Interest Calculation Tool Instructions

Interest Calculation Tool

Instructions

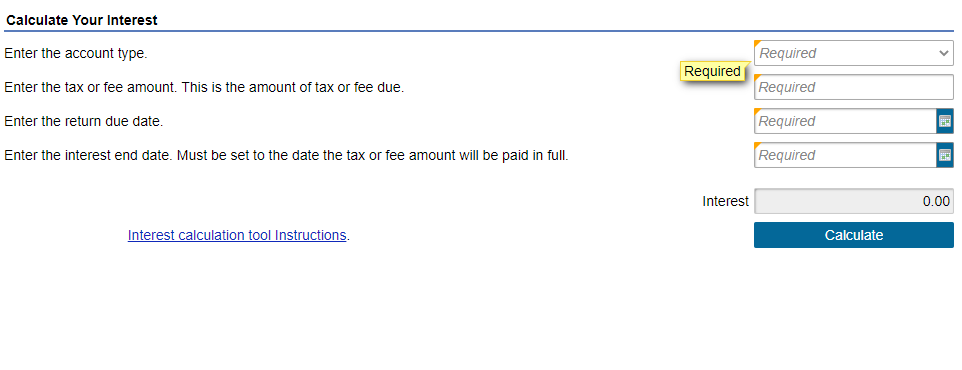

- Enter the Account Type. This is the type of permit/license associated with the account that interest will be calculated. Use the drop-down arrow to select the appropriate account type from the list provided.

- Enter the Tax or Fee Amount. This is the amount of tax or fee due. This amount should be entered as a whole number, do not enter dollar signs, periods, or commas. For example, for $300.00 enter “300”.

- Enter the Return or Payment Due Date. The due date may be entered directly in the field using MM/DD/YYYY format or click on the calendar icon to select the year, month, and day on the calendar that appears.

- Enter the Interest End Date. This is the date the tax or fee amount will be paid. The interest end date may be entered directly in the field using MM/DD/YYYY format or click on the calendar icon to select the year, month, and day on the calendar that appears.

- Click “Calculate” to calculate interest.

The results on this page are estimates based on the information provided. The actual interest due may be re-calculated and adjusted on your billing notice. Interest rates are subject to change in July and January each year.

The calculator will not work for the International Fuel Tax Agreement (IFTA) program.

Taxpayers requiring assistance are encouraged to contact our Customer Service Center at 1-800-400-7115 (CRS:711). Customer service representatives are available Monday through Friday from 7:30 a.m. to 5:00 p.m. (Pacific time), except state holidays.

TDD service for the hearing impaired:

From TDD phones: 1-800-735-2929

From voice phones: 1-800-735-2922

Notes

- COVID: Taxpayers reporting $1,000,000 or more should not use the interest calculator to calculate interest for the months of March 2020 through June 2020. Monthly interest for these months can be calculated by multiplying the Tax or Fee Amount by the monthly interest factor (.00667). Example: $1,000,000*.00667 = $6,670 of interest due per month for the months of March 2020 through June 2020.