Online Payments – Frequently Asked Questions (FAQs)

What are online payments?

Online payments is a payment method that allows funds to be electronically withdrawn from your bank account using the bank routing number and account number.

Who can make online payments?

Any tax or fee payer who has a Sales and Use Tax, Prepayment of Sales Tax on Motor Vehicle Fuel Distributions, Special Taxes and Fees account, or Consumer Use Tax account can make a payment for current and past due taxes and fees.

Accounts required to pay by electronic funds transfer (EFT) may also use pay online to satisfy their EFT requirements.

Property Tax accounts are not currently eligible to make online payments.

Is there a fee for making online payments?

No. Making online payments is a free service that is convenient and secure method to make a payment.

If I file online, can I pay online?

Yes. You can pay amounts due on returns filed online by using online payments. If you did not pay at the time you filed your return or you need to make an additional payment, you can pay online.

I am exempt or not eligible to file online. Can I pay my taxes/fees due online and mail my paper return or prepayment form?

Yes. Accounts filing a paper form can also use online payments to pay the amounts due.

How do I make a payment?

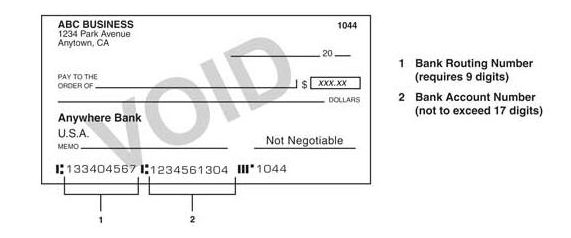

You will need to have your bank account information available (bank routing number, bank account number and type of account – checking or savings). Do not include your check number.

Can I make an online payment and have it held for a date in the future (Warehousing a payment)?

Yes. Payments may be held for any banking day you select up to 90 days in advance of the tax due date. However, you cannot select the current date as your debit date. The debit date is the date your payment transfers from your bank account to the state’s bank account. Please note the current date ends daily at 3:00 p.m. (Pacific time), Monday through Friday, except bank holidays.

Can I pay online if I have an ACH Debit block on my bank account?

Yes. However, if you have an ACH Debit block on your bank account, you must inform your financial institution of the CDTFA's Company Identification Numbers to avoid your payment from being rejected. The CDTFA Company Identification Numbers are 2822162215 and 1822162215.

I received a billing from the CDTFA. Can I pay online?

Yes. Delinquent tax or fee notices, Statements of Account, or Demand for Immediate Payment notices that include tax/fee, penalty and/or interest can be paid online.

Select the Payment Type "Billing". Include the Notice ID number from your bill to ensure proper application of your payment. Payments made for a billing will have an effective date of the day you submit your payment. See What will happen if I make my payment on a weekend or holiday below.

NOTE: If the Notice ID number is not entered, your payment will be applied according to CDTFA's standard rules for applying a payment.

Can I apply a payment toward an audit liability using online payments?

Yes. Audit liabilities that include tax/fee, penalty and/or interest can be paid online.

Select the Payment Type "Audit". Include the Notice ID number from your bill to ensure proper application of your payment. Payments made for an audit will have an effective date of the day you submit the payment. See What will happen if I make my payment on a weekend or holiday? below.

If I make an online payment once, do I have to make all tax/fee payments online?

No, unless you are required by law to remit payments through electronic funds transfer (EFT). You will have the option of paying online, paying by credit card, or paying by check with each return or prepayment. The ability to make an online payment has been established for your convenience. You may pay online one month, and by credit card or check the next month.

If you are required to remit payments through EFT and you use another means (check, cash, money order, credit card, etc.), you will be subject to a penalty.

Will my payment due dates remain the same?

Yes. There is no change in the current due dates of the return or prepayment.

If I make a payment for a return or prepayment, must I still mail the return or prepayment form?

Prepayments – No. Once you make a payment for the prepayment period, you do NOT need to send in a paper prepayment form nor do you need to file online the prepayment period. Your filing requirement for the prepayment period will be satisfied.

Prepayments made by electronic funds transfer (EFT) do not require paper prepayment forms.

For Hazardous Waste accounts only – the paper prepayment form must be mailed to satisfy your filing requirement.

Returns – Yes. The fact that a payment was made does not relieve you of the obligation to mail the form. If you do not file online or you are exempt from filing online, your paper return form must be postmarked on or before the due date to be considered timely.

Notes

- If your account has transitioned to online filing, no paper prepayment or return form is required. You can file and pay online. However, if you have not yet filed online or have additional payments to make, you may pay online.

-

There is a 10% penalty for a late return form even if the tax payment is timely. This applies if you are filing a yearly, fiscal yearly, monthly or quarterly tax/fee return – not the prepayment period. See exception below for Hazardous Waste prepayments.

Hazardous Waste accounts – There is a penalty of 10% of the amount of tax due for a late prepayment form even if the payment is timely.

Alcohol or IFTA accounts – There is a penalty of $50 or 10% of the amount of tax due, whichever is greater, for a late return even if the payment is timely.

When do I initiate my payment to ensure that it is timely for a return or prepayment?

You must submit your payment on or before the due date. If you initiate your payment on the due date, your transaction must be completed before 12:00 midnight (Pacific time) to be considered timely.

For electronic funds transfer (EFT) accounts, if you initiate your payment on the due date, your transaction must be completed before 3:00 p.m. (Pacific time) to be considered timely.

How long after I make my payment will CDTFA see the payment?

Immediately. See What will happen if I make my payment on a weekend or holiday? for additional information.

What will happen if I make my payment on a weekend or holiday?

If you make your payment on a weekend or holiday the effective date of the payment will be the current date.

For accounts participating in the Electronic Funds Transfer (EFT) program, return payments and prepayments submitted by 3:00 p.m. (Pacific time) will have a payment effective date as the current date unless it is a weekend or a non-banking day. Payments submitted after 3:00 p.m. (Pacific time), the effective date will change to the next banking day.

What if I submit my payment after the due date?

Payments submitted after the due date are subject to the same penalty and interest charges as late payments made by electronic funds transfer (EFT), check, cash, credit card, money order, etc.

How do I prove I initiated my payment on time?

When you submit your payment for processing, you will receive a confirmation number. This confirmation number, along with your CDTFA account number and payment amount, will be used to trace your payment. The date and time of your transaction is also displayed on the confirmation page.

Who do I call to verify that my payment has been received or if I need to cancel my payment?

You may contact our Customer Service Center at 1-800-400-7115 (CRS:711), Monday through Friday, 7:30 a.m. to 5:00 p.m. (Pacific time), excluding state holidays.

To cancel a payment, contact our Customer Service Center immediately. You must have your confirmation number in order to cancel your payment. Payments made online are processed frequently throughout the day. Once payments are processed, they cannot be canceled.

How do I claim a refund while making payments?

If you are making payments towards a Notice of Determination (billing) and believe you do not owe the amount due or believe you have been overcharged, you may file one single timely claim for refund (CDTFA-101, Claim for Refund) to cover all payments towards that billing, including payments made within the previous six months and all subsequent payments applied to that billing. If you are disputing more than one billing, you must file a timely claim for refund for each separate billing.

Prior to January 1, 2017, tax or fee payers were required to file a separate claim for refund for each installment payment in order to protect their right to obtain a refund.

For more information, see Publication 17, Appeals Procedures and Publication 117, Filing a Claim for Refund.

I am a licensed used vehicle dealer. How do I apply the payments I made to the California Department of Motor Vehicles (DMV) to my CDTFA sales tax return? (For filing periods ending 6/30/2025 and prior.)

Your payments will automatically be applied to your sales and use tax return when you submit schedule CDTFA-531-MV, Used Vehicle Dealers – Sales Report, along with your return. This schedule is used to report your taxable sales of used motor vehicles and the amount of sales tax paid (if any) to the DMV.

For more information, please see our Frequently Asked Questions for Used Vehicle Dealers.

If I paid sales tax to the DMV as a licensed used vehicle dealer, do I still need to pay the CDTFA? (For filing periods ending 6/30/2025 and prior.)

You still need to pay the CDTFA the sales tax due on any other types of taxable sales that you make during the reporting period. You will need to complete and file your sales and use tax return along with schedule CDTFA-531-MV, Used Vehicle Dealers – Sales Report to calculate the total amount of sales tax due and payable to the CDTFA. Any sales tax paid to the DMV will be subtracted from the total sales tax due upon completion of your return.

For more information, please see our Frequently Asked Questions for Used Vehicle Dealers.