Sales and Use Tax Online Filing – Registration Help

Open All Close AllBusiness Owner

A business owner is an owner, co-owner, partner or corporate officer of a company. A business owner may be related to any of the following ownership types:

- Sole Proprietor

- Partner

- Husband or Wife in a Co-Ownership

- Registered Domestic Partner

- Beneficiary (Unincorporated Business Organization Only)

- Trustee (Unincorporated Business Organization Only)

- General Partner (Limited Partnership & Limited Liability Partnership)

- President

- Vice President

- Secretary

- Treasurer

- Executor/Executrix

- Receiver

- Trustee

- Manager (Limited Liability Company Only)

- Member (Limited Liability Company Only)

Authorized User

Registration Information Required for an Authorized User

- Relationship to the account

- Full Name

- Company Name

- Address

- City, State, Zip

- Telephone Number

Name

Enter your name as registered with the CDTFA. Do not enter the corporate, partnership, LLC or other business entity name in this field. If you are not an owner and are trying to register as an E-Client with the CDTFA, please call our customer service representatives at 800-400-7115, Monday through Friday, 7:30 a.m. to 5:00 p.m. Pacific time, excluding state holidays for assistance.

Corporate officers of businesses registered with the CDTFA prior to 1999 may encounter difficulty trying to register as an E-Client. Please contact your local office to determine if your account requires updated corporate officer information. You will be unable to register as an E-Client until your information is received and the CDTFA updates your account. Until then, you can use the Express Login option to e-file your sales and use tax returns and/or prepayments.

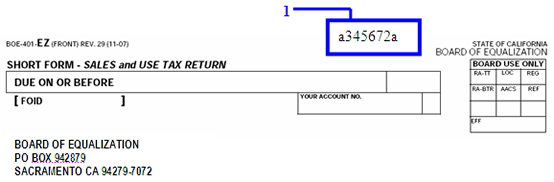

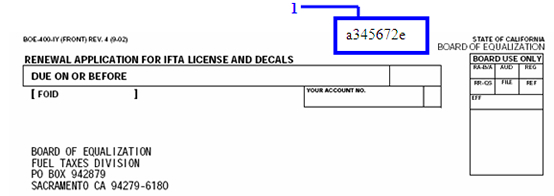

Express Login Code

The Express Login Code is a unique eight digit alphanumeric code. This code can be located or obtained from the following sources:

- Correspondence received from the CDTFA

- Contacting our customer service representatives at 800-400-7115, Monday through Friday, 7:30 a.m. to 5:00 p.m. Pacific time, excluding state holidays.

- The top of your return or form (See number 1 below)