California Use Tax For Personal Use

What items are subject to use tax

Generally, if the item would have been taxable if purchased from a California retailer, it is subject to use tax.

For example, purchases of clothing, appliances, toys, books, furniture, or CDs would be subject to use tax. Purchases not subject to use tax include food for human consumption such as peanut butter and chocolate. Electronically downloaded software, music, and games are not subject to tax if no tangible storage media is obtained. See Foreign Purchases for item(s) purchased in a foreign country and personally carried into this state.

How do I calculate what I owe?

Use the sales and use tax rate applicable to the place in California where the item is used, stored, or otherwise consumed and apply it to the total purchase price. For personal purchases, this is usually your home address. Include handling charges.

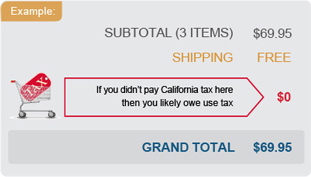

Example

- Question: I bought a stereo online for $200, including shipping, and had it sent to my home. But, I was not charged tax during the purchase. How much use tax do I owe?

- Answer: Find your local tax rate at the time of the purchase on this webpage. If your local rate is 8.0%, then you would owe $16 in use tax ($200 × .08 = $16).

Shipping charges are generally not taxable when items are shipped by common carrier or US Mail, the invoice separately states charges for shipping, and the charge is not higher than the actual cost for shipping.

How do I pay the tax due?1

Use tax is owed by April 15th the year after you make a purchase for which California tax was not charged. You can either pay once a year when you file your state income taxes, or make payments directly to the CDTFA after each purchase.

Option 1: Pay on Your State Income Tax Forms

On your California state income taxes, using forms 540 or 540 2EZ, simply put in the amount owed on the appropriate line for the entire year1.

You can save all of your receipts and report the exact amount you owe or follow the instructions included with your income tax return to use the Use Tax Lookup Table for nonbusiness items with a purchase price under $1,000.

Learn more about the lookup table.

Option 2: Make Payments Directly to the California Department of Tax and Fee Administration

You may report and pay your use tax when filing a return through our Online Services by selecting File a Return under the Express Login or Limited Access Functions, then selecting One-Time Use Tax and/or Lumber Return.

If you are late in paying your use tax, you may be eligible to pay a liability from a previous year and avoid late payment penalties under our In-State Voluntary Disclosure Program.

1 Purchases of vehicles, vessels, aircraft, and mobile homes, as well as purchases of cigarettes and tobacco products cannot be reported on your California state income tax return. If you hold a California consumer use tax account, you are required to report purchases subject to use tax directly to us and may not report the tax on your income tax return.

For More Information

If you have questions or would like additional information, you may call our Customer Service Center at 1-800-400-7115, or your local CDTFA office.