to 4,500 |

4,200 |

105 |

70 |

4,500 to 5,100 |

4,800 |

120 |

80 |

5,100 to 5,700 |

5,400 |

135 |

90 |

5,700 to 6,300 |

6,000 |

150 |

100 |

6,300 to 6,900 |

6,600 |

165 |

110 |

6,900 to 7,500 |

7,200 |

180 |

120 |

7,500 to 8,100 |

7,800 |

195 |

130 |

8,100 to 8,700 |

8,400 |

210 |

140 |

History—Adopted June 24, 1976, effective July 30, 1976.

Amended August 5, 1983, effective October 6, 1983. In subsection (a)(4)(B) changed "California State Colleges" to "California State Universities".

Amended May 1, 1991, effective July 19, 1991. Paragraphs (a)(5) through (a)(12) were renumbered to (a)(6) through (a)(13), and new paragraph (a)(5) was added. Reference to provisions of paragraph (a)(5) was added to new paragraph (a)(6). Reference to paragraph (a)(7) in paragraph (b) was corrected to new paragraph number (a)(8). Paragraph (d) was deleted. Paragraphs (a)(9), (a)(10), (a)(12), (b)(1), (b)(2), (b)(4) and (b)(6) were amended to replace the term "salesmen" with the term "sales persons".

Regulation 1670. Gifts, Marketing Aids, Premiums and Prizes.

Reference: Sections 6007–6009, and 6015, Revenue and Taxation Code.

Charitable Organizations, see Regulation 1570.

Exemption Certificates, see Regulation 1667.

"Free" meals, see Regulation 1603.

(a) Gifts. Persons who make gifts of property to others are the consumers of the property and the tax applies with respect to the sale of the property to such persons.

(b) Marketing Aids. The tax applies to sales of advertising material, display cases, counter display cards, racks, and other similar marketing aids to persons acquiring such property for use in selling other property to customers. A marketing aid is deemed to be "sold" if a consideration at least equivalent to 50 percent of the purchase price of the aid is obtained from the customer, either by the making of a separate charge or by increasing the regular sales price of other merchandise sold to the customer and delivered with the marketing aid.

Manufacturers or others who provide marketing aids to persons engaged in selling their products without obtaining reimbursement equivalent to 50 percent of the purchase price of the aid are deemed to be the consumers of the property provided. In such case the sales tax applies to the sale to or the use tax applies to the use by the manufacturer or other person purchasing the aid for distribution whether it is delivered directly to the person engaged in selling its product or is delivered to a distributor, wholesaler, or jobber for redelivery to such person with "deal merchandise." Distributors, wholesalers, or jobbers are the retailers of aids which they "sell" to persons engaged in marketing their products.

(c) Premium Delivered with Goods Sold. When a person delivers tangible personal property as a premium together with other merchandise sold, and the obtaining of the premium by the purchaser is certain and not dependent upon chance or skill, the transaction is a sale of both articles. Tax applies to the gross receipts received from the purchaser for the goods and the premium except when the premium is delivered along with a food product for human consumption or other exempt item. In such case tax applies to the gross receipts from the sale of the premium, which will be regarded as the cost of the premium to the retailer, in the absence of any evidence that the retailer is receiving a larger sum. If there is no such evidence, and if sales tax or use tax has been paid, measured by the sale price of the premiums to the retailer, no further tax is due.

(d) Prizes. The operator of a game who delivers a prize to each customer is regarded as the retailer of the merchandise delivered as prizes, and the tax applies to the operator's total gross receipts. The awarding of such prizes is not regarded as dependent upon chance or skill, inasmuch as the customer for each game played is certain to receive a prize. Similarly, the tax applies to the entire receipts from operators of "grab bag" concessions by which the customer always receives some tangible personal property. If the prize consists of a food product, the tax does not apply.

An operator who delivers both food items and nonfood items as prizes may take a deduction of that percentage of his total receipts which equals the percentage of the cost to him of the food items to the total cost to him of all merchandise purchased for delivery as prizes.

The operator of a game who awards property as a prize the winning of which depends upon chance or skill is the consumer of the property and tax applies with respect to the sale to or the use of the property by the operator.

History—Effective August 1, 1933.

Replacing Ruling No. 72, adopted as of January 1, 1945.

Amended January 8, 1947.

Amended and renumbered November 3, 1969, effective December 5, 1969.

Amended December 7, 1978, effective January 28, 1979. Amends subsection (c) to provide that no tax is due on premiums sold with a taxable commodity if sales or use tax has been paid measured by the sales price of the premiums; amends subsection (e) to delete the paragraph pertaining to sales tax reimbursement and excess tax reimbursement collected from customers on free meals.

Amended November 14, 1979, effective January 5, 1980. Added (b); changed former (b) to (c) and relettered remaining subsections.

Amended November 16, 1988, effective January 28, 1989. Paragraph (b), "Donations of Original Works of Art," has been deleted from Regulation 1670 and moved to Regulation 1586, "Public Works of Art."

Regulation 1671. Trading Stamps and Related Promotional Plans.

Reference: Sections 6006, 6011, and 6012, Revenue and Taxation Code.

(a) Introduction. A variety of sales promotion plans involving premiums are in use by retailers. Common to these plans are some indicia furnished by the retailer to his customers based on the amount of purchases. Examples of such indicia are trading stamps, coupons, tickets and cash register tapes. Given quantities of indicia are surrendered by the customer in exchange for the premium.

(b) Description of Plans. For the purposes of this regulation, these plans may be divided into three types, as follows:

(1) At or near the time of making the sale the retailer incurs expense with relation to the premium by paying a third party, which third party assumes the obligation to furnish the premium to the retailer's customer. The retailer's payment to the third party is not dependent on his customers' subsequently surrendering the indicia in exchange for the premium.

(2) The retailer incurs no expense with relation to the premium until such time as the customer obtains the premium. The retailer purchases the premium and delivers it to his customer in exchange for the required quantity of indicia.

(3) The retailer incurs no expense with relation to the premium until about the time the customer obtains the premium. A third party delivers the premium to the customer in exchange for the required quantity of indicia. The retailer pays the third party on an agreed basis related to premium merchandise delivered to the customer by the third party.

The typical trading stamp plan falls under (1) above. The typical cash register tape plan falls under (2) or (3) above.

(c) Cash Discounts Generally. Cash discounts allowed and taken on taxable retail sales may be excluded from the measure of the tax. The promotion plans described above constitute cash discounts. The cash discount is allowed by the retailer and taken by the customer at the time the retailer incurs the expense with relation to the premium.

(d) Plan Described in (b)(1).

(1) Cash Discount. The retailer is entitled to a cash discount deduction at the time he pays the third party who undertakes to redeem the indicia used in the plan. The amount of the cash discount shall be computed on the basis of the amount the retailer pays to the third party for the indicia. See paragraph (g) below for proration of cash discount where retailer's sales are not all taxable.

(2) Sale of Premium. The delivery of premium merchandise in exchange for a prescribed number of units of indicia used in this type of plan constitutes a taxable retail sale of the premium merchandise by the person delivering the merchandise (assuming that the premium merchandise is of a kind the retail sale of which is subject to tax). The selling price is the average amount paid to the third party by its customers for the indicia surrendered in exchange for the premiums.

(e) Plan Described in (b)(2).

(1) Cash Discount. The retailer incurs the expense with relation to the premium at the time he delivers the premium to his customer. The retailer is entitled to a cash discount deduction at the time he delivers the premium to his customer. The amount of the cash discount deduction shall be the selling price of the premium as determined by paragraph (e) (2) below. Since the cash discount relates to the previous sales on which indicia of some kind were issued to customers and which indicia are surrendered in exchange for the premium, the retailer is not entitled to the full cash discount deduction unless the previous sales on which indicia were issued were all taxable retail sales. Where some, but less than all, of such previous sales were taxable retail sales the retailer shall be allowed a portion of the cash discount as a deduction. See paragraph (g) below.

(2) Sale of Premium. The delivery of premium merchandise by the retailer to his customer in exchange for a prescribed number of units of indicia constitutes a taxable retail sale of the premium merchandise (assuming that the premium merchandise is of a kind the retail sale of which is subject to tax). The selling price is the sales price to the retailer of the premium merchandise.

(f) Plan Described in (b)(3).

(1) Cash Discount. If a third party delivers the premium to the customer and the retailer pays such third party on an agreed basis related to premium merchandise delivered to the customer by the third party, the retailer is entitled to a cash discount deduction for the reporting period in which he pays the third party. The amount of the cash discount is the amount of the payment to the third party.

If the retailer's sales are not all taxable retail sales, there must be a proration of the cash discount. See Paragraph (g) below.

(2) Sale of Premium. The delivery of premium merchandise by a third party to a retailer's customer in exchange for a prescribed number of units of indicia is a taxable retail sale (assuming the premium merchandise is of a kind the retail sale of which is subject to tax). The selling price is the amount received by the third party.

(g) Proration of Cash Discount Between Taxable and Exempt Transactions. If the retailer makes taxable sales and also engages in exempt transactions (for example, sales of food or services such as dry cleaning), and issues indicia on both taxable and exempt transactions, the cash discount must be prorated between taxable and exempt transactions and the cash discount deduction on his sales tax return may be taken only for cash discounts on taxable sales. In making tax returns, the retailer may use the following formula to determine the proration of cash discounts to taxable sales:

Taxable sales of the current reporting period on which indicia are issued divided by all transactions of the current reporting period on which indicia are issued.

If upon audit this formula is shown to produce an incorrect proration, an appropriate determination or refund will be made.

History—Adopted February 8, 1961.

Amended and renumbered August 5, 1969, effective September 6, 1969.

Amended December 7, 1978, effective February 18, 1979. Amends subsection (d)(2), (e)(2), and (f)(2) to delete language on excess tax reimbursement.

Regulation 1671.1. Discounts, Coupons, Rebates, and Other Incentives.

Reference: Sections 6011 and 6012, Revenue and Taxation Code.

Gifts, Marketing Aids, Premiums and Prizes, see Regulation 1670.

Trading Stamps and Related Promotional Plans, see Regulation 1671.

Receipts for Tax Paid to Retailers, see Regulation 1686.

Reimbursement for Sales Tax, see Regulation 1700.

(a) In General. Retailers often engage in marketing and sales programs in which they issue coupons or other indicia to their customers that entitle the customers to a reduction in the amount they are required to pay for products sold by the retailers. Manufacturers, vendors, and other third parties often engage in various programs that result in credits or payments made to retailers with respect to a retailer's taxable sale of products to an end-use customer. These payments and credits include, but are not limited to, purchase and cash discounts, coupon reimbursements, ad or rack allowances, buy-downs, scanbacks, voluntary price reductions and other incentives, promotions, and rebates. Under certain conditions, payments received by the retailer in the form of rebates or other types of payments or credits for products sold at retail are included in the retailer's gross receipts or sales price from the sale of the product.

(b) Discounts.

(1) Cash Discounts are offered by a retailer to its customer for prompt payment by that customer. If the customer makes prompt payment and takes the discount, the retailer's gross receipts are reduced by the amount of the discount. Cash discounts allowed and taken on sales are excluded from gross receipts. If, however, the customer does not make prompt payment, the retailer's gross receipts are the amount billed. Generally, discounts provided to customers utilizing a grocery store discount club card are regarded as cash discounts or retailer coupons.

(2) Purchase Discounts are given by a manufacturer and/or wholesaler to a vendor (i.e., a retailer) based upon the amount of prior or future purchases by that vendor. These discounts are regarded as trade discounts and are excluded from gross receipts as they are based on the number of products the retailer purchased from the manufacturer and/or wholesaler and not the number of products sold by the vendor at retail. Agreements wherein the retailer agrees to sell the products at a target price for a period of time are also "purchase discounts" and excluded from gross receipts when the discount is based on the number of products purchased by the vendor. The rebates received either directly from the manufacturer or from the wholesaler are not subject to tax since they are tied to the retailer's wholesale purchases of the products, not to the number of retail sales made at the target price.

(3) Ad or Rack Allowances are contractual agreements usually between a manufacturer and the retailer to advertise a product, or to give that product preferential shelf space. Ad or rack allowances are also known as "Local Pay," "Display Shelf Payments," or something similar. Such allowances are not related to the retail sale of the underlying product and are excluded from gross receipts. Generally, payments to a grocery store retailer pursuant to discounts offered through a grocery store discount club card are regarded as ad or rack allowances.

(4) Retailer Coupons are issued by a retailer in paper or paperless form. When presented to the retailer by the customer, they entitle the customer to buy tangible personal property at a certain amount or percentage off the advertised selling price. Although the coupons are presented to the retailer to receive a reduction in the selling price, retailer coupons do not result in compensation from a third party. If the customer has not paid any consideration for the coupon, e.g., a coupon clipped from a magazine or newspaper, the coupon represents a true price reduction resulting in a corresponding reduction in the retailer's gross receipts from the sale. If, however, the customer has previously given compensation to the retailer for the coupon, e.g., the coupon was purchased as part of a coupon booklet sold by the retailer to the customer, the pro rata share of the cost of the booklet represented by the purchase for which the coupon was given must be included in gross receipts.

(5) Manufacturer Coupons are paper or paperless coupons funded by the manufacturer that customers can utilize at the time of purchasing the manufacturer's product, thus entitling customers to a certain amount or percentage off the advertised selling price. These coupons are generally identified as "manufacturer coupons" and include retailer reimbursement terms that must be followed by retailers in order to redeem the coupons. Amounts paid by a manufacturer to a retailer to reimburse the retailer for the value of the manufacturer coupon are included in the retailer's gross receipts. The retailer may, by contract, charge the customer sales tax reimbursement on the amount paid by the manufacturer. When a retailer charges such reimbursement, the amount on which the reimbursement is charged is fully disclosed to the customer through the customer's utilization of the manufacturer coupon.

(c) Rebates and Incentives.

(1) Definitions. For purposes of this subdivision (c) only, the following definitions shall apply:

(A) "Discount" means a reduction in the amount of consideration the customer is required to provide in order to purchase the tangible personal property from a retailer as a result of third-party consideration promised to or received by the retailer.

(B) "Retailer's vendor" means a person who sells tangible personal property for resale directly to the retailer.

(C) Operative October 1, 2007, "third party" means a person other than the retailer or the retailer's customer, such as a manufacturer or retailer's vendor.

(2) Rebates Issued Directly to Customers. Manufacturers engage in promotional programs in which they offer product rebates directly to the retailer's customers following their purchase of the manufacturer's products. To receive the product rebate, customers are generally required to submit a rebate application form along with any required documentation (e.g., sales receipt) to the manufacturer or manufacturer's representative directly or through the retailer. Once the rebate form and required documents are processed and accepted, the manufacturer or the manufacturer's representative will issue the customer a rebate check. Rebates checks issued by manufacturers directly to the retailer's customers are not part of the retailer's gross receipts. In this situation, the customer pays the retailer the full selling price and receives a subsequent rebate directly from the manufacturer.