Laws, Regulations, and Annotations

Lawguide Search

Business Taxes Law Guide—Revision 2026

Sales And Use Tax Regulations

Title 18. Public Revenues

Division 2. California Department of Tax and Fee Administration — Business Taxes

Chapter 4. Sales and Use Tax

Article 6. Specific Businesses Engaged in Retailing

- 1565 Auctioneers

- 1566 Automobile Dealers and Sales Representatives

- 1566.1 Auto Auctions and Auto Dismantlers

- 1567 Banks and Insurance Companies

- 1568 Beer, Wine and Liquor Dealers

- 1569 Consignees and Lienors of Tangible Personal Property for Sale

- 1570 Charitable Organizations

- 1571 Florists

- 1572 Memorial Dealers

- 1573 Court Ordered Sales, Foreclosures and Repossessions

- 1574 Vending Machine Operators

- 1583 Modular Systems Furniture

Regulation 1565. Auctioneers.

Reference: Sections 6006.6 and 6015, Revenue and Taxation Code.

Persons engaged in the business of making retail sales at auction of tangible personal property owned by such person or others are retailers, and are, therefore, required to hold sellers' permits and pay tax measured by the gross receipts from such sales.

The amount upon which tax is computed includes the amount charged for merchandise returned by a customer at an auction sale, if the sale is made under an agreement or understanding at the time of sale that the property will not be delivered or that any amount paid will be returned to the bidder.

Sales tax does not apply, however, when an owner of property delivers it to an auctioneer for auction and bids in his own property at the auction.

History—Effective August 1, 1933 (first paragraph).

Effective September 11, 1957 (second paragraph).

Amended and renumbered August 5, 1969, effective September 6, 1969.

Regulation 1566. Automobile Dealers and Sales Representatives.

Reference: Sections 6011, 6012, 6012.3, 6015, 6092–6242, 6248, 6249, 6271–6294, and 6422.1, Revenue and Taxation Code; and Section 11713.21, Vehicle Code.

(a) Dealer Aid to Sales Representative. An automobile dealer, pursuant to Section 6015, is regarded as the retailer of tangible personal property sold by the dealer's sales representatives in their own behalf if the dealer aids the sales representatives in making such sales in either of the following ways:

(1) By reporting the sales representatives' sales on the dealer's report of sales to the Department of Motor Vehicles.

(2) By executing conditional sales agreements with respect to such sales representatives' sales in which the dealer appears as the seller.

Dealers who aid their sales representative by acting as guarantors on conditional sales agreements executed by the sales representatives or by requiring or permitting the sales representatives to use the dealer's showroom or other facilities in making such sales are not required to pay tax on the sale of the vehicles. The purchasers from these sales representatives, and from sales representatives making sales without dealer aid, must pay the use tax to the Department of Motor Vehicles.

(b) Resale Certificates from Nondealer Retailers. A dealer who is licensed or certificated pursuant to the California Vehicle Code and who sells a vehicle to a retailer who is not regularly engaged in selling or leasing vehicles should accept a resale certificate only if it contains a statement that the specific vehicle is being purchased for resale in the regular course of business.

Unless the person named as the purchaser on the resale certificate is also named on the dealer's report of sale and application for registration, either singly or jointly as registered owner, the sale will be regarded as a retail sale subject to sales tax, and the resale certificate will not be honored, whether or not it contains a statement that the specific vehicle is being purchased for resale in the regular course of business.

(c) Sales to Members of the Armed Services. A dealer (or manufacturer or dismantler) who is licensed or certificated pursuant to the California Vehicle Code must report and pay sales tax to the Board with respect to the sale of a vehicle in California to a member of the armed services regardless of the service member's place of residence. A dealer (or manufacturer or dismantler) so licensed or certificated who sells a vehicle outside of California to a member of the armed services for use in California must collect use tax from the service member and remit it to the Board unless the sale is made to a service member on active duty, prior to the effective date of discharge and the intention to use the vehicle in California results from official transfer orders to California and not from the service member's own independent determination. The service member will be considered to have made an independent determination to use the vehicle in California if the contract to purchase the vehicle is made after the service member receives official transfer orders to California or if at the time the contract to purchase the vehicle is made the service member arranges to take receipt of the vehicle in California.

(d) Out-of-state Purchases of Vehicles. Regarding the applicability of tax to the out-of-state purchase of a vehicle, see subdivision (b) of Regulation 1620 (18 CCR 1620).

(e) Contract Cancellation Options Required by Car Buyer's Bill of Rights.

(1) Contract Cancellation Option. On and after July 1, 2006, the terms "gross receipts" and "sales price" do not include the purchase price for a contract cancellation option agreement with respect to a contract to purchase a used vehicle with a purchase price of less than forty thousand dollars ($40,000), which a dealer is required to offer to a buyer pursuant to Vehicle Code section 11713.21. The purchase price for a contract cancellation option described in this paragraph shall not exceed:

(A) Seventy-five dollars ($75) for a vehicle with a cash price of five thousand dollars ($5,000) or less;

(B) One hundred fifty dollars ($150) for a vehicle with a cash price of more than five thousand dollars ($5,000), but not more than ten thousand dollars ($10,000);

(C) Two hundred fifty dollars ($250) for a vehicle with a cash price of more than ten thousand dollars ($10,000), but not more than thirty thousand dollars ($30,000); or

(D) One percent of the purchase price for a vehicle with a cash price of more than thirty thousand dollars ($30,000), but less than forty thousand dollars ($40,000).

(2) Restocking Fee. On and after July 1, 2006, the terms "gross receipts" and "sales price" do not include the dollar amount of a restocking fee the buyer must pay to the dealer to exercise the right to cancel a purchase of a used car under a contract cancellation option agreement pursuant to Vehicle Code section 11713.21 as described in paragraph (1) of this subdivision. The dollar amount of a restocking fee described in this paragraph shall not exceed:

(A) One hundred seventy-five dollars ($175) if the vehicle's cash price is five thousand dollars ($5,000) or less;

(B) Three hundred fifty dollars ($350) if the vehicle's cash price is more than five thousand dollars ($5,000), but less than ten thousand dollars ($10,000); or

(C) Five hundred dollars ($500) if the vehicle's cash price is ten thousand dollars ($10,000) or more.

(3) Amounts Refunded to Customers. On and after July 1, 2006, the terms "gross receipts" and "sales price" do not include that portion of the selling price for a used motor vehicle that is refunded to the buyer due to the buyer's exercise of the right to return the vehicle for a refund, which is contained in a contract cancellation option agreement pursuant to Vehicle Code section 11713.21 as described in paragraph (1) of this subdivision.

History—Adopted August 7, 1957, as restatement of previous ruling, effective September 11, 1957.

Amended September 18, 1963, effective as amended October 1, 1963.

Amended and renumbered August 22, 1969, effective September 24, 1969.

Amended August 5, 1970, effective October 1, 1970.

Amended November 16, 1977, effective December 25, 1977. Clarified taxable sales to service members and noted new interpretation of such sales effective January 1, 1977.

Amended December 14, 2004, effective March 18, 2005. Changed the word "salesmen" to "sales representatives" in the title and throughout the text. Changed the word "he" to "the dealer" and changed the word "his" to "the dealer's." Changed the word "board" to upper case throughout. Subdivision (c): Deleted the last two sentences. Subdivision (d): Deleted the phrase "—90-Day Test" from the title. Deleted the subdivision's language and added language referencing subdivision (b) of Regulation 1620.

Amended November 20, 2006, effective April 10, 2007. Added subdivision (e) to incorporate provisions of Revenue and Taxation Code section 6012.3 and Vehicle Code section 11713.21.

Regulation 1566.1. Auto Auctions and Auto Dismantlers.

Reference: Sections 6011, 6012, 6015, 6091, 6092, 6092.5, 6093, 6094.5, 6242, and 6243 Revenue and Taxation Code.

(a) Definitions.

(1) Qualified Person. A "qualified person" means a person making a sale at auction or a dismantler licensed under the Vehicle Code.

(2) Vehicle. "Vehicle" means:

(A) A mobilehome or commercial coach required to be registered annually under the Health and Safety Code.

(B) A vehicle required to be registered under the Vehicle Code or subject to identification under Division 16.5 (commencing with Section 38000) of the Vehicle Code.

(C) A vehicle that qualifies under the permanent trailer identification plate program pursuant to subdivision (a) of Section 5014.1 of the Vehicle Code.

(D) Any salvage certificate vehicle as defined in Section 11515 of the Vehicle Code.

(b) Presumption.

(1) It is presumed that a sale of a "vehicle" by a "qualified person" is a sale at retail and not a sale for resale.

(2) Rebutting the Presumption. To rebut the presumption, a "qualified person" may timely take in good faith a resale certificate in the form described in subdivision (c) from any of the following:

(A) A person that certifies it is licensed, registered, regulated, or certificated under the Health and Safety Code or the Vehicle Code as a dealer or dismantler.

(B) A person that certifies it is licensed, registered, regulated, or certificated under the Business and Professions Code as an automotive repair dealer, or is qualified as a scrap metal processor as described in the Vehicle Code.

(C) A person that certifies it is licensed, registered, regulated, certificated, or otherwise authorized by another state, country, or jurisdiction to do business as a dealer, dismantler, automotive repairer, or scrap metal processor.

(3) A "qualified person" shall not accept a resale certificate from any person except as provided in subdivision (b)(2).

(4) A certificate will be considered timely if it is taken at any time before the seller bills the purchaser for the property, or any time within the seller’s normal billing and payment cycle, or any time at or prior to delivery of the property to the purchaser. A resale certificate remains in effect until revoked in writing.

(5) In absence of evidence to the contrary, a seller will be presumed to have taken a resale certificate in good faith if the certificate contains the essential elements as described in subdivision (c)(1) and otherwise appears to be valid on its face.

(c) Form of Certificate.

(1) Any document, such as a letter or purchase order, timely provided by the purchaser to the seller will be regarded as a resale certificate with respect to the sale of the property described in the document if it contains all of the following essential elements:

(A) The signature of the purchaser, purchaser’s employee or authorized representative of the purchaser.

(B) The name and address of the purchaser.

(C) The number of the seller’s permit held by the purchaser. If the purchaser is not required to hold a permit because the purchaser makes no sales in this State, the purchaser must include on the certificate the reason the purchaser is not required to hold a California seller’s permit in lieu of a seller's permit number.

(D) A statement that the property described in the document is purchased for resale in the regular course of business. The document must contain the phrase "for resale." The use of phrases such as "non-taxable," "exempt," or similar terminology is not acceptable. The property to be purchased under the certificate must be described either by an itemized list of the particular property to be purchased for resale, or by a general description of the kind of property to be purchased for resale.

(E) A statement that the purchaser is licensed, registered, regulated, or certificated under the Health and Safety Code or the Vehicle Code as a dealer or dismantler; or is licensed, registered, regulated, or certificated under the Business and Professions Code as an automotive repair dealer; or is qualified as a scrap metal processor as described in the Vehicle Code; or is licensed, registered, regulated, certificated, or otherwise authorized by another state, country, or jurisdiction to do business as a dealer, dismantler, automotive repairer, or scrap metal processor. The purchaser shall include the license or registration number, as applicable. If the purchaser is regulated by another state, the certification should identify the state.

(F) Date of execution of document. (An otherwise valid resale certificate will not be considered invalid solely on the ground that it is undated.)

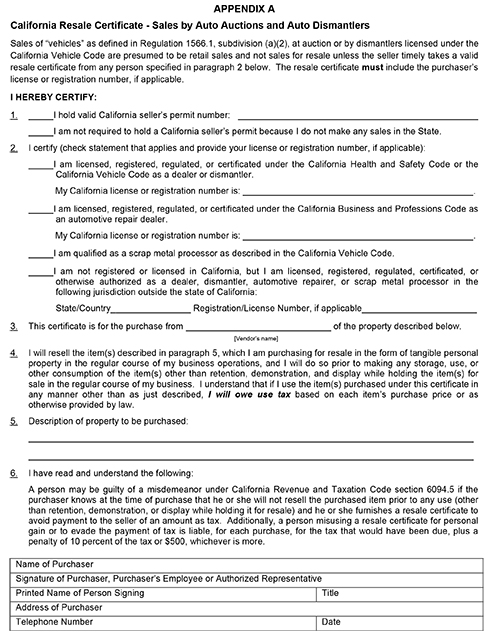

(2) A document containing the essential elements described in subdivision (c)(1) is the minimum form which will be regarded as a resale certificate. However, in order to preclude potential controversy, the seller should timely obtain from the purchaser a certificate substantially in the form shown in Appendix A of this regulation.

(d) Other Evidence to Rebut the Presumption that the Sale is at Retail. If the seller does not timely obtain a resale certificate in the form described in subdivision (c), the seller will be relieved of liability for the tax only where the seller shows through some alternative verifiable method that the property:

(1) Was in fact resold by the purchaser and was not stored, used, or otherwise consumed by the purchaser for any purpose other than retention, demonstration, or display while holding it for sale in the regular course of business, or

(2) Is being held for resale by the purchaser and has not been stored, used, or otherwise consumed by the purchaser for any purpose other than retention, demonstration, or display while holding it for sale in the regular course of business, or

(3) Was stored, used, or otherwise consumed by the purchaser and tax was reported directly to the Board by the purchaser on the purchaser's sales and use tax return, or

(4) Was stored, used, or otherwise consumed by the purchaser and tax was reported to the Department of Housing and Community Development, acting for and on behalf of the Board, at the time of making application for registration, or

(5) Was stored, used, or otherwise consumed by the purchaser and tax was reported to the Department of Motor Vehicles, acting for and on behalf of the Board, at the time of making application for registration or identification, or

(6) Was stored, used, or otherwise consumed by the purchaser and tax was paid to the Board by the purchaser pursuant to an assessment against or audit of the purchaser developed either on an actual basis or test basis.

(e) Purchaser’s Liability for Tax. A purchaser who issues a resale certificate containing the essential elements as described in subdivision (c) and that otherwise appears valid on its face, and who thereafter makes any storage, use, or other consumption of the property other than retention, demonstration, or display while holding it for sale in the regular course of business is liable for use tax on the cost of the property. The tax is due at the time the property is first stored, used, or otherwise consumed and must be reported and paid by the purchaser with the purchaser’s tax return for the period in which the property is first so stored, used, or otherwise consumed. A purchaser cannot retroactively rescind or revoke a resale certificate and thereby cause the transaction to be subject to sales tax rather than use tax.

A purchaser who issues a resale certificate for property which the purchaser knows at the time of purchase is not to be resold in the regular course of business is liable for the sales tax on that purchase measured by the gross receipts from the sale to that purchaser. The tax is due as of the time the property was sold to the purchaser and must be reported and paid by the purchaser with the purchaser's tax return for the period in which the property was sold to the purchaser.

History—Adopted August 13, 2013, effective January 1, 2014.

Regulation 1567. Banks and Insurance Companies.

Reference: Sections 6203 and 6352, Revenue and Taxation Code.

Mutual Life Insurance Co. v. City of Los Angeles (1990) 50 Cal.3d 402.

(a) Banks.

(1) Sales by Banks. Sales tax applies to the sale by banks, other than federally-chartered banks exempt from direct state taxation under federal law such as federal reserve banks and federal home loans banks, of tangible personal property sold at retail in this state.* Use tax applies to the storage, use, or other consumption in this state of tangible personal property purchased at retail from a bank for storage, use, or other consumption in this state, the sale of which is exempt from sales tax. Banks, whether or not exempt from direct state taxation, which are engaged in business in this state and making sales of tangible personal property the storage, use, or other consumption of which is subject to use tax, must collect the tax from the purchaser and pay the amount of tax to the board.

(2) Sales to Banks. Sales tax applies to the sale to banks, other than federally-chartered banks exempt from direct state taxation under federal law, of tangible personal property sold at retail in this state. Banks, other than federally-chartered banks exempt from direct state taxation under federal law, are required to pay use tax to the same extent and in the same manner as other persons storing, using, or otherwise consuming tangible personal property in this state. Retailers engaged in business in this state and making sales to banks of tangible personal property the storage, use, or other consumption of which is subject to use tax must collect the tax from the purchaser and pay the amount of the tax to the board.

(b) Insurance Companies.

Sales tax applies to retail sales in this state to insurance companies. Although sales tax does not apply to sales by insurance companies, they are required to collect use tax from consumers when making sales or leases of tangible personal property, and to pay the amount of the tax to the board to the same extent and in the same manner as other retailers selling or renting tangible personal property for storage, use, or other consumption in this state.

Use tax does not apply to the storage, use or other consumption in this state by insurance companies of tangible personal property.

History—Effective July 1, 1935.

Adopted as of January 1, 1945, as a restatement of previous rulings.

Amended September 2, 1965, applicable as amended August 1, 1965.

Amended and renumbered November 3, 1969, effective December 5, 1969.

Amended August 17, 1976, effective September 19, 1976. Deleted footnote and noted that sales to national banks are taxable, subject to noted exceptions.

Amended and added January 9, 1980, effective February 29, 1980. Added subsections and headings (a)(1), (a)(2), and (b), and footnotes (1) and (2) conforming to new legislation and operative dates.

Amended April 6, 1983, effective July 3, 1983. In subdivision (a)(1), inserted "whether or not exempt from direct state taxation, which are" and deleted "other than federally-chartered banks exempt from direct state taxation under federal law". In subdivision (a)(2), in first sentence inserted "other than federally-chartered banks exempt from direct state taxation under federal law," and deleted footnote 2.

Amended August 4, 1994, effective January 13, 1995. Deleted the phrase "used in the course of their insurance operations" from paragraph (b), effectively implementing the decision in the case of Mutual Life Ins. Co. v. City of Los Angeles (1990) 50 Cal.3d 402.

* Sales and use taxes imposed upon banks with respect to all income years, as defined in Revenue and Taxation Code Section 23042, beginning on and after January 1, 1980.

Regulation 1568. Beer, Wine and Liquor Dealers.

Reference: Section 6012, Revenue and Taxation Code.

Federal Areas, sales on, see Regulation 1616.

Federal Taxes Generally, see Regulation 1617.

The measure of tax with respect to retail sales of beer, wine and spirituous liquors is the entire amount charged therefore, inclusive of the amount of other State or federal taxes imposed with respect to the property.

History—Effective August 1, 1933.

Adopted as of January 1, 1945, as a restatement of previous rulings.

Amended and renumbered August 5, 1969, effective September 6, 1969.

Regulation 1569. Consignees and Lienors of Tangible Personal Property for Sale.

Reference: Section 6015, Revenue and Taxation Code.

Sales by court-appointed officers, see Regulation 1573.

A person who has possession of property owned by another, and also the power to cause title to that property to be transferred to a third person without any further action on the part of its owner, and who exercises such power, is a retailer when the party to whom title is transferred is a consumer. Tax applies to his gross receipts from such a sale.

Pawnbrokers, storage men, mechanics, artisans, or others selling the property to enforce a lien thereon, are retailers with respect to sales of the property to consumers and tax applies to the receipts from such sales.

History—Effective August 1, 1933.

Adopted as of January 1, 1945, as a restatement of previous rulings.

Amended and renumbered November 3, 1969, effective December 5, 1969.

Regulation 1570. Charitable Organizations.

Reference: Sections 6371, 6375, 6375.5, 6408, 6409, 23701d and 23701f, Revenue and Taxation Code.

(a) Definition. For purposes of this regulation, the term "charitable organization" means and includes any organization which meets all of the following conditions:

(1) The organization must be formed and operated for charitable purposes and must qualify for the "welfare exemption" from property taxation provided by section 214 of the Revenue and Taxation Code.

(2) The organization must be engaged in the relief of poverty and distress.

(3) The organization's sales or donations must be made principally as a matter of assistance to purchasers or donees in distressed financial condition.

(4) The property sold or donated must have been made, prepared, assembled or manufactured by the organization.

(A) The welfare exemption referred to in condition (1) is available to property owned and operated by a charitable organization under certain conditions. Among them is the requirement that the property be used in the actual operation of a charitable activity. Property used merely to raise funds is not used in a charitable activity even though the funds will be devoted to a charitable purpose. An example of a retail location being engaged in a charitable activity is a store employing handicapped persons as store personnel which devotes its profits to the store operation and an associated closed workshop for the handicapped.

(B) In order to receive the sales tax exemption it is necessary for the organization to receive the welfare exemption on the retail location for which the seller's permit is held. The welfare exemption must be claimed annually with the county assessor on forms provided for this purpose. If the organization does not own the store premises, it must receive the welfare exemption on its personal property, i.e., furnishing and fixtures.

(C) Conditions (2) and (3) are fulfilled if the primary purpose of the organization is to relieve poverty and distress and to aid purchasers and donees by selling its property at reduced prices or donating its property so as to be of real assistance to the purchasers and donees. Incidental sales to persons other than indigents will not preclude the organization from receiving the benefits of Revenue and Taxation Code section 6375.

(D) Condition (4) is fulfilled when the property is picked up at various locations and brought together (assembled) at one or more locations for purposes of sale or donation, even though nothing further remains to be done to the property to place it in saleable condition. Property is deemed "prepared" when it is made ready for sale or donation by such processes as cleaning, repairing, or reconditioning.

(b) Sales by Charitable Organizations. Sales by a charitable organization are exempt from the sales tax and the purchaser is exempt from the use tax provided all of the conditions of paragraph (a) above are met.

(c) Sales to Charitable Organizations.

(1) Effective January 1, 1990, neither the sales tax nor the use tax apply to tangible personal property purchased by a charitable organization for the purpose of donation by the organization provided all of the conditions of paragraph (a) above are met. Tax applies, however, to sales to the organization of supplies such as tools and office supplies and other articles not otherwise exempt.

(2) Except as provided in (c)(3), tax does not apply to the gross receipts from the sale of, and the storage, use, or other consumption in this state of new children's clothing that is sold to a nonprofit organization for its distribution without charge to elementary schoolchildren. For purposes of this subdivision, "nonprofit organization" means an organization that meets all of the following requirements:

(A) Is organized and operated for charitable purposes.

(B) Has exempt status under Revenue and Taxation Code section 23701d.

(C) Is engaged in the relief of poverty and distress.

(D) Distributes new children's clothing principally as a matter of assistance to recipients in distressed financial conditions.

(3) From January 1, 2008, through December 31, 2013, tax does not apply to the gross receipts from the sale of, and the storage, use, or other consumption in this state of new children's clothing that is sold to a nonprofit organization for its distribution without charge to individuals under 18 years of age. For purposes of this subdivision, "nonprofit organization" means an organization which meets all of the following criteria:

(A) Is organized and operated for charitable purposes.

(B) Has exempt status under Revenue and Taxation Code section 23701d or 23701f.

(C) Furnishes new children's clothing principally as a matter of assistance to recipients in distressed financial conditions.

(4) Any seller claiming an exemption from the sales tax for property sold to a charitable organization for subsequent donation may obtain from the organization and retain an exemption certificate in accordance with the requirements of Section 1667, Title 18, California Code of Regulations (Regulation 1667, "Exemption Certificates").

(d) Seller's Permits Required. Organizations qualifying for exemption under Section 6375 are retailers and are required to hold seller's permits even though all of their sales are exempt from tax.

(e) Medical Health Information Literature. Use tax does not apply to the storage, use, or other consumption in this state of medical health information literature purchased by any organization formed and operated for charitable purposes which qualifies for the exemption provided by section 214, the "welfare exemption," which is engaged in the dissemination of medical health information; provided that such purchases are made from a national office, or another branch of that national office, of the same organization.

(f) Health and Safety Materials. Use tax does not apply to the storage, use, or other consumption in this state of health and safety educational materials and insignia routinely sold in connection with health and safety and first aid classes, purchased or sold by any national organization formed and operated for charitable purposes which qualifies for the exemption provided by section 214, the "welfare exemption," which is engaged in the dissemination of health and safety information; provided that such purchases are made from a national office or another branch or chapter of such office of the same organization.

(g) Medical Identification Tags. Tax does not apply to the sale of, or the storage, use, or other consumption of, medical identification tags furnished by an organization exempt from taxes under Revenue and Taxation Code section 23701. The term "medical identification tags" includes any tag worn by a person for the purpose of alerting other persons that the wearer of such tag has a medical disability or allergic reaction to certain treatments.

History—Effective September 18, 1959.

Amended and renumbered June 4, 1970, effective July 9, 1970.

Amended August 16, 1978, effective October 6, 1978. In (d) added medical health information literature; in (e) added health and safety materials.

Amended November 14, 1979, effective January 5, 1980. Added (f), (g), (h) and (i).

Amended June 25, 1981, effective November 1, 1981. In (f) deleted the termination date of the exemption.

Amended November 16, 1988, effective January 28, 1989. Paragraph (g), "Original Works of Art," and paragraph (h), "Property Purchased to Replace Destroyed Museum Property," have been deleted from Regulation 1570 and moved to new Regulation 1586, "Public Works of Art."

Amended May 1, 1990, effective July 13, 1990. Moved portion of the first paragraph of subdivision (a) relating to sales by charitable organizations to new subdivision (b) and added definition of "charitable organization" in subdivision (a), renumbered subdivision (b) as (c) and amended it to provide that sales to and purchases by charitable organizations for the purpose of donation are exempt. Renumbered subdivision (c) as (d) and deleted reference to Board form BT-719, "Certificate of Exemption - Charitable Organizations". Renumbered subdivisions (d), (e) and (f) as (e), (f), and (g), respectively.

Amended effective March 2, 1994, Subsection (c) was amended to add "Revenue and Taxation Code" before "Section 6375," subsection (f) was amended to add the word "charitable" after "operated for," subsection (g) was amended to delete the word "alert" from "medical alert tags" and add the word "identification" i.e. "medical identification tags."

Amended February 1, 2008, effective April 10, 2008. Renumbered subsection (c)(2) as (c)(4), and added new subsections (c)(2) and (c)(3) to incorporate statutory provisions regarding an exemption for sales of new children's clothing to certain nonprofit organizations for distribution without charge.

Amended effective December 27, 2011. Subdivision (a)(4)(B) was amended to delete the reference to "inventory" in the example of personal property to incorporate statutory provisions which provide an exemption from property tax for business inventories. Subdivision (a)(4)(B) was also amended to delete the reference to the specific due date for claiming the welfare exemption.

Regulation 1571. Florists.

Reference: Section 6012, Revenue and Taxation Code.

(a) Definition. For purposes of this regulation, the term "florist" means a retailer who conducts transactions for the delivery of flowers, wreaths, etc., through a florist delivery association utilizing telephonic, electronic, or other means for the transmission of orders, except that the term "florist" shall not include any retailer who does not fulfill other florists' orders for the delivery of flowers, wreaths, etc.

(b) Application of Tax.

(1) Tax applies to amounts charged by a florist to customers for the delivery of flowers, wreaths, etc., to points within California, even though the florist instructs another florist to make the delivery, but in such case tax does not apply to amounts received by the florist making the delivery.

(2) Tax applies to amounts charged by florists who receive orders for the delivery of flowers, wreaths, etc., to points outside this state and instruct florists outside this state to make the delivery.

(3) The measure of tax includes charges made for faxes or telephone calls whether or not the charges are separately stated. A "relay" or other service charge, made in addition to the charge for the fax or telephone call, must also be included in the measure of tax.

(4) Tax does not apply to amounts received by California florists who make deliveries in this state pursuant to instructions received from florists outside this state.

(5) When a retailer of flowers who is not a florist instructs a California florist to make a delivery of flowers, wreaths, etc. in California, tax does not apply to the amounts received by the florist making the delivery, nor shall the florist making the delivery be treated as a drop shipper within the meaning of Regulation 1706.

(6) When an out-of-state florist instructs a California retailer of flowers who is not a florist to make a delivery of flowers, wreaths, etc. in California, tax does not apply to amounts received by the retailer making the delivery, nor shall the retailer making the delivery be treated as a drop shipper within the meaning of Regulation 1706.

History—Originally effective August 1, 1933.

Adopted as of January 1, 1945, as a restatement of previous ruling.

Amended and renumbered January 5, 1971, effective February 18, 1971.

Amended February 1, 2007, effective April 29, 2007. Added subdivision (a), "Definition," and renumbered. In subdivision (b)(1), revised to incorporate gender-neutral language. In subdivision (b)(3), changed "telegrams" and "telegram" to "faxes" and "fax." Added subdivisions (b)(5) and (b)(6).

Regulation 1572. Memorial Dealers.

Reference: Sections 6006 and 6010–6012, Revenue and Taxation Code.

(a) Memorial Dealers as Retailers. Memorial dealers are retailers of the tombstones, markers, and other memorials sold by them, and the consumers of materials, such as cement, used in setting the memorial in the cemetery. The term memorial dealer includes cemeteries which sell memorials.

(b) Measure of Tax—Cemetery Installations by Memorial Dealers. When the memorial dealer agrees to furnish a memorial and to set it in the cemetery, the dealer must segregate on the invoice presented to his customer, and in his records, the fair retail selling price of the memorial from the charge for setting the memorial in the cemetery. Tax applies to the sale to the customer measured by the fair retail selling price of the memorial, including charges for cutting, shaping, polishing, or lettering the memorial, or for transporting the memorial to the cemetery. Tax does not apply to the charge for the labor of setting the memorial in the cemetery. Tax applies to the sale to or the use by the memorial dealer of the material consumed in the installation of the memorial.

(c) Cemeteries Constructing Foundations. When a cemetery constructs a foundation upon which a memorial dealer places a memorial the cemetery is the consumer of the materials furnished in the construction of the foundation and tax applies to the sale to or the use by it of the material consumed in constructing the foundation. This is the case, whether a cemetery collects charges for the foundation from the memorial dealer or directly from the customer of the memorial dealer.

(d) Segregation of Charges. If the memorial dealer or cemetery does not segregate the retail selling price of the memorials from the charges for installation of the memorials and the construction of the foundations, a segregation of these charges will be determined by the Board based on information available to it.

History—Effective August 1, 1933.

Adopted as of January 1, 1945, as a restatement of previous rulings.

Amended and renumbered August 5, 1969, effective September 6, 1969.

Amended February 28, 1978, effective March 30, 1978. Required separation of material and labor on bill.

Amended December 7, 1978, effective February 18, 1979. Subsection (d) was amended to delete language pertaining to excess tax reimbursement.

Regulation 1573. Court Ordered Sales, Foreclosures and Repossessions.

Reference: Sections 6006, 6015, and 6019, Revenue and Taxation Code.

(a) Sales Ordered by State Courts. Tax applies to the sale of tangible personal property by an officer of the court such as a sheriff, commissioner, assignee for the benefit of creditors, executor or administrator (including a bank), or other officer appointed by a court to make the sales if the officer is a retailer with respect to that sale.

Generally, an officer is a retailer if he makes three or more sales of tangible personal property for substantial amounts, or a substantial number of sales for relatively small amounts, in any period of 12 months in the conduct or liquidation of a single business or estate. Sales of vehicles required to be registered or subject to identification under the Vehicle Code or of vessels or aircraft are not counted in determining the number of sales for this purpose.

An officer is a retailer with respect to every sale of a vehicle required to be registered under the Vehicle Code or subject to identification under Division 16.5 of that code, of a vessel, or of an aircraft. This is true whether or not the officer makes a series of sales of other tangible personal property from the same business or estate. The purchaser of such a vehicle, vessel or aircraft is generally required to pay use tax.

(b) Foreclosure Sales. Tax does not apply to sales of tangible personal property at public auction pursuant to the provisions of a security agreement if the property is purchased by the secured party who sold the property to the debtor. Tax applies to other foreclosure sales and to other sales by the secured party or the debtor to the same extent as it applies to sales generally.

(c) Repossessions. Tax does not apply to a repossession of tangible personal property by a seller from a purchaser who has not completed his payments provided the purchaser does not receive an amount from the seller, including the cancellation of the unpaid balance, that is greater than his purchase price.

History—Effective August 1, 1933.

Adopted as of January 1, 1945, as a restatement of previous rulings.

Amended by renumbering November 3, 1971, effective December 3, 1971.

Amended May 15, 1974, effective June 16, 1974.

Regulation 1574. Vending Machine Operators.

Reference: Sections 6015, 6066–6068, 6353, 6359, 6359.4, 6359.45, 6363, 6364, and 6370, Revenue and Taxation Code.

Canteen Corporation v. State Board of Equalization (1985), 174 Cal. App. 3d 952.

Taxable Sales of Food Products, see Regulation 1603.

Parent-teacher associations as consumers, see Regulation 1597.

Nonreturnable containers, see Regulation 1589.

(a) General.

(1) Permits. Persons operating vending machines dispensing tangible personal property of a kind the gross receipts from the retail sale of which are subject to tax or dispensing food products at retail for more than 15 cents must obtain permits to engage in the business of selling tangible personal property. One permit is sufficient for all machines of one operator.

A statement in substantially the following form must be affixed upon each vending machine in a conspicuous place:

"This vending machine is operated by

Name of Operator_______________

Address of Operator_____________

who holds Permit No. ______ issued pursuant to the Sales and Use Tax Law."

(2) Records. Adequate and complete records must be kept by the operator showing the location or locations of each machine operated by him or her, the serial number thereof, purchases and inventories of merchandise bought for sale through all such machines, the prices charged by the operator, the gross receipts derived from the operation at each location, the receipts from exempt sales, and where applicable, the sales price to the operator of all tangible personal property of which the operator is the consumer, see subdivision (b). Records must be kept of the receipts derived from each machine at a location if differing kinds of merchandise are vended through separate machines at that location.

(3) Schedule Showing Allocation by County. If the machines are operated in more than one county, a schedule must be attached to the return showing the tax allocable to each county. If a person purchases property under a resale certificate and dispenses it through a vending machine under circumstances where the person is considered to be the consumer of the property, see subdivision (b), a schedule must be attached to the return showing the use tax due thereon allocable to each county.

(4) Sales to Operators Not Furnishing Resale Certificates. Persons making sales of tangible personal property of a kind the gross receipts from the retail sale of which are taxable, to operators of vending machines to be resold through such machines, must notify this board of the name and address of each operator who fails to furnish a valid resale certificate. In the event such persons fail to so notify the board, or desire to assume tax liability for the operations of particular vending machines, then, pursuant to Revenue and Taxation Code Section 6015, they are required to return the tax to the state, measured by the receipts from the retail sale of the property.

(b) Application of Tax.

(1) In General. Persons operating vending machines dispensing tangible personal property of a kind the gross receipts from the retail sale of which are subject to tax must report and pay to the state the tax upon gross receipts from all sales of such property made through such machines. Sales of tangible personal property through vending machines are presumed to be made on a tax-included basis. Gross receipts from retail sales of tangible personal property through the vending machines are total receipts less the amount of sales tax reimbursement included therein.

(A) Photocopies. Tax applies to the gross receipts from sales of photocopies through coin- or card-operated copy machines. However, library districts, municipal libraries, county libraries, or any vendor making sales pursuant to a contract with a library district, municipal library, or county library are consumers of photocopies sold at retail through a coin-or card-operated copy machine located at a library facility.

(B) Sales by Parent-Teacher Associations. Parent-teacher associations or equivalent associations under Regulation 1597(f) (18 CCR 1597 (f)), are consumers of tangible personal property dispensed through vending machines and are not required to hold seller's permits by reason of such activities.

(C) Sales by Nonprofit, Charitable, or Education Organizations. Nonprofit, charitable, or education organizations dispensing tangible personal property for 15 cents or less through a vending machine are the consumers of such property and are not required to hold a seller's permit by reason of such activities.

(D) Sales of Water. Sales of purified drinking water through vending machines where the water enters the machine through local supply lines and is dispensed into the customer's own containers are exempt from the tax under Revenue and Taxation Code Section 6353.

(2) Food Products.

(A) Effective January 1, 1986, tax applies to the gross receipts from the retail sale of food products, including candy and confectionery, dispensed through a vending machine at retail for more than 15 cents unless otherwise exempted as provided below. Since sales through vending machines are presumed to be made on a tax-included basis, total receipts from the taxable retail sale of food products through vending machines should be adjusted to compensate for the sales tax included therein. The term "food products" does not include carbonated beverages. A vending machine operator is a consumer of, and not a retailer of, food products, including candy and confectionery, dispensed through a vending machine at retail for 15 cents or less, effective January 1, 1986. Tax is measured by the sale price to the vending machine operator of such items unless otherwise exempt. If the property sold to the operator is an exempt food product or a nonreturnable container, no tax is payable regardless of the nature of the product when dispensed through the vending machine, and regardless of whether facilities for consumption are furnished at locations of the vending machines. For the purposes of this subdivision, the term "candy and confectionery" includes candy-coated gum products.

(B) Operative January 1, 1988, tax does not apply to the sales, and the vending machine operator is the consumer, of any food products, including candy and confectionery other than beverages or hot prepared food products, sold through a coin-operated bulk vending machine if the amount of each sale is twenty-five cents ($0.25) or less. For purposes of this regulation, "bulk vending machine" means a vending machine containing unsorted food products, including candy and confectionery, which, upon insertion of a coin, dispenses those products in approximately equal portions, at random, and without selection by the customer. For the purposes of this subdivision, the term "candy and confectionery" includes candy-coated gum products.

(C) Beginning January 1, 1988, a partial exemption from the tax is allowed any retailer who receives gross receipts through vending machines from the sale of cold food products, hot coffee, hot tea and hot chocolate which are subject to the tax. The following percentages of the gross receipts from the sales of such products are subject to the tax: 77% for the calendar year 1988, 55% for the calendar year 1989, and 33% thereafter. This partial exemption does not apply to sales of hot prepared food products (except hot coffee, hot tea and hot chocolate) and receipts from such sales may not be included in the computation of the exemption.

"Gross receipts from the sale of cold food products, hot coffee, hot tea and hot chocolate" represents total receipts after adjusting for sales tax included. Therefore, in order to determine taxable receipts, an adjustment must be made to compensate for sales tax included in total receipts. Following is an example of the computation using the 7¼ percent rate:

Total receipts from sales of cold food products, hot coffee, hot tea and hot chocolate through vending machines |

$10,000.00 |

Factor |

32.2289% |

Taxable receipts |

$3,222.89 |

Tax rate |

7.25% |

Tax included |

$233.66 |

Exempt receipts |

$6,543.45 |

Proof: $10,000 – 233.66 = $9,766.34

$9,766.34 × 33% = $3,222.89

Gross receipts from the sale of cold food products, hot coffee, hot tea and hot chocolate subject to the tax may be calculated for the year 1990 and forward using the following percentages for the tax rates indicated:

| TAX RATE | PERCENTAGE |

|---|---|

| 7.25% | 32.2289% |

| 7.375% | 32.2160% |

| 7.50% | 32.2030% |

| 7.625% | 32.1900% |

| 7.75% | 32.1771% |

| 7.875% | 32.1641% |

| 7.975% | 32.1538% |

| 8.00% | 32.1512% |

| 8.125% | 32.1383% |

| 8.25% | 32.1254% |

| 8.275% | 32.1228% |

| 8.375% | 32.1125% |

| 8.475% | 32.1022% |

| 8.50% | 32.0996% |

| 8.725% | 32.0765% |

| 8.75% | 32.0739% |

| 9.00% | 32.0482% |

| 9.25% | 32.0225% |

To compute the cold food factor for other tax rates the formula is as follows:

Cold food factor percentage = 100 divided by [3.0303 + tax rate (decimal form)]

Example: Cold food factor at 7.25% = 100 divided by (3.0303 +.0725) = 100 ÷ 3.1028 = 32.2289%

(D) Tax does not apply to sales of any food products, whether sold through a vending machine or otherwise, to students of a school by public or private schools, school districts, student organizations, or any blind person (as defined in Section 19153 of the Welfare and Institutions Code) operating a restaurant or vending stand in an educational institution under Article 5 (commencing with Section 19625) of Chapter 6 of Part 2 of Division 10 of the Welfare and Institutions Code.

(3) Definitions.

(A) Food Products. For the period July 15, 1991 through November 30, 1992, the term "food products" does not include snack foods (as defined in Regulation 1602 (18 CCR 1602), "Food Products"), nonmedicated gum, candy, and confectionery. Sales during this period of such items through vending machines are subject to the tax unless exempted under subdivisions (b)(1) and (b)(2) above.

(B) Nonprofit Organizations. Nonprofit organizations include any group, association, or corporation which is formed for charitable, religious, scientific, social, literary, educational, recreational, benevolent or any other purpose, provided that no part of the net earnings of such organization inures to the benefit of any member, shareholder, director, officer, or any person having a personal and private interest in the activities of the organization. Examples of this type of organization are museums, veterans organizations, youth sportsmanship organizations, clubs such as the Kiwanis Club, fraternal societies, orders or associations operating under the lodge system such as the Loyal Order of the Moose, and student organizations.

(C) Charitable Organizations. Charitable organizations include any group, association, or corporation created for or devoted to charitable purposes, the net earnings of which are used solely for charitable purposes such as the relief of poverty, the advancement of education, the advancement of religion, the promotion of health and the promotion of government. Examples of this type of organization are libraries, museums, hospitals, senior citizen community centers, thrift shops, and organizations such as the Salvation Army and Goodwill.

(D) Education Organizations. Education organizations include any profit or nonprofit group, association, or corporation which normally maintains a regular faculty and curriculum and normally has a regularly enrolled body of pupils or students in attendance at the place where its education activities are regularly carried on. Examples of such organizations are primary and secondary schools, colleges, professional and trade schools, whether public, private, nonprofit or profit making.

(4) Resale and Exemption Certificates.

(A) Vendors of Items for 15 Cents or Less Only. A purchaser who sells the property purchased only through vending machines for 15 cents or less may give an exemption certificate with respect to the purchase of nonreturnable containers, but may not give a resale certificate with respect to the purchase of any other property. The supplier is responsible for payment of sales tax on the gross receipts from the sales to the purchaser of property, the sale of which is subject to tax.

(B) Vendors of Items for 15 Cents or Less and Over 15 Cents. A purchaser who holds a valid seller's permit and who sells the property purchased only through vending machines both at prices of 15 cents or less and at prices of more than 15 cents may give a resale certificate with respect to the purchases of such property.

(C) Vendors Selling Both Through Vending Machines and Otherwise. A purchaser who holds a valid seller's permit and who sells the property purchased both through vending machines and other than through vending machines may give a resale certificate with respect to the purchases of such property.

(D) Vendors Not Segregating Purchases. A purchaser who does not wish to segregate the purchases of property which is sold through vending machines for 15 cents or less from purchases of like property which is otherwise sold, may reimburse his or her vendor for sales tax measured by the retail selling price of all such property provided the vendor is authorized to report and pay the tax to the state in the manner provided by Section 6015.

History—Effective May 1, 1940.

Adopted as of January 1, 1945, as a restatement of previous rulings.

Amended August 8, 1967.

Amended August 6, 1968.

Amended and renumbered December 10, 1969, effective January 11, 1970.

Amended December 15, 1971, applicable on and after December 15, 1971.

Amended February 16, 1972, effective March 25, 1972.

Amended July 31, 1974, effective September 6, 1974. Changed cold food taxable receipts factor due to increase in tax rate.

Amended September 19, 1975, effective October 26, 1975. Clarified tax on hot bakery goods, hot beverages and cold food products sold by schools and eliminated sections applicable to prior periods.

Amended December 7, 1977, effective January 19, 1978. In (a) (1) added alternate display method of vendor's name.

Amended October 18, 1978, effective December 17, 1978. Amends Sections (a), (a) (3)(A), (b), and (b)(1).

Amended December 7, 1978, effective February 18, 1979. Amends subsection (a)(1) to provide that sales through a vending machine will be considered tax included if there is an appropriate sign posted on the premises.

Amended December 7, 1978, effective February 18, 1979. Correction of error in (a).

Amended February 1, 1985, effective March 3, 1985. In (a) deleted "RULES" from title and the sentence following. In (a) (1) added "or dispensing food products"; deleted (2) and (3) and renumbered remaining subsections. Added new subsection (b) which includes former (b) (3) and (4). Added new subsection (c).

Amended June 26, 1985, effective September 22, 1985. In subdivision (b)(2) corrects reference to Welfare and Institutions Code by changing the word "Distribution" to "Institutions". Adds new subdivision (b)(3) entitled "Photocopies" which provides that any library district, municipal library, or county library, and any vendor making sales pursuant to a contract with those libraries, is a consumer rather than a retailer of photocopies which it sells at retail through a vending machine located at a library facility. Also, renumbers subdivisions (b)(3) and (b)(4) to read subdivisions (b)(4) and (b)(5) respectively. In renumbered subdivision (b)(5), provides that nonprofit, charitable, or education organizations, which includes libraries, are consumers of tangible personal property dispensed through vending machines for 15 cents or less.

Amended April 9, 1986, effective July 3, 1986. In subdivision (a)(1), amended definition of vending machine operators required to obtain a seller's permit. In subdivision (b)(2), amended definition of vending machine operator's gross receipts. Subdivision (b)(5), amended provisions relating to sales of property through vending machines by nonprofit, charitable, or educational organizations.

Amended April 8, 1987, effective July 1, 1987. In subdivision (b)(5)(C), (b)(5)(D) and (c)(2)(D), added reference to application of tax to certain nonreturnable containers.

Amended June 2, 1988, effective August 26, 1988. In subdivision (b)(2)(C), added provisions that provide for a partial exemption from tax the gross receipts from the sale of food products sold through vending machines. In subdivision (b)(2)(A), added provisions that exclude carbonated beverages from the definition of food products.

Amended July 28, 1993, effective November 13, 1993.

Added subdivision (b)(1)(D) to provide that sales of purified drinking water through vending machines into customer's own containers under certain conditions is exempt from tax; (b)(2)(A) and (b)(2)(B) amended to provide that candy and confectionery are not food products effective July 15, 1991. Sales of candy and confectionery through vending machines for 15 cents or less (or 25 cents or less if a bulk vending machine) will continue to be exempt from tax and clarified that candy-coated gum is considered candy; (b)(2)(C) amended to update the example and reflect current tax rate; added (b)(3)(A) to explain that the term "food products" does not include snack foods, candy, nonmedicated chewing gum and confectionery for the period July 15, 1991 to November 30, 1992.

Amended June 20, 2001, effective October 20, 2001. Subdivision (a)(1)—second, third, and fourth unnumbered paragraphs deleted. Subdivision (b)(1)—wording in second sentence replaced with "Sale of … basis." New third sentence added. Subdivision (b)(2)(A)—"If … (a)(1)" in second sentence of first paragraph replaced with "Since … basis;" "taxable" inserted after "total receipts from the;" phrase "which … dispensed" deleted; "should" substituted for "may" in second sentence; second paragraph deleted. Subdivision (b)(2)(C)—Third paragraph deleted; tax rate table updated.

Amended August 24, 2004, effective November 2, 2004. Subdivision (b)(1)(B)—deleted "(e)" after the word "Regulation 1597" and replaced it with "(f)" to correct referencing error.

Amended August 20, 2008, effective September 24, 2008. In the table under subdivision (b)(2)(C), deleted tax rate percentages that no longer are relevant, and added relevant percentages.

Regulation 1583. Modular Systems Furniture.

Reference: Sections 6006, 6011, 6012, 6015, 6016, and 7053, Revenue and Taxation Code.

Modular systems furniture is tangible personal property, whether or not affixed to realty. A contract to sell and install modular systems furniture is a contract for the sale of tangible personal property and is not a construction contract. Persons who contract to sell and install modular systems furniture are retailers of the items which they sell and install, and tax applies to the entire contract price less those charges excludable from gross receipts or sales price pursuant to Sections 6011 and 6012 of the Revenue and Taxation Code. Retailers who claim a deduction for such charges should maintain complete and detailed records to support the amounts claimed. Such records should include, but not be limited to, a separate accounting of charges for installation labor, such as labor to affix, bolt, fasten, or hardwire panels to realty and labor to fasten or affix fully constructed components to fully constructed panel systems or other components. Charges for fabrication labor, such as labor to attach, assemble, connect, construct, or fabricate panel systems or components, labor to attach or connect one panel to another to form workstations or cubicles, and labor to construct or fabricate the individual panels, components, or accessories are subject to tax.

For contracts to sell and install modular systems entered into on or after October 1, 1999, ten percent (10%) of the total contract price, excluding charges attributable to freestanding desks, credenzas, lateral files, bookcases, worktables, returns, convergents, corner units, storage towers, chairs, footrests, and other property not attached to panels, other components, or realty, but including all other charges, will be presumed to be a charge for labor to install or apply the property sold. Retailers may claim the ten percent (10%) labor deduction in lieu of separately accounting for the actual installation charges incurred.

History—Promulgated September 1, 1999, effective December 3, 1999.