Laws, Regulations, and Annotations

Lawguide Search

Business Taxes Law Guide—Revision 2026

Transactions and Use Tax Annotations

800.0000 Application of Transactions (Sales) Tax and Use Tax—Regulation 1823

- 800.0001 Applicable Rate—Terminated District Tax

- 800.0002 Binding—Fixed-Price Contracts

- 800.0003 Change Orders—Fixed-Price Contracts

- 800.0004 Deliveries Out of District and Use in District

- 800.0005 Delivery of Casket

- 800.0005.200 Delivery or Pick Up in a Tax District

- 800.0005.900 District Use Tax

- 800.0006 District Use Tax—Collections—Fleet Dealers

- 800.0008 District Use Tax—Leases of Construction Equipment

- 800.0009 Fixed Price Contract

- 800.0009.005 Fixed Price Contract

- 800.0009.250 Fixed Price Contract-Decrease in Tax Rate

- 800.0009.550 Fixed Price Contract—Nonenforcement

- 800.0009.750 Fixed Price Contract—Sales of Mobile Home for Occupancy as a Residency

- 800.0010 Fixed-Price Contracts

- 800.0012 Fixed Price Contracts—District Taxes

- 800.0014 Fixed Price Contracts—Option Contracts

- 800.0015 Fixed-Price Contract—Unconditional Right to Terminate

- 800.0020 Lease Contracts

- 800.0023 Lease of MTE Vehicles

- 800.0025 Local Transportation Authority Tax Ordinance

- 800.0027 Motor Vehicle Lease

- 800.0030 Offer to Purchase

- 800.0032 Property Obligated Under Lease Agreement

- 800.0033 Property Transshipped to Offshore Platforms

- 800.0035 Purchase of Airplane—District Use Tax

- 800.0040 Purchases of Fleet Vehicles by State Agencies

- 800.0048 Purchases Prior to Effective Date of Tax

- 800.0090 Storage of Property

- 800.0880 Refund of Illegally-Imposed District Tax

- 800.0900 Regular Deliveries into a Tax District

- 800.0920 Rental Equipment

- 800.0950 Sales Agents Operating in Districts

- 800.0956 Sales to Contractor—Installation Site in District

- 800.0958 Sales by Fueling Network

- 800.0960 Sale in Nondistrict Area with Shipment from a District Area

- 800.0980 Shipment Contracts

- 800.0981 Shipments of Warehoused Merchandise

- 800.1000 Subcontractors Located in Other Countries

- 800.1150 Tax Rate After Tax Credit Program Ends—SB 263

- 800.1350 Use Tax Allocation

- 800.1450 Validity of District Tax

- 800.1500 Vehicle

- 800.2150 Deliveries From Storage

800.0000 Application of Transactions (Sales) Tax and Use Tax—Regulation 1823

800.0001 Applicable Rate—Terminated District Tax. A dealer sold a vehicle for European delivery in February 1995 to a California customer from its dealership in California. The vehicle was picked up by the customer in Germany on March 14,1995, used in Germany for a short time, and then it was shipped to the dealership in California. The customer took possession of the vehicle in California on April 21,1995.

The district tax in effect on March 14,1995, terminated prior to the April 21, 1995, arrival of the vehicle in California. While the applicable rate generally is the rate in effect on the date of purchase, there can be no accrual of tax liability until the property is first stored or used in this state. The retailer should collect district use tax at the rate in effect when the vehicle is first used in the district, that is, upon its entry to the district. 8/14/95.

800.0002 Binding—Fixed-Price Contracts. The seller by accepting the consideration which the purchaser paid pursuant to the terms of the purchase order, created a binding contract which satisfies one of the criteria of a fixed-price contract. 10/4/90.

800.0003 Change Orders—Fixed-Price Contracts. Change orders are regarded as new contracts. If they are executed after the operative date of the ordinance, they are subject to the new tax rate. 10/4/90.

800.0004 Deliveries Out of District and Use in District. Normally, the retailer is entitled to assume that the place of use is the place where the purchaser resides. If the customer's business address is located outside a district, the retailer is entitled to assume that the tangible personal property is not purchased for use in a district. On the other hand, if a customer's address is within a district, under section 6247 a retailer engaged in business in that district must collect its use tax unless the retailer obtains a statement from the purchaser that the property was purchased for use outside the district. Regardless of where the customer's business address is located, if the retailer knows, or has reason to know, that the property will be used in a district, such as by the delivery address, the retailer must collect the use tax in effect in the district where the property is actually used if the retailer is engaged in business there.

As a result, when a retailer located in Sacramento County delivers chemicals to farmers or crop dusters located in a nontaxing district, the district tax will not apply. However, if the farmer or crop duster uses the chemicals on a farm located in the taxing district, the farmer or crop duster will be liable for the district use tax. 6/6/89; 6/10/03. (Am. 2004–1).

800.0005 Delivery of Casket. A mortician located in a county with one district tax delivers a casket and other tangible personal property to an adjoining county which has two district taxes. If the contract requires shipment to the adjoining county, the sale is not subject to the district sales tax in county where the sale occurred; however, since the casket will be used in the adjoining county, the district use tax is due for the two district taxes imposed there. If the mortician is "engaged in business" in the destination county he/she is required to collect the district use taxes imposed there.

If shipment is not required under the contract of sale, the district sales tax imposed in the county where the mortician's place of business is located and the sale is made. In this case, the district use taxes in the destination county also apply, but the customer is entitled to a claim a credit for the district tax paid to the county in which the mortician is located. 4/3/90.

800.0005.200 Delivery or Pick Up in a Tax District. If a contractor picks up construction materials which it purchases in tax district A, the district A sales tax applies. If a vendor located in tax district A delivers the property sold to a point outside the tax district, the district sales tax does not apply. If delivery is in tax district B, use tax applies and the vendor is required to collect the district use tax if it is engaged in business in district B. Otherwise, the buyer must report and pay the district B use tax. 4/25/95.

800.0005.900 District Use Tax. A person purchases property for use in several districts. The applicable district use tax is the district tax in which the property is first functionally used even though it is not principally used there. 5/15/92.

800.0006 District Use Tax—Collections—Fleet Dealers. The January 1, 1988 amendments to section 7262 did not change the incidence of use tax. Rather it merely expanded the collection responsibilities of the retailer when a vehicle was registered in a county which has a district tax. Accordingly, if a fleet of vehicles is registered to a firm located in a district, ordinarily the retailer is required to collect the district's use tax. However, if the vehicle is to be used in a county other than the county of registration, the district tax of the county of use is the applicable tax. If the dealer is engaged in business in the county of use, it would be required to collect the district tax for the county of use. If the dealer is not engaged in business in the county of use, the purchaser is responsible for the district use tax. 5/14/90.

800.0008 District Use Tax—Leases of Construction Equipment. A lessor, located in a county without a district tax, rents construction lift equipment on a short term basis, either daily, weekly or monthly. The lessor generally purchases the equipment tax paid and has it delivered to their place of business.

If within 90 days following the first lease of the equipment, any lessee uses such equipment in a county with a district tax, then that district's use tax will apply to the lessor's purchase price of the equipment provided that within the next six months the equipment is used in that district more than half the time. If one district's use tax applies, then no other districts use tax can apply. 4/2/90.

800.0009 Fixed Price Contract. A contract calling for "machinery $10,000 plus Missouri sales tax" is a fixed price contract if it contains no other provision regarding California sales and use tax. It would qualify for exemption from the district tax provided it met all of the other requirements for exemption. 3/22/91.

800.0009.005 Fixed Price Contract. When a lessee has agreed to pay "any applicable use tax," the contract is not for a fixed price. Rather, the amount of the lease receipts could be increased after the operative date of a districts transactions and use tax ordinance. This opinion is not altered by a contract having a handwritten notation "6%" above the word "applicable." In order for the lessor and lessee to avoid the increased tax rate, the word "applicable" would have to be lined out. 2/21/89.

800.0009.250 Fixed Price Contract-Decrease in Tax Rate. The Santa Cruz Earthquake Recovery Tax of .50 percent expired on March 31, 1997. On April 1, 1997, the new Santa Cruz County Public Library transactions and use tax of .25 percent commenced. Thus, on March 31, 1997, the combined sales and use tax rate in Santa Cruz was 8.25 percent and, on April 1, 1997, the rate was 8 percent. The question arises as to the proper tax rate due with respect to fixed-price contracts and leases entered into prior to April 1, 1997 which specify a tax rate of 8.25 percent. (The applicable tax rate to leases of mobile transportation equipment is set forth in Regulation 1661(b)(2)(B), the analysis below relates to all other transactions:)

The basic rule of the Sales and Use Tax Law and the Transactions and Use Tax Law is that the rate applicable to the sales or use of tangible personal property is the rate in effect when the taxable sale or taxable use occurs. The only exception to this rule is when there is an exemption from a tax rate increase (including a new district tax). There is nothing in the fixed-price contract exemptions provided by sections 7261(g) and 7262(f) which requires the payment of more tax than is due. Rather, these provisions are applicable only to provide an exemption and not to require payment of more tax than is due simply because the contract of sales (or leases) states that tax will be paid at a rate higher than is actually due when the transaction occurs.

An alternate argument is that the rate should be 7.75 percent on April 1, 1997 for persons with fixed-price contracts would be based on the theory that the fixed-price contract protects the parties from new tax commencing after the contract date even though the fixed-price in the contract specified a rate in excess of the proper total rate in effect April 1, 1997. The fixed-price contract exemptions were adopted to protect the expectations of the participants to a contract of sale or lease from a tax rate increase, not to provide them a windfall of paying less tax than has been specified in their contract of sale. When the contract qualifies as a fixed-price contract under section 7261(g) or 7262(f) because it specifies the tax rate in effect when the parties entered into the contract, the rate that applies is the lesser of the rate at the time the taxable transaction occurs or the amount of tax specified in the contract.

In this situation, the lesser of those rates is 8 percent, which is the correct rate applicable in Santa Cruz County on and after April 1, 1997, without regard to any fixed-price contracts that may specify a tax of 8.25 percent. 1/24/97.

800.0009.550 Fixed Price Contract—Nonenforcement. The fact that a retailer may voluntarily choose not to enforce a fixed price contract does not preclude the section 6376.1 exemption. If the initial contract is binding and neither party may cancel, the subsequent voluntary action by the retailer not to enforce some contracts does not affect the exemption. 1/14/97.

800.0009.750 Fixed Price Contract—Sales of Mobile Home for Occupancy as a Residency. The taxpayer sold a mobile home to be used as a residence of the buyer. Under the provisions of sections 6012.8 and 6012.9, the applicable tax is a use tax on the taxpayer. If all of the other provisions of a fixed price contract under section 6376.1 are met, the fact that the taxpayer is a "retailer consumer" and may not charge tax reimbursement does not prevent the exemption from applying.

The taxpayer's cost worksheet shows the tax computed at the old rate and is passed on to the buyer at the old rate under the contract price. Since there was no provision in the contract which allows the taxpayer to increase the price of the mobile home due to the tax increase, the cost worksheet together with the contract/disclosure statement satisfies the requirement that the tax be fixed. 1/14/97.

800.0010 Fixed-Price Contracts. A sales contract is a "fixed-price" contract if it satisfies the following criteria:

(1) It is binding prior to the operative date of the ordinance establishing the tax.

(2) Neither party has an unconditional right to terminate the contract.

(3) The amount of tax or the tax rate is set forth in the contract. 10/4/90.

800.0012 Fixed Price Contracts—District Taxes. A contract for the purchase of light rail cars was entered into prior to the imposition of a new district tax. The contract which calls for payment of a lump sum amount for the rail cars, including a fixed amount for sales and use taxes, itemized at 6 percent, qualifies as a fixed price contract. As such, it is not subject to the imposition of a new district tax which became operative after the contract was signed. Regulation 1823 provides that if no party to the contract has the unconditional right to terminate the contract, then the sales of tangible personal property occurring after that date are not subject to the (new) district taxes.

However, the ¼% state earthquake tax increase, effective 12/1/89, had no comparable exemption for contracts other than fixed-price construction contracts and leases. Since the contract for the rail cars was neither a construction contract nor a lease, if the cars were delivered during 1990, before the expiration of the ¼% tax increase on 1/1/91, the applicable state tax rate was 6¼%. The tax was due and payable when the property was delivered from the seller to the buyer, regardless of when payment was due or is made. As such, the tax was required to have been reported and paid with the return for the period in which the sale occurred. 1/23/90.

800.0014 Fixed Price Contracts—Option Contracts. A contract that was entered into prior to the effective date of a transactions tax gives the purchaser an option to purchase additional units. The contract is not covered by a "grandfather clause" when the option is exercised after the effective date of the transaction tax. By exercising the option, the parties agree to buy and sell after the transaction tax effective date. Thus, the units purchased under the option are subject to the new transaction tax. 2/22/95.

800.0015 Fixed-Price Contract—Unconditional Right to Terminate. The following terms and conditions contained in a fully-executed sales contract are not the type of unconditional termination clauses which would disqualify it from being a fixed-price contract: "Seller may make changes only with the written consent of the purchaser and the purchaser may terminate the contract only upon full payment for goods already shipped or by payment of a reasonable amount for goods not shipped which the seller cannot recover from other sources." 10/4/90.

800.0020 Lease Contracts. Lessor entered into two types of leases of tangible personal property. The first type required the lessee to pay rent for a minimum of six months. Upon termination of the lease either by lapse of time or by exercise of an option to terminate after payment of six months' rent, the property would be offered for sale, and if the original value exceeded the sales price of the property plus accumulated depreciation reserve, the lessee agreed to pay such excess to the lessor. If the sales price of the property plus the accumulated reserve exceeded the original value of the property, the lessor agreed to pay the excess to the lessee. The lease further provided that the lessee agreed to pay "all taxes now or hereafter assessed of every kind of nature by whomsoever payable on or relating to the vehicle and the ownership, leasing, purchase, sale, use, and operation thereof. Any of these amounts paid for by the lessor shall be repaid by the lessee upon demand."

The lease is not "for an amount fixed by the lease prior to the operative date of the ordinance" because the lessee agreed to pay any taxes now or hereafter assessed and thus the amount of the rental could be increased after the operative date of the ordinance. This is the same construction placed on "fixed price" in section 6376 and in Bulletin 67-12.

After six monthly lease payments were made, the lessee had the option, upon notice, to terminate the lease. The rental adjustment described above would be made upon termination of the lease either by lapse of time or by reason of the exercise of the option to terminate given to the lessee. Since this adjustment is to be made regardless of whether the lease runs its full term or is earlier terminated by the lessee, this is not a condition for termination within the meaning of sections 7261 and 7262.

The second type of lease is for a straight 24-month period. The only right to terminate is given to the lessor conditioned upon default of the lessee. However, the terms of the lease provide that the lessee agrees to pay "all taxes of every kind and by whomsoever payable (other than Federal and State income taxes) on or relating to said vehicle and the ownership, leasing, purchasing, sale, use, or operation thereof."

For the reasons discussed with respect to a similar clause in the first type of lease, the second type of lease agreement cannot be said to be for "an amount fixed by a lease prior to the operative date of the ordinance." Accordingly, the district tax applies to the rentals from such leases. 3/31/70.

800.0023 Lease of MTE Vehicles. Where a vehicle is purchased ex-tax as mobile transportation equipment and a timely election is made to pay use tax measured by the fair rental value of the vehicles, the applicable tax rate is the rate in effect in the county in which the lease first commences. If the vehicle is delivered to the lessee for use in the lessee's county, the lease first commences in that county and the total use tax rate in effect in that county applies to the fair rental value, including any district use taxes. On the other hand, if the lessee takes delivery in the lessor's county, the lease first commences in the lessor's county and the total tax rate in effect in the lessor's county applies to the fair rental value, including any district use taxes, regardless of where the lessee later uses the vehicle. 8/6/85.

800.0025 Local Transportation Authority Tax Ordinances. Where two statutes are in apparent conflict, the statutes are to be harmonized if at all possible. However, specific statutes have control over general statutes. Thus, the provisions of the Public Utilities Code section 180204, which provides for an operative date of any transactions or use tax ordinance enacted under the Local Transportation Authority and Improvement Act on the first day of the first calendar quarter 120 days after the tax ordinance is adopted takes precedence over the 110 days called for in section 7265 of the Revenue and Taxation Code. 3/10/93.

800.0027 Motor Vehicle Leases. Under a motor vehicle lease, which is a continuing sale, the vehicle's registration address is the address of use. If this is in a district with a district tax, the district's tax is applicable to the rentals payable. If a lessee notifies the lessor in writing that the location at which the vehicle will be located is different from that shown on the registration, that written notification would be documentation indicating the district of use of the vehicle. However, that notification, if not accompanied by a change in the vehicle registration address, must include a valid explanation for this discrepancy in order to overcome the presumption that the registration address is the address of use. 7/3/91.

800.0030 Offer to Purchase. A taxpayer requested an opinion as to the sales tax rate applicable to purchases made in San Joaquin County. The problem arose with regard to contracts in which the order was placed prior to, and the goods were shipped after, the date a county-wide transactions and use tax was imposed. Does this contract come within the fixed-price contract exemption?

A contract is not binding until the seller accepts the buyer's offer to purchase. An offer to purchase may be accepted by any reasonable means. The normal method of accepting a purchase order offer is to ship the goods. In such contracts, the agreement is not binding until the date of shipment. The buyers acquires title to the goods when delivery is complete. If the order requires some specific mode of acceptance, then the contract would become binding on the date the seller negotiated the payment or issued the written acceptance. If this contract is not binding prior to the date this tax is revised, it is subject to the higher rate. 6/11/91.

800.0032 Property Obligated Under Lease Agreement. A box on a lease agreement above the signature lines includes a provision that states: "This is a noncancelable lease agreement for the term shown above." The agreement also provides for a specific amount of tax per month. The agreement is a fixed price lease agreement. Therefore, a newly enacted transactions and use tax would not apply to the lease payments. 10/24/89.

800.0033 Property Transshipped to Offshore Platforms. Property delivered to a customer's warehouse and subsequently shipped to an offshore platform is not subject to the district use tax. Regulation 1823 provides an exception to the application of use tax when it is limited to storing for subsequent use solely outside the district. 12/6/90.

800.0035 Purchase of Airplane—District Use Tax. An individual purchased an airplane located in a special taxing district. Although the purchaser subsequently re-registered the plane outside the district, the flight log disclosed that the airplane had been in the district 64.13% of the time, during the first six months after the initial flight. Since the airplane was in the district more than one half the time during the first six months, it must be presumed that the airplane was purchased for use in the district and that the district use tax applies. 4/26/91.

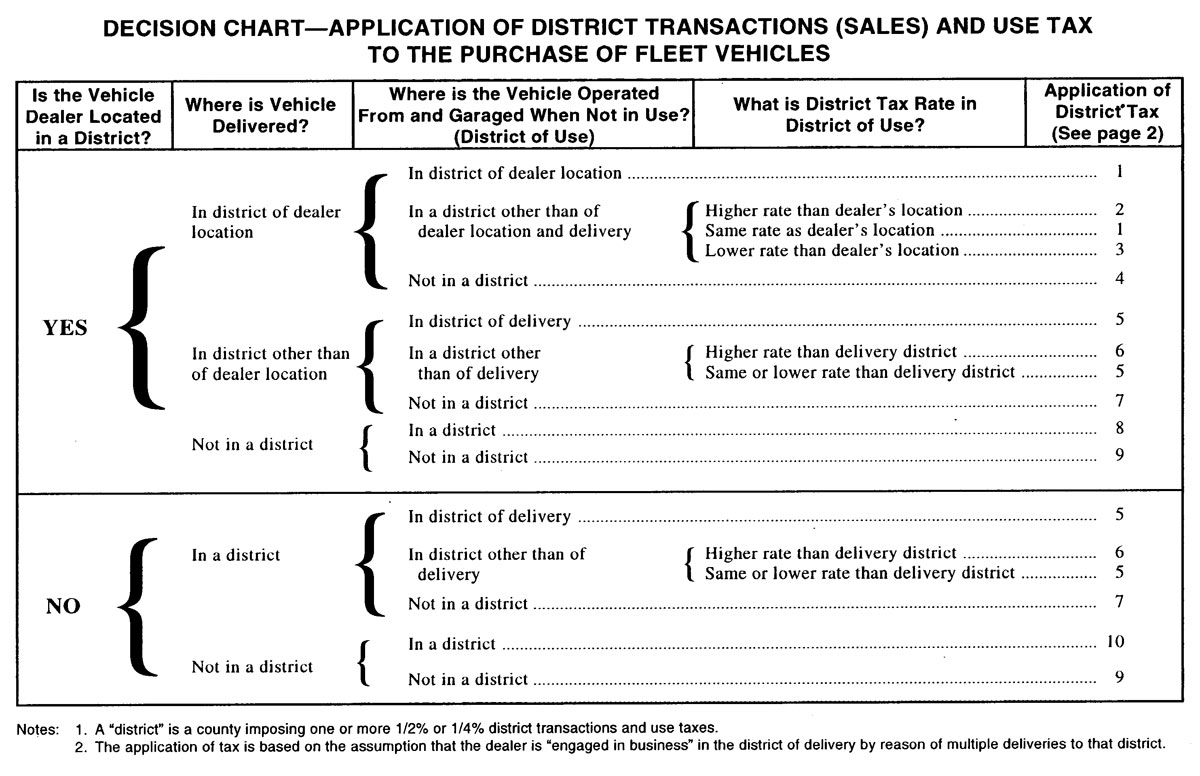

800.0040 Purchases of Fleet Vehicles by State Agencies. State agencies may purchase a vehicle in one location, register it to a second location (generally Sacramento), and operate it from a third. If a fleet vehicle purchaser buys a vehicle from a dealer located in a district and takes delivery there, then that district's transactions tax applies. On the other hand, merely registering in a district a vehicle purchased outside that district does not subject the purchase to that district's use tax. Regulation 1827(b)(3) does not deal specifically with situations involving fleet vehicles where the county of registration is not always the same as the county in which the vehicle is used. Thus, the location where the vehicle is delivered, where it is used, and where it is registered all affect the application of district tax.

The following decision table was developed to illustrate at least ten different applications of district tax that may occur in the above situation depending on the precise circumstances of the sale:

Decision Chart—Application of District Transactions (Sales) and Use Tax to the Purchase of Fleet Vehicles

KEY APPLICATION OF TAX

(1) Vehicle dealer is responsible for reporting the district sales tax for the district in which the dealer is located. The buyer has no reporting responsibilities.

(2) Vehicle dealer is responsible for reporting the district sales tax for the district in which the dealer is located. Also, if the buyer registers the vehicle in the district of use that has a higher rate, the dealer is responsible for reporting the additional district use tax for district of use. If the buyer does not register the vehicle in the district of use, the buyer is directly responsible for reporting the additional district use tax for the district of use.

(3) Vehicle dealer is responsible for reporting the district sales tax for the district in which the dealer is located, unless the buyer provides a declaration (copy attached) stating the vehicle will be used in the district with a lower rate, in which case the dealer is responsible for reporting the district use tax for the district of use. The buyer has no reporting responsibilities.

(4) Vehicle dealer is responsible for reporting the district sales tax for the district in which the dealer is located, unless the buyer provides a declaration (copy attached) stating the vehicle will not be used in any district, in which case the dealer is not responsible for reporting district tax. The buyer has no reporting responsibilities.

(5) Vehicle dealer is responsible for reporting the district use tax for the district of delivery. The buyer has no reporting responsibilities.

(6) Vehicle dealer is responsible for reporting the district use tax for the district in which the vehicle is delivered. Also, if the buyer registers the vehicle in the district of use that has a higher rate, the dealer is responsible for reporting the additional district use tax for the district of use. If the buyer does not register the vehicle in the district of use, the buyer is directly responsible for reporting the additional district use tax for the district of use.

(7) Vehicle dealer is responsible for reporting the district use tax for the district in which the vehicle is delivered. The buyer may submit a claim for refund for the total district use tax paid to the district of delivery.

(8) Vehicle dealer is not responsible for reporting district tax, unless buyer registers the vehicle in the district of use, in which case the dealer must report the district use tax for the district where the vehicle will be used. If the buyer does not register the vehicle in the district of use, the buyer is directly responsible for reporting the district use tax to the district where the vehicle will be used.

(9) Neither the buyer nor the seller have any district tax reporting responsibilities.

(10) The seller is not responsible for reporting the district use tax unless the vehicle is registered in the district where it will be used. If the vehicle is not registered in the district of use, the buyer is responsible for reporting district use tax to the district of use.

PLACE OF DELIVERY OF CERTAIN VEHICLES, AIRCRAFT AND UNDOCUMENTED VESSELS.

(2) For commercial vehicles:

DECLARATION (Commercial Vehicle)

I HEREBY CERTIFY THAT:

(1) The (here insert description of commercial vehicle, giving name of manufacturer and type) purchased from (insert name of seller) will be registered to the following address:

(2) The vehicle will be operated from the following address:

(3) The address from which the vehicle will be operated is outside the (name of district) District.

(4) When not in use, the vehicle will be kept or garaged at:

(5) The vehicle will be stored, used or otherwise consumed principally outside the (name of district) District.

(6) □ (a) The purchaser does not hold a California seller's permit.

□ (b) The purchaser holds California seller's permit No.

(Check applicable box.)

I understand that this declaration is for the purpose of allowing the above named seller to treat the sale of the above described tangible personal property as exempt from the transactions (sales) tax imposed by the (name of district) District. If the property is principally stored, used or otherwise consumed in that district, the purchaser shall be liable for and pay the use tax.

The foregoing declaration is made under penalty of perjury.

PURCHASER

TITLE

AUTHORIZED AGENT

DATE

800.0048 Purchases Prior to Effective Date of Tax. The effective date of the Sacramento County district tax was April 1, 1989. Property purchased before that date and stored in Yolo County is not subject to the district use tax when, after April 1, 1989, it is transported by the purchaser to a location in Sacramento County for use there. Regulation 1823(b)(1) provides that, under certain conditions, the district use tax may apply to property " … purchased from a retailer on or after the operative date of the district taxing ordinance." 3/30/89.

800.0090 Storage of Property. A not-for-profit hospital operates a large warehouse facility in which it maintains a stock on hand of general supplies that are used at its hospitals and administrative buildings. The warehouse is located in District A where the combined state, local, and district tax rate is 7.75%. The hospital and administrative buildings are located in District B where the combined state, local, and district tax rate is 8.25%.

The taxpayer's purchasing department, located in District A, places orders with various vendors. The orders are shipped to the warehouse in District A where they are received, counted, verified, and stocked. Ownership to the property vests with the taxpayer at its warehouse in District A. The taxpayer receives requests from internal departments and delivers the property in its own trucks to the hospital or administrative buildings in District B. The warehouse in District A and the internal departments in District B are not separate "persons" within the meaning of section 6005.

In this case, the transaction between the taxpayer and its vendors is completed when the goods are delivered to the warehouse with the state and Bradley-Burns sales and use tax consequences being set at that time. However, District taxes are another matter. The resolution of this issue turns on whether district transaction (sales) or district use tax applies to the transaction.

Section 6009.1 applies where the property has no functional purpose other than as a mere object in transit. The temporary storage of property under such condition is not a taxable use of the property. The same rule is incorporated into the District Tax Law. Thus, where an out-of-district (but in-state) retailer ships the property to the purchaser's warehouse in District A, where it is stored temporarily, and later transferred to District B and put to functional use, the transactions are subject to district use tax only in District B. The taxpayer must self-report the 1% District B tax for the quarter in which the property is delivered to District B, but is entitled to a credit for the ½% District A tax if it had paid such tax to the retailer.

However, if the property is delivered to the taxpayer from the retailer's place of business in District A, section 6009.1 does not apply since the applicable district tax would be a sales tax. As a result, District A's transactions tax applies to the sale. The retailer owes tax at the total rate in effect in District A and may collect tax reimbursement from the taxpayer at that rate. Again, the taxpayer must self-report the 1% District B tax for the quarter in which the property is delivered to District B, but is entitled to a credit for the ½% District A tax reimbursement it had paid to the retailer. If District A's rate were higher than B's, the taxpayer would not be entitled to a refund but also would not owe additional tax to District B. (Regulation 1823(b)(2)(B).) 10/11/95.

800.0880 Refund of Illegally-Imposed District Tax. Section 7276(b) provides that in the event that a district tax is declared unconstitutional, the Board shall administer any refunds in accordance with the guidelines set forth in sections 7275–7279.6 to the extent feasible and practical. In the case of claims filed for the San Francisco Educational Authority, it was neither feasible nor practical to apply the refund guidelines of these provisions. Therefore, the normal refund rules set forth in section 6901 and the three year statute of limitations provided by section 6902 apply to claims for such district taxes. 3/1/96.

800.0900 Regular Deliveries into a Tax District. A printer who regularly delivers printing to clients in a tax district for use in that district is required to collect the district use tax. 5/18/93.

800.0920 Rental Equipment. Equipment is purchased in California and sales tax reimbursement is paid on cost at the time of purchase. It is first leased, in substantially the same form as acquired, in a county which does not have a district tax. Soon after the equipment is moved to Nevada and leased there for a period of 90 days. Later, the property is returned to California and leased in another county which imposes a district tax.

Under these circumstances, no district use tax is due, since the equipment was leased outside the district imposing the tax for more than 90 days. However, if the property was returned to California within the 90 day period after the date of purchase and was leased in a county which has a district tax, then the district use tax would be due. 8/23/89

800.0950 Sales Agents Operating in Districts. Taxpayer operates from a warehouse in Burbank, California, and a showroom in Hollywood, California. It ships products to all points in California and the United States. It has no other offices or distribution points, but does employ outside people who solicit for business throughout the state.

All products are sold F.O.B. the Burbank warehouse and all shipments are arranged with freight forwarding companies by the clients.

The taxpayer's place of business is in the Los Angeles County and, as a result, all sales to Los Angeles County residents or in which the purchaser picks up the goods at the warehouse are subject to Los Angeles County transaction taxes.

When pursuant to the contract of sale, products are shipped out of Los Angeles County, its transaction (sales) taxes do not apply. However, if taxpayer ships property into a countywide taxing district in which one of its sales agents is operating, it is engaged in business in that district and is required to collect use tax on that sale at the rate in effect there. 3/25/92.

800.0956 Sales to Contractor—Installation Site in District. A supplier located in a nontransit district sells materials to contractors who take delivery at the supplier's place of business. The supplier knows that the contractor will consume the materials in a transit district.

If the supplier is "engaged in business" in the transit district in which the materials are consumed by the contractor, the supplier would be obligated to collect the transit district use tax from the contractor when the supplier's local office or representative in the transit district has participated in any way in the sale. "Engaged in business" means and includes one who has an office in the district, or who has agents or representatives operating in the district for the purpose of selling, delivering, or taking orders for tangible personal property.

However, if supplier is not "engaged in business" in the transit district and supplier delivers the property sold to customer at the supplier's factory, the supplier has no obligation to collect transit district use tax even though it knows the customer will use the property in the transit district. 4/28/88.

800.0958 Sales by Fueling Network. A fueling network has three parties involved in each network transaction: the "host participant," the "foreign participant," and the "trucker." The host participant is the person who physically provides the fuel. The foreign participant is the party who contracts with the trucker for the sale of fuel to the trucker.

Each participant has its own truckers to whom it issues network cards, and enters into agreements with each trucker for the sale of fuel at a specific price. This price is confidential; whenever a sale is made within the network, the host participant is never apprised of the retail selling price of the fuel. For participation in the sale of the fuel through the network, the host participant is reimbursed for its cost of the fuel, as determined by the OPIS price at the time of the sale, plus actual freight charges and a previously agreed upon network allowance.

Where the foreign participant is engaged in business in this state, the host participant is a seller making a sale for resale to the foreign participant. Thus, the retail sale is made by the foreign participant directly to the trucker (consumer) with whom it has an agreement for the sale of fuel. As the negotiations leading up to the sale are entirely between the foreign participant and the trucker, the location of the place of business of the foreign participant is the place of sale of the fuel for local tax purposes under Regulation 1802(a)(2). The same holds true for district taxes. (Regulation 1822(a)(2).) However, the local and district tax consequences differ.

The local sales tax would be allocated to the location of the foreign participant's place of business, but the sale would be subject to the district use tax, if any, of the location in which the host participant delivered the fuel. (Regulation 1823(a)(2)(B).) For purposes of collecting the tax, the foreign participant would be considered engaged in business in the district under Regulation 1827(c)(2) and so required to collect its use tax. (Regulation 1827(a).)

When the foreign participant's place of business is located out of state and is not engaged in business in the state, the host participant is deemed the retailer under the second paragraph of section 6007. The applicable local tax is that of the location of the host participant's place of business. (Regulation 1802 (a)(1).) If the host participant is located in a taxing district, the transaction (sales) tax of that district (or districts) applies to the sale. Thus, the tax rate in effect at the host participant's location will apply whether the foreign participant is engaged in business in this state (and thus, the retailer) or not (meaning that the host participant is deemed the retailer). (Regulation 1823(a)(1).) 1/29/96.

800.0960 Sale in Nondistrict Area with Shipment from a District Area. A company has its sales office in a county which does not impose district taxes. It maintains its warehouse in, and makes shipments via common carrier from, a county which does impose district taxes. The company is liable for district taxes only for the district in which the warehouse is located. If it has no sales representatives or agents elsewhere, the company is not required to collect district use tax for any other district. 5/16/95.

800.0980 Shipment Contracts. A retailer, located in Los Angeles County, is involved in making sales to customers located in Los Angeles and adjacent counties. Orders are either received via purchase order, or verbally by phone. Orders are delivered to customer by the retailer's truck, common carrier, or U.P.S.

A retailer has the duty to collect the use tax of a district if it is making regular deliveries into those counties, (Regulation 1823(a)(2)(b)), or is otherwise engaged in business in those counties, Regulation 1827(c). These sales would not be subject to the Los Angeles County District tax if they are shipped outside the county pursuant to the contract of sale. 1/28/91.

800.0981 Shipments of Warehoused Merchandise. Taxpayer has offices in Sonoma and Contra Costa Counties. A customer located in Santa Clara County sends a purchase order for products which contain its logo to the taxpayer. Taxpayer bills the customer and holds the goods in its Sonoma County warehouse. At customer's direction, taxpayer sends the products to customer's offices located throughout the world. Once a month the customer is billed for fulfillment and shipping costs. The products shipped are intended as gifts to new employees.

Assuming that title passed to customer upon delivery to the taxpayer's Sonoma County warehouse, sales tax would apply to the products purchased unless the contract specifically required the property to be shipped outside California. Since shipments are made based on future instructions, it appears that the contract does not require shipment outside of California or to any other county. Consequently, the tax rate in Sonoma County (including the ¼ percent district tax) is the applicable rate since subsequent shipments are not made pursuant to the contract of sale. However, shipments to other counties are also subject to the destination county's district tax (if any). Since taxpayer ships the property to the customer in the destination county, and the customer makes the gift in that county, the use occurs in the destination county.

Taxpayer is required to collect the district tax in any district in which it is engaged in business (e.g., sales persons operating in the destination county such as in its Contra Costa County office would be required to collect the BART District Tax and two Contra Costa transit authority taxes). Credit for the Sonoma County district tax is applicable against another county's district tax the taxpayer is required to collect. Also, the purchaser is entitled to a credit against and district use tax, not required to be collected by the seller, for the district sales tax reimbursement paid to the seller. (See Regulation 1823.) 1/13/93.

800.1000 Subcontractors Located in Other Countries. A taxpayer's principal place of business is located in Sacramento County. He contracts out most activities such as order taking, warehouse storage, fulfillment, order processing, and shipping to subcontractors located in other counties. Shipments are made by UPS, Federal Express, or other common carriers. Sources of customers are ads which are placed in various publications which contain "800" numbers. Orders received are relayed to a warehouse (outside of Sacramento) for shipment.

Taxpayer's subcontractor's operations qualify as "engaged in business" in each taxing district where they are located. Accordingly, taxpayer is liable for collection of the district tax for sales to customers located in a district where taxpayer is "engaged in business". The purchaser is responsible for reporting the use tax in locations where taxpayer is not "engaged in business". 6/25/93.

800.1150 Tax Rate After Tax Credit Program Ends—SB 263. In 1993, SB 263 was enacted to provide for a program of tax credits to effect the refund of certain local taxes (section 7276). Under that program, the legal tax rate in Monterey County remained at 7.25% but, for a period of time, taxpayers there could take a credit of 0.75% against their tax liability for an effective rate of 6.5%. That tax credit program ended March 31, 1996. SB 263 did not provide for a fixed-price contract exemption from the end of the tax credit program. Therefore, even though a sale is pursuant to a contract entered into during the rollback period which meets the definition of a "fixed price contract" under section 6376.1, it is subject to the full legal tax rate of 7.25% if the sale takes place after March 31, 1996. The "rollback" rate of 6.5% would apply, however, if the goods to be sold were specifically identified by the seller and buyer as the goods to be delivered to the buyer, and the buyer had paid for the goods prior to April 1, 1996, even if they were not delivered to the buyer until after March 31. 4/24/97.

800.1350 Use Tax Allocation. The test for determining district use tax liability is parallel to the tests for determining state use tax liability, as contained in Regulation 1620. If the first functional use of the property occurs in a transit district, that district's use tax applies, and no other district's use tax can apply. If the first functional use of the property is outside of any district, and the property is then brought into a district within 90 days after purchase and is thereafter principally used in that district, that district's use tax applies, and no other district's use tax applies. 5/31/90.

800.1450 Validity of District Tax. As a result of the voters approval of Proposition 62, which added sections 53720 through 53730 to the Government Code, local government is allowed to impose taxes for general purposes with the approval of a majority of the voters voting in an election on the issue. section 53721 defines a "general tax" as one "imposed for general government purposes."

In the wake of Proposition 62, the legislature enacted Revenue and Taxation Code section 7285, which authorizes counties to impose district taxes for general purposes with approval of a majority of the voters voting in an election on the same issue. Therefore, a county may impose a transaction and use tax (district tax) for general purposes with the approval of a majority of the voters voting in an election on the issue. 1/4/94.

800.1500 Vehicle. An out-of-state dealer, who is not engaged in business in California, takes an order for an automobile and the order is shipped from a third party warehouse in Irvine, California, to a retail customer in Los Angeles, California.

Since the property is located in Irvine at the time the sale takes place, the sale takes place in Irvine and sales tax applies to the sale. Pursuant to section 6007, the person who delivers property directly to a California consumer pursuant to a retail sale made by a retailer not engaged in business in California is deemed to be the retailer and must report tax on the retail sales price.

When the vehicle is registered and licensed to the customer in Los Angeles County, the sale is exempt from district transactions taxes imposed in Orange County and is subject to district use tax in Los Angeles County. Thus, the 1% Los Angeles district use tax applies, and the retailer is required to collect the tax. 9/27/94.

800.2150 Deliveries From Storage. A taxpayer manufactures, prints, and purchases for resale business forms and supplies. The taxpayer stores the merchandise in its warehouses and ships the merchandise, as needed, by common carrier to customers in California and in other states. Some customers periodically order merchandise to be stored in the warehouse until needed. A customer may agree to a specific time limit for the storage of merchandise. The taxpayer may not know where specific merchandise so stored will be shipped until instructions are received from the customer. Some customers are billed for the merchandise when it is received for storage at the taxpayer's warehouse. Others are billed when the merchandise is actually shipped to the customer. The contract provides that title passes upon full payment.

When merchandise is shipped from an out-of-state warehouse to a California customer, California use tax would apply. If the customer incurs tax or tax reimbursement liability in the other state, the customer is allowed a credit for the tax or tax reimbursement liability actually incurred. However, if tax was mistakenly paid to the other state, no credit would be allowed.

If shipment is made from a California warehouse to a customer's location outside the state and the contract specifically requires delivery to the out-of-state location, the tax will not apply even though title may have passed in California. This result is valid only if the purchaser is not authorized under the contract to direct that the property be diverted to a California destination.

If a shipment is made from a California warehouse to a California customer located in a different tax district, the applicable district tax is that of the destination district if the taxpayer is required by the contract to ship the merchandise to the customer in the other tax district.

If it is unknown at the time of the contracting whether merchandise will be shipped instate or out of state, the application of tax will depend on the time of title passage. Under the contracts provided, title passes upon full payment. Accordingly, if the customer is billed when merchandise is delivered to the taxpayer's warehouse, tax will apply at that time. If the customer is billed at the time that the taxpayer makes shipment, tax will apply at that time if the merchandise is shipped to a California location. Also, when billing takes place at the time of shipment, no tax applies if the merchandise is shipped out of the state pursuant to the contract of the sale. 8/26/94.