MOTOR FUELS FLAT (FLT) FILE and EDI FILING GUIDE

Getting Started

You must connect to the CDTFA website to submit your files and use a browser that supports 128 bit SSL. Usernames and passwords are required. A Secure Socket Layer (SSL) encrypted session will be established between you and the CDTFA when you log in. Your system must be configured to accept cookies. The CDTFA Online Services system requires a cookie as an element in maintaining the secure internet connection.

Log In Procedures

You must go to our Online Services login page and enter your Username and password.

Transmitting Data

For a FLT or an EDI file that contains a single account: After you have logged in to the Online Services Login page, on your Home page, follow these steps:

- Select File and/or View a Return button, then

- Select the account and period to file and select the Add button, then select the type of file (EDI or FLT) to be uploaded.

- If the file passes a basic syntax check, you will be required to verify the amounts included in the filing. You will be prompted to certify that the information contained in the file is true, correct, and complete by entering your name, title, and telephone number, and then selecting submit, and entering your login password. The Confirmation page displays the confirmation number, filer information, and total due. Links are included on the Confirmation page to make a payment, print the return, and exit the page.

For an EDI file that contains more than one account: After you have logged in to the Online Services Login page, on your Home page, follow these steps:

- Select Return Bulk File button, then

- Select EDI Motor Fuel Returns button, and select Add

- Select the type of file (EDI or FLT) to be submitted. If the file passes a basic syntax check, you will be required to verify the amounts included in the filing. You will be prompted to certify that the information contained in the file is true, correct, and complete by entering your name, title, and telephone number, and then selecting submit, and entering your login password. The Confirmation page displays the confirmation number, filer information, and total due. Links are included on the Confirmation page to make a payment, print the return, and exit the page.

The CDTFA will not accept the following data transmissions:

- Files of a type not identified in this document as approved for submission

- Data for multiple taxpayers in the same envelope

- Multiple report formats in the same envelope.

Other Functions

In addition to the File and/or View a Return option, the Home page provides the customer with several other options. Below is a sample of the available options.

Make a Payment - Allows you to make a payment.

Return Bulk File Allows you to upload EDI files that contain multiple accounts in one file

Return Bulk File then Validate Bulk File Allows you to validated the syntax of a filing before upload

Request Access to an Account Allows you to request access to another account

Request Power of Attorney Allows you to request Power of Attorney to another account

Contacts

File Transmissions:

If you have any questions regarding transmitting Motor Fuels FLT or EDI filings, please contact the eServices Coordinator between 8:00 a.m. and 5:00 p.m., (Pacific time), Monday through Friday except state holidays at:

You may submit written correspondence to the eServices Coordinator at the following address:

California Department of Tax and Fee Administration

eServices Coordinator, MIC:40

PO Box 942879

Sacramento, CA 94279-0040

Data Concerns/Questions:

If you have questions regarding data for motor fuels online filing, please call the Business Tax and Fee Division, Appeals and Data Analysis Branch, Data Analysis Unit between 8:00 a.m. and 5:00 p.m., Pacific time, Monday through Friday (excluding State holidays), at:

Phone: 1-800-400-7115 (TTY: 711); from the main menu, select the option "special taxes and fees." FAX: 1-916-445-6385

You may submit written correspondence to the Data Analysis Unit at the following address:

California Department of Tax and Fee Administration

Business Tax and Fee Division

Data Analysis Unit, MIC: 30

P.O. Box 942879 Sacramento, CA 94279-0030

Please include the tax program you are inquiring about and provide contact information, such as name, address, phone number, and email in your written inquiries.

General Questions

If you have any general questions, you may contact our Customer Service Center at 1-800-400-7115 (CRS:711), Monday through Friday, 7:30 a.m. to 5:00 p.m., (Pacific time), except state holidays.

Website Information

For additional information on motor fuels online filing, please visit the CDTFA website. On the CDTFA website, you can find the latest developments in tax-related news. Some of the topics and information available include:

- Motor Fuels Online Filing Page, including:

- FLT templates

- Online Filing Glossary

- Filing Frequently Asked Questions (FAQs)

- CDTFA Online Services Information

- Hot Topics

- News Releases

- Special Taxpayer Alerts

- Telephone Numbers and Addresses for Other Services

You can also obtain tax forms, publications, and other information online.

Guide Updates

The information contained in this guide is subject to change. If you are a filing participant in CDTFA motor fuels online filing, we recommend that you check our website for updates to this guide and the Motor Fuels Online Filing web page. Updates may include, but are not limited to:

- Changes to online filing rules or requirements

- Changes to motor fuel tax returns or reports

- New schedules

- New tax forms added to online filing

Assistance for Persons with Disabilities

Assistance for persons with hearing or speech impairments can be obtained by calling California Relay Service (CRS): 711, between 8:00 a.m. and 5:00 p.m., Pacific time, Monday through Friday (excluding State holidays).

Disclaimer

This guide summarizes the law and applicable regulations in effect when the document was written. However, changes in the law or in regulations may have occurred since that time. If there is a conflict between this guide and the law, decisions will be based on the law, and not this guide.

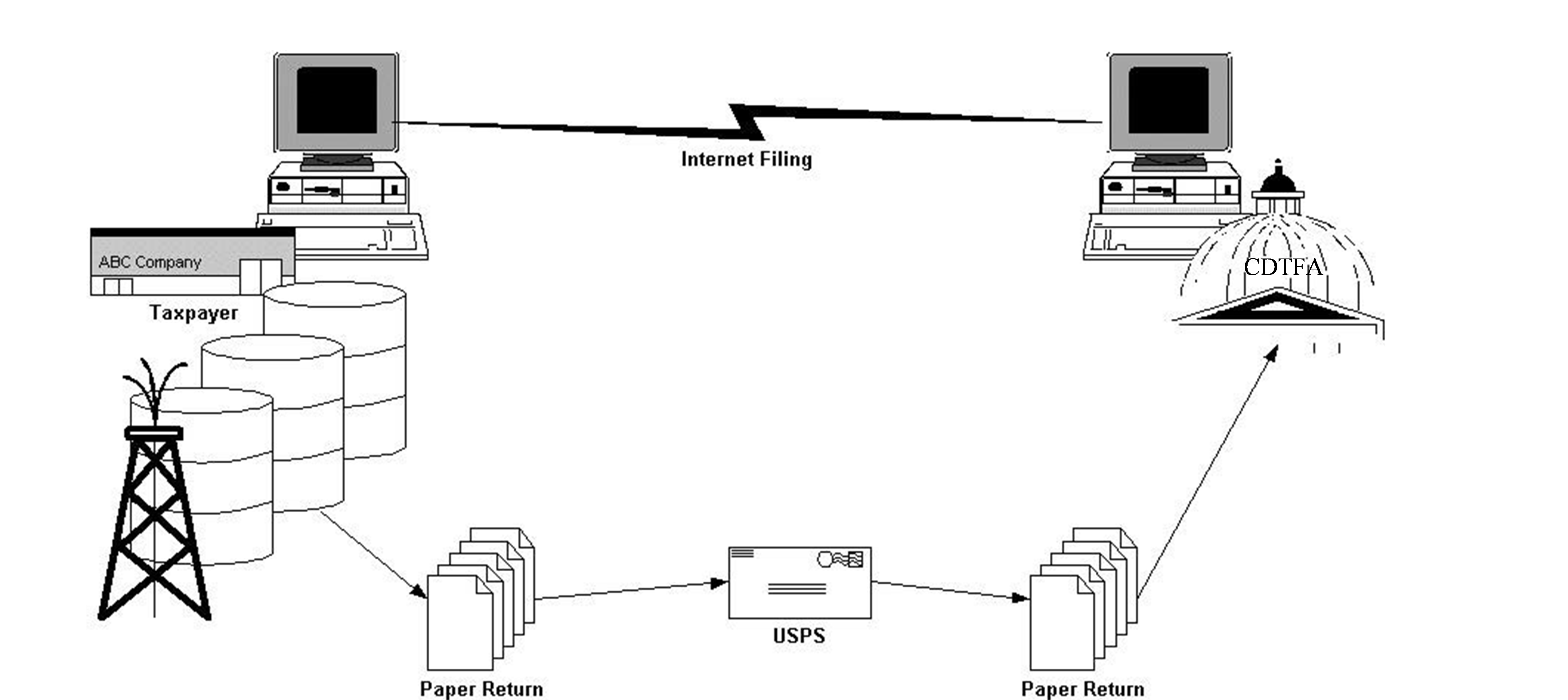

Illustration

Figure 1, below, illustrates the information flow from taxpayer to tax authority in both the paper and online processing environment. To effectively and efficiently process large volumes of information, both parties to the transaction need to eliminate paper processing by sharing information online. Online, both parties can communicate and resolve errors faster, thereby reducing overhead costs. Online processing can also reduce the possibility of interest and penalty charges as a result of more efficient and timely processing.

Information Flow Model

Figure 1 illustrates the information flow from taxpayer to tax authority in both the paper and online processing environment. To effectively and efficiently process large volumes of information, both parties to the transaction need to eliminate paper processing by sharing information online. Online, both parties can communicate and resolve errors faster, thereby reducing overhead costs. Online processing can also reduce the possibility of interest and penalty charges as a result of more efficient and timely processing.

Figure 1. Illustrates the path information flows from customer to Tax Authority

XML and Other File Format Standards

The CDTFA continues to be responsive to the reporting needs of our online filing participants. If there is a demand for mapping using XML or other emerging file formats, the CDTFA will work with its customers to develop reporting procedures.